How IRR Can Help You Invest Like a Pro?

Have you have heard of the terms “Performance Metrics”, “Key Result Area (KRA)” and “Key Performance Indicator (KPI)”? The terms are quantitative measures that help us make good decisions. Finance has its own dictionary of such terms, one such term is called Internal Rate of Return (IRR). It is an extremely powerful term especially when making large investment decisions.

Before we understand what IRR is, we need to understand Time Value of Money, Discounting Rate and Net Present Value (NPV).

Time Value of Money

Ask yourself this question – What was the cost of a 2 BHK flat in your locality about 20 years back? How much did a kg of onion cost in the year 2000? How much did 1 gm of gold cost in 1975? The answer to these questions will highlight the time value of money. The value of currency or cash decreases with time, generally due to inflation. This is one of the primary motivations for investing, i.e sacrificing purchasing power today to get better purchasing power tomorrow.

Net Present Value

This brings us to the term, Net Present Value(NPV). NPV is a term used to calculate the cash (profit) an investment generates in the future discounted to the present year. The discounting is used to account for the time value of money. Consider a fruit shop that makes a neat profit of 3 lakhs a year. How much will you pay to acquire it? 10 lakhs or 20 lakhs or 1 crore? To help us with such decisions NPV can be used. The formula for NPV is:

NPV = ∑ Ct/ (1+r)t – Capital

Where:

Ct is net profit during the year “t”

t is the number of years

r is the discount rate (inflation rate in some cases)

Capital is the money you put in

A quick calculation on the fruit shop NPV in 10 years at a discounted rate of 8% yields an NPV of INR 20,13,000/-. So if the shop is available for below this value it looks like a profitable investment. You can try out the free NPV calculator free NPV calculator here.

The fruit shop problem could have got a bit more complex if we had to account for increase in profitability over the years. This would mean a higher NPV but would also skew your judgement if growth is misjudged. You will be surprised to know that venture capitalists do no more than NPV calculations, but they include potential growth in the future. In reality, even growth projections are based on industry trends and judgements.

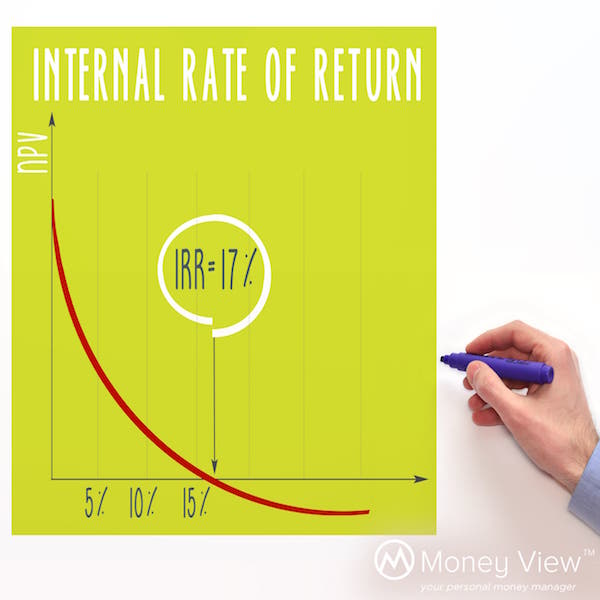

Internal Rate of Return

IRR is the discounting rate that gets the NPV to zero. In other words, it is the rate of return that will make the sum of all future profits equal to the capital we put in. So higher the IRR, more attractive the investment is as we are allowing for a much higher rate of discount for future profits. For instance if the fruit shop was available at 10,00,000/- then the IRR would be around 27% for 10 years. This compared to a loan from a bank to fund the investment at say 12% is extremely attractive. In simple words, if the IRR is much greater than the cost of capital, the investment can be considered a good one.

It’s a Numbers Game

Investments are about tracking the right numbers and performance metrics. If we do this right, there is no end to creating wealth. The decrease in value of money tells us two things indirectly:

- Postpone gratification to get more in the future

- Give a thought to the quality of the future returns of your current investments

Hope this article did not bring back your high school math nightmares! Do let us know your thoughts in the comments section below.

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.