What is Credit Score or CIBIL Score?

Just like your exam score signifies your performance as a student, your credit score also known as CIBIL score indicates your performance as a borrower.

A credit score indicates your creditworthiness and is a factor that lenders take into consideration before providing you with loans and holds true even if you have an existing relationship with the lender.

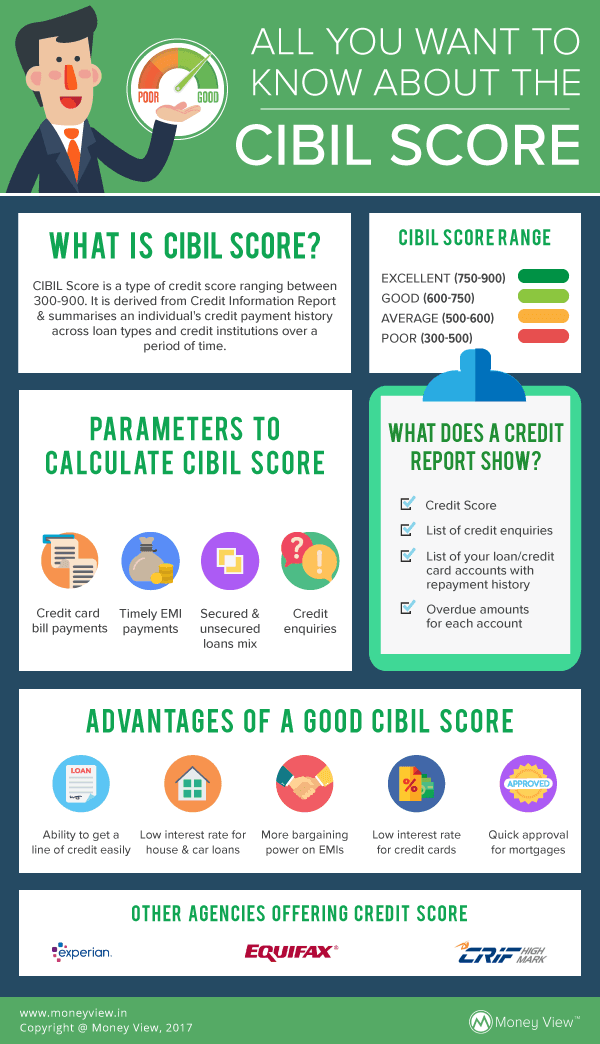

For an individual with a credit history of over 6 months, CIBIL scores range from 300 to 900. An individual with a higher CIBIL score is perceived as a better borrower than an individual with a lower score.

So, an individual with a credit score of 800 will get a loan more easily than one with a credit score of 625. As such, your CIBIL score impacts your access to new loans and credit cards. Hence, it is extremely important to have a good score.

How is Your Credit Score Calculated?

Your credit score gets calculated on the basis of following parameters:

- Repayment History – A repayment history with no defaults will help you get a good credit score. This includes timely EMI payments of loans and regular/ full payment of credit card bills among others.

- Credit Mix – A mix of debt consisting of both secured loans and unsecured/ personal loans/ credit cards helps you improve your credit score.

- Credit Inquiries – Your credit report also includes the list of loan inquiries made in the recent times. The Credit Information Bureau keeps a record of all inquiries made by lenders and frequent credit inquiries over a short span may be perceived as the reluctance of other banks to grant you loans.

What Does a Credit Report Show?

In a nutshell, a credit report will feature your credit score, list of your loan/credit card accounts with the repayment history, and overdue amounts for each account along with the list of credit inquiries made.

Finding your CIBIL Score

The most widely used credit score is the CIBIL Transunion Score, deriving its name from the agency maintaining the credit history database and calculating the score.

Here is how you can check your CIBIL score, once a year, for free:

- Visit the CIBIL website. Click on the free credit report link on the page. This will take you here

- Click on the ‘Get Your Free Annual CIBIL Score & Report’. A pop-up window will open asking you to upgrade your account if you choose to, if not, you can move on to the next step.

- Enter the required details on the page that opens. The details required are PAN, Email Address, Date of Birth, Gender, Income Type and Monthly Income.

- The next page will then ask for a few more details like name, address, phone number etc. The details will then be matched by the server with the database. Post this, you will receive your credit report.

- It is also important to note that while the credit report is accessible only for a fee from the portal, users can download the credit report once for free every year. One should make the most of this facility to track their credit score.

Do Other Websites Provide Credit Scores?

There are a couple of other credit bureaus offering credit history and credit reports viz. Equifax, CRIF High Mark etc.

These sites are approved by the RBI and can be used to check credit scores. However, the scores might vary but not by a huge margin. The variation is due to different methodologies used for calculation of the credit score, timing difference in the availability of the credit data by banks etc.

Recently, a couple of public sector banks have linked their interest rates with credit scores. Hence, it is really important to have a good credit score for better eligibility for loan amount and sanction terms.

In Conclusion

Your credit score is a numeric representation of your creditworthiness and is essential for any form of credit. Having a high credit score can make life easier for you as it allows you to avail credit easily, at beneficial terms.

A good way to build your credit score is to avail personal loans of a low amount and we have the perfect one for you. Easy to avail with minimal documentation and disbursed within 24 hours of application approval, Money View loans are a great way to start your credit score journey.

Visit the Money View website or download the app and apply today.

Basically this cibil is only depends on banks. If they make mistakes or want to take revenge they can do.

If we try to put our documents nothing happened. Or cibil nothing to do.

Hi Anil,

Well even while it is true to say that the score depends upon the information from banks and other lenders, you can dispute the information in case you feel the same has been put up wrongly. CIBIL then processes it in a time bound manner and also marks the same as disputed. As such, its impact on your loan applications gets eliminated.

How I can see my cibil scorr

Dear Sh. Patel,

The procedure to check your CIBIL score is highlighted in the article above under the para ‘Finding your CIBIL score”.

If, i didn’t taken any loan or emi, then how my cibil score will calculated, and then how can i get loan.

Good

Good