Why Should You Take A Medical Emergency Loan from moneyview

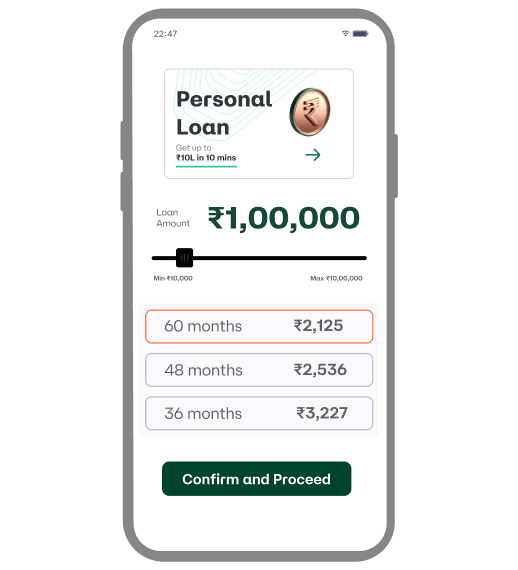

Flexible Amount and Repayment Term

You can choose a loan amount from Rs.5,000 to Rs.10 Lakh and a repayment period from 3 months to 5 years based on your eligibility and requirement

Quick Disbursement

In the case of emergencies, getting financial assistance as quickly as possible is important. Funds from moneyview personal loans get disbursed within 24 hours of you submitting the loan agreement

No Security or Collateral

With moneyview loans, you don’t need to pledge any security or collateral as they are unsecured loans

Affordable Interest Rates

Interest rates are important as they determine the EMI amount to be paid. At moneyview, the interest rates start at just 1.33% per month