Moneyview se Paisa

Toh Rukna Kaisa

Watch our latest campaign here

Saving was never this simple & rewarding!

The most loved financial app

We’re one of the very few fintech platforms with 4.8 rating on Google playstore

12 Crore+

Users

36 Lakh+

Reviews

18,400+

Pincodes served

Safety at your fingertips!

Stay protected with our 256 - bit, safe & secure system, always!

We are an ISO 27001:2022 certified company

Download app

FAQs

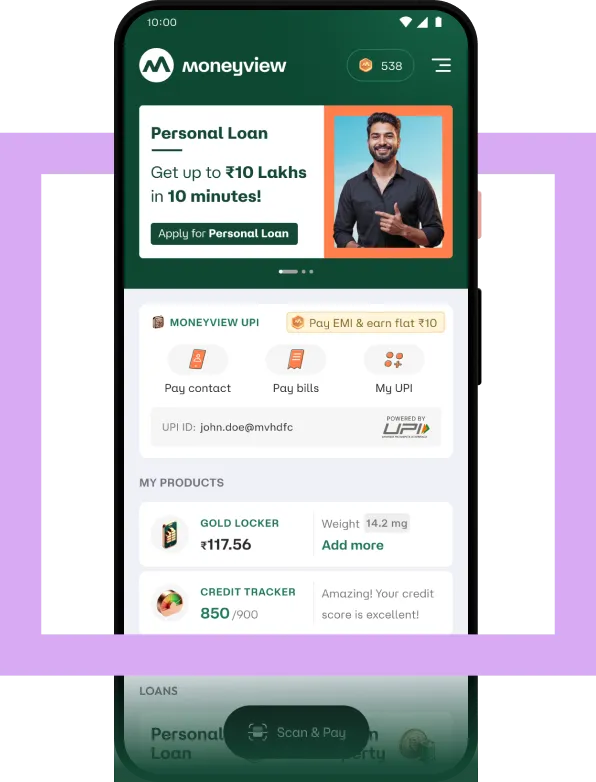

What is Moneyview?

Is it safe to use the Moneyview app?

How does the Moneyview app work?

How to download the Moneyview app?

What are the products offered by Moneyview?

-

Personal loans

-

Home Loans

-

Business Loan

-

Loan on Property

-

Credit Cards

-

Fixed Deposit Investment

-

24K Pure Gold Investment

-

Motor Insurance

-

Credit Tracker

-

Money Manager

What are the features & benefits of Moneyview digital lending platform?

Moneyview is one of the most trusted online digital lending app in India. It offers the following features & benefits to customers through its partnerships with its lending partners-

- Flexible Terms - Instant collateral-free and online loans from Rs. 5,000 to Rs. 10,00,000 with flexible repayment options that can extend up to 5 years.

- Affordable Rates - Economical interest rates that are easy on your pocket starting at just 14% per annum.

- Quick Eligibility Check - Skip the long queues and check your loan eligibility with us in just 2 minutes.

- Hassle-free Loans - From eligibility check and document verification to loan disbursement, the entire process is online, enabling you to apply for loans from the comfort of your home.

- Unique credit model - Our lending partners underwriting allows us to customize the loan offers based on your eligibility and individual requirements.

- Quick Disbursement - The need for a loan arises at any time. To ensure your needs are met immediately, the loan amount is credited to your account within a few minutes.

- Minimal Documentation - Our documentation requirements involve your PAN, a clear selfie, and a mobile number linked to your Aadhaar. Additionally, depending on your profile we may sometimes request other documents.

How do I contact Moneyview if I face any issues with the Moneyview app & website?

Customers wanting to file a complaint or report an issue can do so through the Moneyview app. You will receive a response within 24 - 48 working hours.