How to Plan for Your Dream Home

Almost all of us at some point in our lives dream of an abode that we would like to settle in. A “dream house” some may call it, and others may call it a need. Either way a house is on everyone’s mind, but only a few systematically plan for it. The key is to start early, as time is your best friend when it comes to compounding money. By the way we have a surprise for you readers! This post has an attached excel file which helps you attain your goal, which we will explain shortly.

Planning Early

Trust me, if you are below 25 years of age and have just started working, the best thing you can do is to start accumulating a corpus. The corpus is the single largest hurdle that a prospective house buyer encounters. The thought of buying a house for most of us occurs around the age of 30-35, sometimes older. At that age we might be earning enough to qualify for housing loan, but we struggle for the 20% upfront corpus. At the moment most banks offer loans up to 80% of the house value. They won’t give you more even if you earn a bomb! Start accumulating the corpus right away.

Systematic Investment Plan (SIP)

I can’t re-iterate this enough. Start a SIP, in any which form. It can be in the form of a recurring deposit (see our post on bank deposits for more information), or a mutual fund investment plan or even if you are a maverick invest in stocks directly. But do it consistently, that’s the secret. Just imagine that your pay was lower and think about the formula:

Income – Saving= Expenditure

So, How Much to Save?

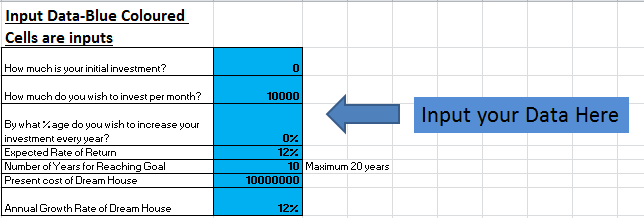

To answer this precise question, we have created a simple yet wonderful tool for you. Using the tool is quite easy, you key in the inputs in the cells coloured in blue and tadaaa! It calculates whether you would achieve your goal. The inputs needed are shown below (screenshot from the tool):

- Your initial investment: This is the corpus (saving) you already have. If you have saved nothing (I hope not), please input zero.

- How much do you wish to invest per month: This is the SIP amount you can put away today.

- What percentage you wish to increase your investment per month: We get salary raises every year, so our SIPs will also increase. If you don’t wish to increase SIP % every year, please input zero.

- Expected Rate of Return: This is the tricky one, for which nobody has an answer. It is reasonable to expect 12% but if you think you may get higher with your investments feel free to change it.

- Number of years for Reaching Goal: This is the time in which you desire to reach your goal.

- Present cost of your Dream House: This is the present value of the house you desire to own in the desired time frame. This varies from city to city.

- Annual Growth Rate of Dream House: This is again a tricky one. But 12% is a realistic number over a long time frame

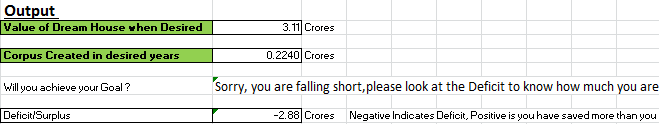

Now, after you feed in your inputs the tool comes up with the Output (see below). The output is whether your accumulated corpus meets the entire house value in the desired time frame. Please don’t be alarmed if the tool says you will fall short. The deficit amount can be borrowed as bank loan, if you are eligible for the amount.

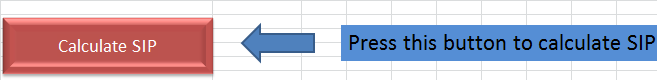

To make the tool more sophisticated, we have even provided you with a button (see screenshot below), which if you press will automatically calculates the required monthly SIP you need! So you don’t need to perform a trial and error exercise to find out the exact SIP amount required to reach your goal. Isn’t this fantastic?

Go on, download the spreadsheet and play with it. See where you stand now and what you need to do to achieve your goal of owning your dream home. Please also let us know your experience of using this tool in your comments.

Download the excel spreadsheet file: Dream Home Goal Calculator Tool

Conclusion

The key to buying your dream house is to:

- Start planning as early as you can

- Investing in an asset that beats inflation i.e real estate and mutual funds. You can buy a small house in the outskirts when you start your career.

- Invest systematically

A house is an emotional asset, more than a financial investment. Your financial planning can help you satisfy your family’s emotional need.

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.

Hello Team,

The article is very nice but i didn’t found the excel spreadsheet in ur website. So request you to please send it my mail ID (chrujeevan111@gmail.com).

Thanks in advance.