How Budget 2017 Affects the Common Man?

While the demonetization decision by the Govt. showcased its strong will to curb the menace of black money and counterfeit currency, the common man accepted the decision in anticipation of the benefits it will reap. Considering the large supply of money coming into the banking system, tax revenues were expected to improve. No wonder, everyone was looking forward to this year’s budget as a budget of hopes. Here’s how the Union Budget 2017 affects the common man:

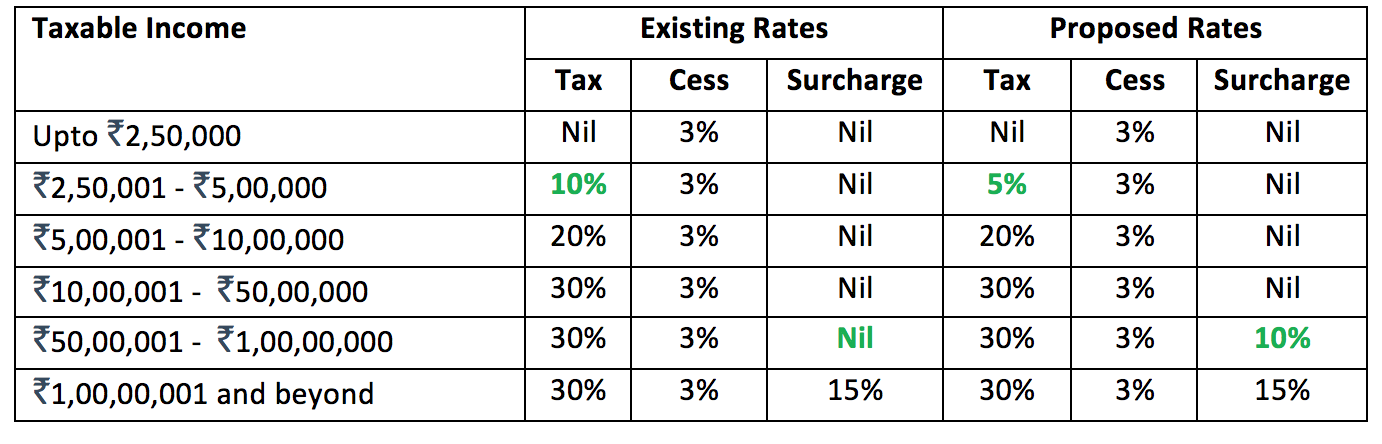

Changes in Income Tax Rates

Starting with the budget proposals, FM shared some interesting data. There are just 76 lakh individual assesses who declare income above 5 lakh and out of these, 56 lakh are in the salaried class. This was in contrast to the fact that more than 2 crore Indian citizens flew abroad, either for business or tourism, in the year 2015.

He also admitted that the present burden of taxation is mainly on honest taxpayers and salaried employees who are showing their income correctly.

Giving a marginal relief to the taxpaying assessees and with an intent to increase the tax base, the tax rate has been reduced from 10% to 5% for the income between ₹2.5 lakhs to ₹5 lakh. Further, a super-rich surcharge has now been imposed on individuals earning between ₹50 lakhs and ₹1 crore @ 10%. Earlier, this surcharge was only applicable for individuals earning more than ₹1 crore @ 15% which continues to be levied.

The tables below explain this further:

Here is how much an individual at different levels of income saves under the existing tax rates and the proposed tax rates:

There has not been any additional relief for senior citizens apart from the above. Since their basic exemption limit has been a little higher than the normal tax assessees, the tax relief has indeed been lower for them. For the senior citizens with taxable income between ₹5 lakhs to ₹50 lakhs, there has been an uniform tax relief of ₹10,300. For very senior citizens of age 80 years or more, the basic exemption limit was ₹5,00,000, and there has been no additional tax relief for them.

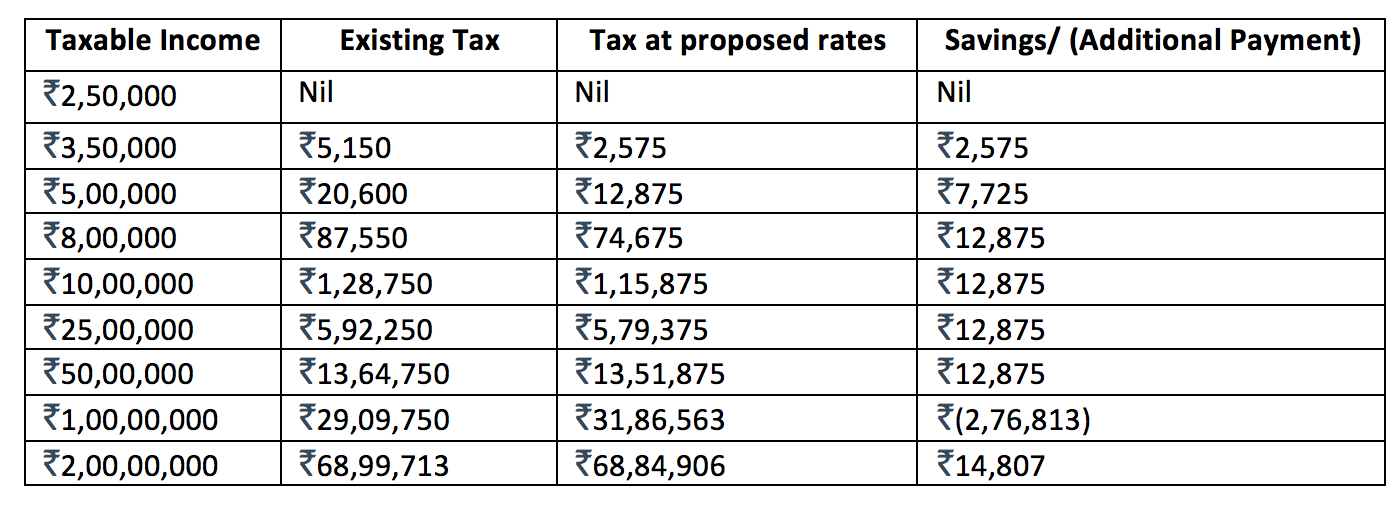

No Major Changes in Excise Duty and Service Tax

Since Goods & Service Tax (GST) is due to be implemented latest by Sept. 2017, no major changes were made in the rates & provisions of excise duty and service tax. However, minor tinkering of the rates in excise duty has been done due to which certain articles get cheaper and some dearer.

Here is a chart that details this:

Tax Incentive for Digital Payments

In order to promote digital transactions and to encourage small unorganized business to accept digital payments, Govt. has reduced the deemed profit of 6% for business receipts received through electronic means instead of 8% of those received in cash.

It is important to note that the benefit of reduced deemed profit will be available even for the revenue generated during the whole current year 2016-17. The existing rate of 8% for the deemed profits shall continue to apply in respect of total turnover or gross receipts received by way of any other mode.

Computation of Long Term Capital Gains

As per existing provisions, for computing capital gains in respect of an asset acquired before 01.04.1981, the assessee is allowed to take either the fair market value of the asset as on 01.04.1981 or the actual cost of the asset as the cost of acquisition. As the base year for computing, the indexed cost of acquisition or cost of improvement has become more than three decades old, assessees were facing genuine difficulties due to non-availability of relevant information for computation of fair market value (FMV) of such asset as on 01.04.1981.

Govt. has therefore proposed to shift the base year to 2001. In other words, the cost of acquisition of an asset acquired before 01.04.2001 shall be allowed to be taken as FMV as on 1st April 2001 and the cost of improvement shall include only those capital expenses which are incurred after 01.04.2001. This amendment has been made in order to ease the compliance and measurement issues.

Change in Holding Period of Immovable Properties for Long Term Capital Gains

To make the real estate sector more attractive for investment, Govt. has decided to reduce the period of holding from the existing 36 months to 24 months in the case of immovable property, being land or building or both, to qualify as a long-term capital asset. Long-term capital gains are subject to various concessions like eligibility for tax exemptions, indexation benefits, concessional tax rates etc.

Restricting Cash Donations

Currently, no deduction is allowed for the cash donations in excess of ₹10,000. This threshold limit is proposed to be reduced to ₹2,000.

Tax Deduction on Rent

Govt. has proposed that every individual or HUF paying monthly rent above ₹50,000 will be required to deduct tax at the rate of 5%. The tax shall be deducted at the time of making payment or at the time of credit of rent to the account of the landlord, for the last month of the previous year or the last month of tenancy (if the property is vacated during the year), whichever is earlier.

Simplification of Tax Filing Process

One page income tax return is proposed to be made applicable for the individuals with taxable income less than ₹5 lakhs. Also, the time period for revising a tax return is being reduced to 12 months from completion of financial year, at par with the time period for filing of return. The time for completion of scrutiny assessments is being compressed further from 21 months to 18 months for Assessment Year 2018-19 and further to 12 months for Assessment Year 2019-20 and thereafter. The person with income less than ₹5 lakhs filing the return for the first time will not be subjected to scrutiny.

Further, to ensure filing of returns within due date, the fee for delayed filing of return has now been proposed in the Income Tax Act. If the return is filed after the due date but on or before 31 December, the assessee shall be liable to pay ₹5,000. If the return is filed after 31 December, the charges shall be ₹10,000. However, with a soft corner for the smaller taxpayers, it is proposed that the fee shall not exceed ₹1,000 in case the total income does not exceed ₹5 lakhs. So, from next year onwards, the normal perception of treating 31 March as the return filing deadline should improve.

Capital Markets

The target of disinvestment receipts during the next year has been set at ₹72,500 crores. This includes ₹46,500 crores as disinvestment receipts, ₹15,000 crores as strategic disinvestment receipts and the balance of ₹11,000 crores from the listing of general insurance companies. Shares of Railway Public Sector Enterprises like IRCTC, IRFC and IRCON will be listed on stock exchanges. Also, a new ETF with diversified CPSE stocks and other Government holdings will be launched in 2017-18. With the CPSE ETF FFO launched in January 2017 getting a bumper response and same giving decent 10-12% returns in a short span of time, it is going to be an exciting time for the capital market investors as well.

The common man has some reasons to smile after this budget.

How do you rate the budget? Share your thoughts in the comments below.

Simardeep Singh is a Chartered Accountant based in Delhi. He loves sharing his knowledge about personal finance and investment. He blogs regularly at www.simardeep.com.