All of us have who’re salaried receive a salary slip on a monthly basis once the salary is credited to our bank A/c. However, do you know your salary slip in detail or how it helps you?

Salary slip contains a detailed description of the employee’s monthly/annual earnings along with deductions like professional taxes, TDS etc.

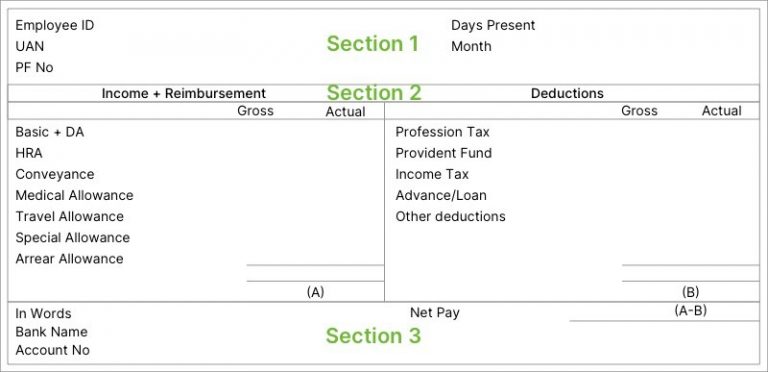

In order to explain the parts of your salary slip more accurately, let us take a look at the sample salary slip given below -

This is the header of the slip which displays the company name and employee details, employee ID, name, PF/UAN number, days present, date, etc.

The most important and informative section, this part contains details of the employee’s income, reimbursement, and deductions.

Given below are some of the most important components of this section -

This is the most important part of your salary and is about 35%-40% of your total compensation. This amount also determines the other components of your salary slip.

As the name suggests, this component is paid as part of the salary for the employee’s house rent. This amount is dependent on the location of the rented house and is anywhere between 40% - 50% of the basic salary. There is also a tax exemption applicable on this component.

This amount is intended to cover the cost of travel for the employee from his/her residence to work and back again. Did you know that income tax can be saved on this component as well?

This amount is provided to cover the cost of travel when the employee is on leave and covers the travel cost of immediate relatives as well. Proof of the said journey must be provided in order to avail the deduction.

Money is a great motivator. In order to encourage employees to do their best, companies sometimes offer a special allowance. However, this amount is fully taxable.

Depending on the company and the type of work being done, employees may receive other allowances as well which can either be categorized separately or clubbed under ‘Other Allowances’.

This section contains information about all the deductions that are part of the employee’s salary package as explained below -

This is the tax levied by the state government on an individual. The amount is a maximum of Rs. 2,500 per annum and can vary from one state to another. This amount is based on the employee’s tax slab.

This is a compulsory contribution made by the employee towards an EPF account. To learn more about EPF and its importance, check out our blog -A Beginner's Guide to EPF

This is the amount deducted by the employer on behalf of the employee. The amount will vary based on the employee’s tax slab as well as other factors as applicable.

Based on the company policy or the nature of the employee’s job, there may be other deductions applicable which will be mentioned in this section.

The last component of the salary slip contains details of the net salary being paid for that month.

Note - Every company’s salary slip will vary slightly and may have more or fewer details. This blog is intended to be a generic explanation based on commonly seen formats.

Your salary slip is more than just a description of your salary. This document plays an important role for a number of reasons. These include -

Your salary slip is one of the most important documents that you can receive as a salaried employee and gives you an insight into your salary structure. Not only is this document informative, it is also useful for a number of situations such as when you are paying your income taxes or even to avail loans

Did you find this blog useful? Let us know in the comments below!

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?