65 million

users trust us!

Security is foundational to Moneyview's technology. Our sophisticated systems ensure unwavering security assurance across all daily operations

We adheres to the Payment Card Industry Data Security Standard

Certified Information Security Management System

Encryption protects all your data and transactions

Uses your fingerprint or face for secure login

Protection from remote app fraud, data leaks, and screen mirroring

We adopt fintech industry best practices including regular security audits, and end-to-end encryption

All user data stored on systems located within India

Access restricted to employees who require it to provide services

Employees undergo training on security procedures

Internal processes to handle any information security breaches

Safe

Safe

We follow RBI guidelines on data security and digital lending

Secure deletion, destruction, or anonymization of user data after retention period

Facilitate deletion of customer data upon requests

RBI compliant

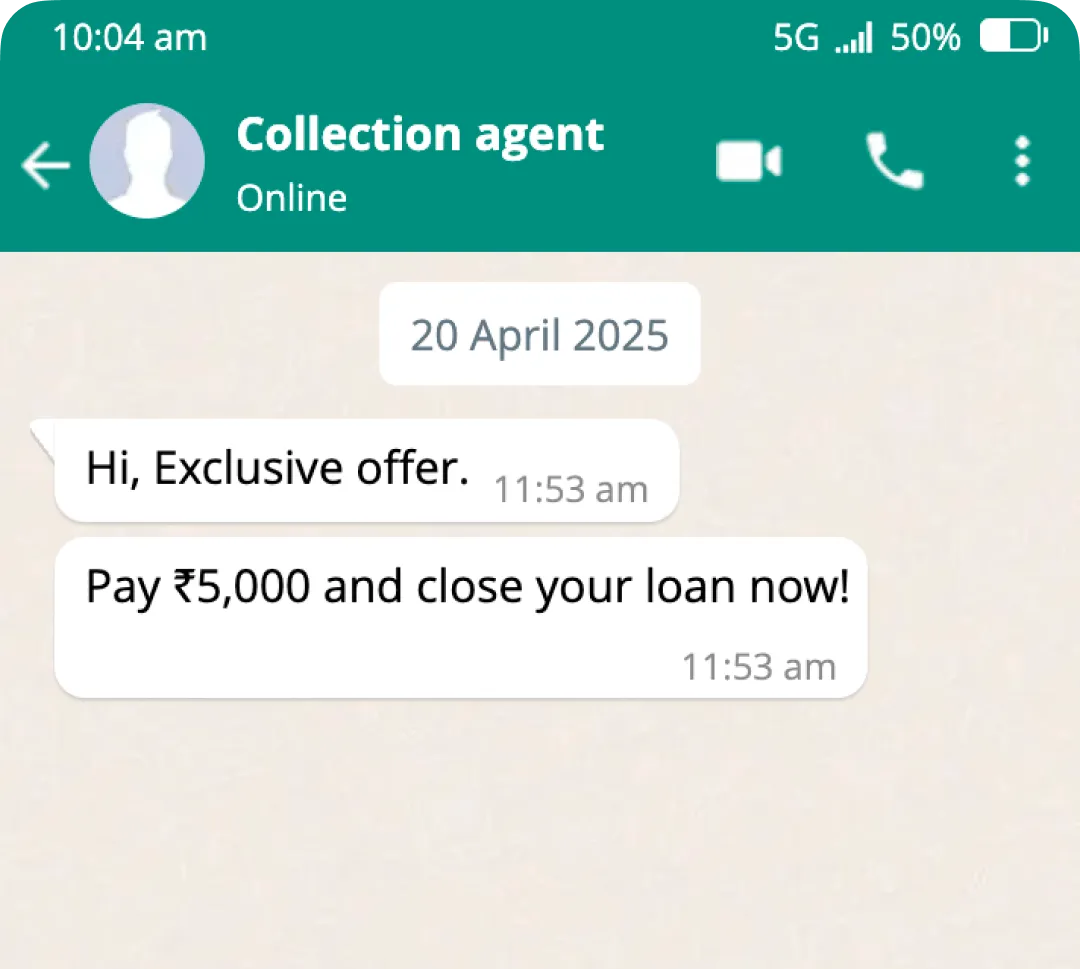

RBI compliantBe aware not to fall for these frauds

Impersonation of Moneyview collection agent

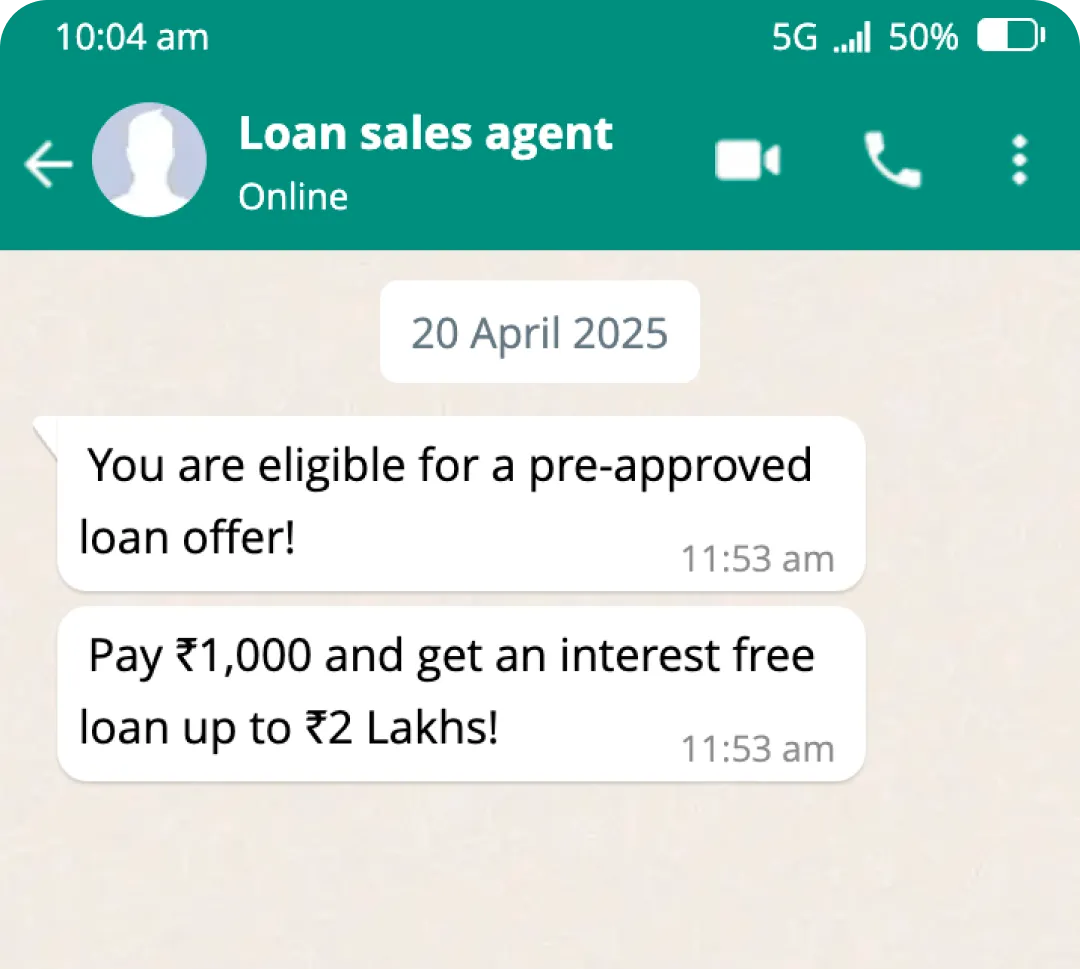

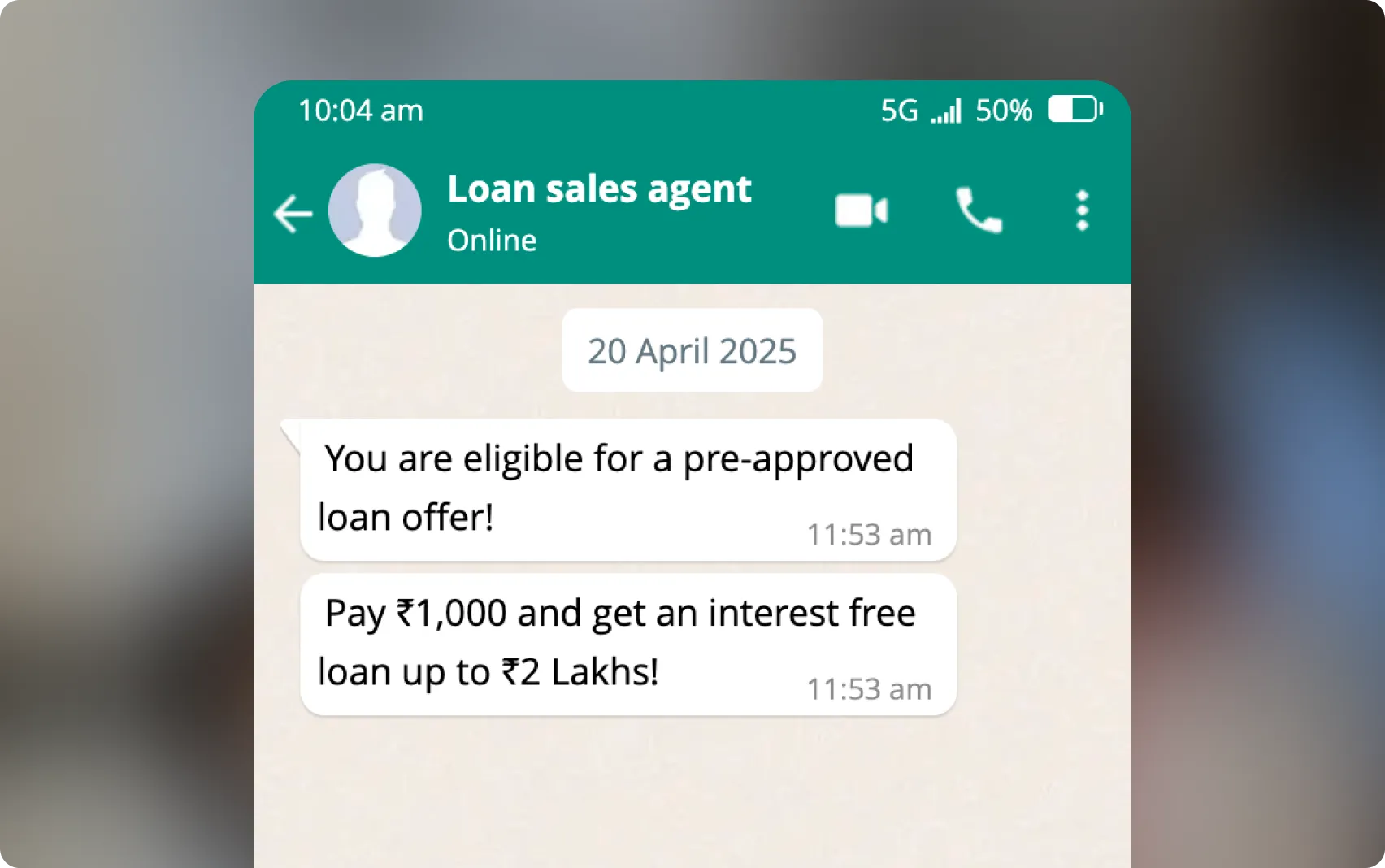

Impersonation of Moneyview sales agent

In case you face a security issue

Phone:

080 6939 0476Email:

care@moneyview.in

Change your email password

and UPI PIN

Phone:

1930Tips to prevent fraud attempts

Ensure you are on a secure website

Official Moneyview links are always secured with SSL

Truecaller shows verified badge for authentic Moneyview calls

Do not respond to email outside of @moneyview.in

Moneyview agents will never contact from personal emails

Moneyview won't call you regarding interest free loans

All genuine Moneyview calls starts with 1600 or 1400

Do not call on other numbers shown in unauthorised websites

Contact Moneyview support only through 080 6939 0476 or care@moneyview.in

Avoid financial transactions on public Wi-Fi

Moneyview official communications will be only through Verified WhatsApp accounts

Download Moneyview app only from official Google Play and Apple App Stores

Please download it from official stores

Report

Cross-Site Scripting (XSS)

SQL Injection

Remote Code Execution (RCE)

Authorization Issues

Information Disclosure

Insecure Direct Object References (IDOR)

Report

Server-Side Request Forgery (SSRF)

Cross-Site Request Forgery (CSRF)

Denial of Service (DoS)

API Security Issues

Mobile Application Security Issues

What data does Moneyview gather?

Does Moneyview track my personal messages or OTP messages?

Can my data be accessed by any one in Moneyview?

Does Moneyview intend to sell my data to any third-party firms or vendors?

What happens to my data if my loan application gets rejected?