Often we ignore the simplest of investment options, and look for more complex solutions for higher returns. The formula for success in creating wealth in investing is have a simple framework and being patient. This is termed as the flywheel effect. You need to do hard work to get the flywheel moving initially especially from rest, but when the flywheel gets into momentum it is a self-perpetuating machine.

Similarly get your investment framework right, be patient and then your money flywheel will run on almost auto-mode. In this article we will discuss one such investment instrument that can be a useful part of your financial flywheel – ELSS. Let’s see the benefits of investing in ELSS.

ELSS (Equity Linked Savings Scheme)

ELSS enables the investor to do two things:

- Invest in equity/stock market: This will enable the investor to beat inflation over a long time frame

- No capital gains tax: One of the losses that we have when we put our money in fixed deposits is that we have to pay tax on the gains. Not only are the returns low on these deposits but the returns are taxed. Double whammy. ELSS gains on the other hand are tax free.

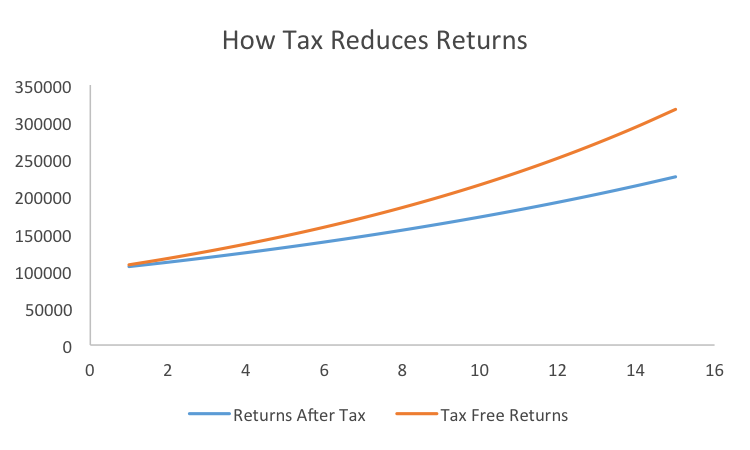

To highlight how tax can eat into our returns, let’s look at the chart below.

It plots the year-on-year return on an initial investment of INR 1,00,000/- compounded at the rate of 8%. The orange curve represents tax free returns and the blue curve represents returns after tax.

Over a 15 year time period there is almost a 40% difference in the final corpus. This is assuming you pay a tax of 30% on the returns in the taxed case. Without your knowledge tax makes your returns look very average. Tax management is one of the facets of personal wealth management.

ELSS is one of the options to avail under Section 80C.

ELSS Better Than ULIPs as an Investment Choice

This is a very important concept to understand. Getting insurance and making an investment need not be good when done together. ULIP(Unit Linked Insurance Plan) is often the instrument of choice for the common man. Often we don’t really understand the gains of ULIP compared to ELSS.

You may be surprised to know that a number of ELSS schemes have outperformed ULIPs handsomely. On the other hand a number of banks earn more money on ULIPs and hence the agents mislead you. What about insurance? You can get a term insurance for very little for the sum assured. Check it out.

ELSS Vs PPF

This is a tough one honestly. Both are wonderful instruments, of course each having their own pros and cons. Both are tax saving schemes under Section 80C.

One major difference is that the returns on PPF are fixed and promised by the government. This is a debt instrument and safer. The returns on ELSS is dependent on the performance of the stock market. ELSS can beat the PPF returns when a bull market is on. It is sound investment policy in diversifying by investing in both.

Minimum Lock In

To avail of the tax benefits, you have to be invested in ELSS for at least 3 years. You may think that OMG my money is stuck. On hindsight, this is a blessing in disguise! The lock-in period makes you a long term investor which is a prudent investment tactic especially when it comes to equity markets. Time of investment is taken care of by the law .

A Simple Route to the Stock Market

We believe every citizen in the country should have a certain amount of money invested in the stock market. Why should it be a privilege of the high net worth individuals only? We all need to be part owners of businesses. The benefit of ELSS is that it offers you this opportunity. You can use a SIP (Systematic Investment Plan) method to start the process.

ELSS – A Neat Beginning

If you have just started thinking about investing in the stock market, ELSS offers a simple way of participating in the same and saving tax as well. For established investors, ELSS still is a good option to diversify your portfolio at relatively lower risk. Do talk to your financial planner and do your research before choosing the right scheme. But don’t let go an opportunity to avail of the benefits of ELSS.

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.