Introducing FD Select

Enjoy Superior FD Returns with Confidence

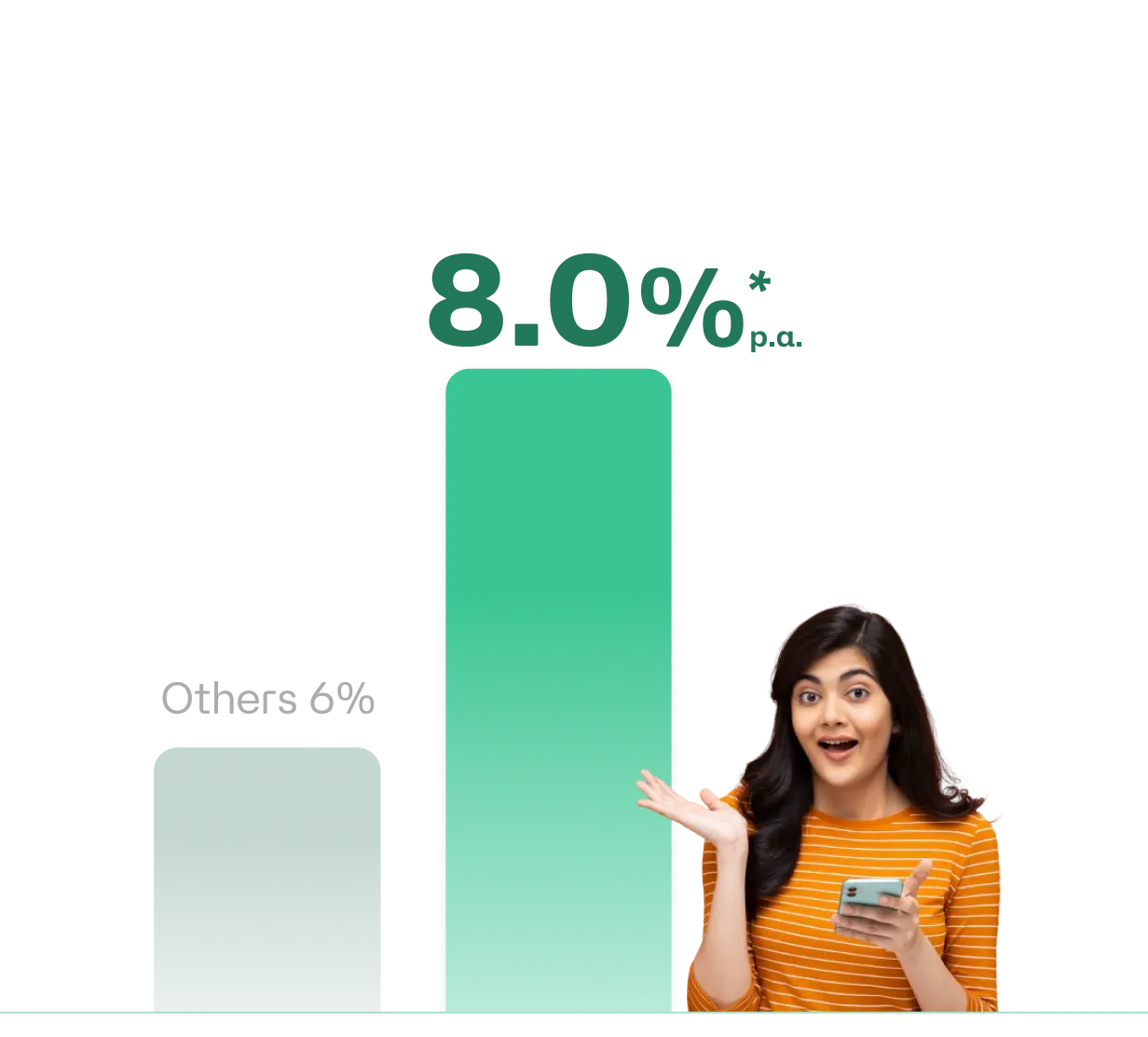

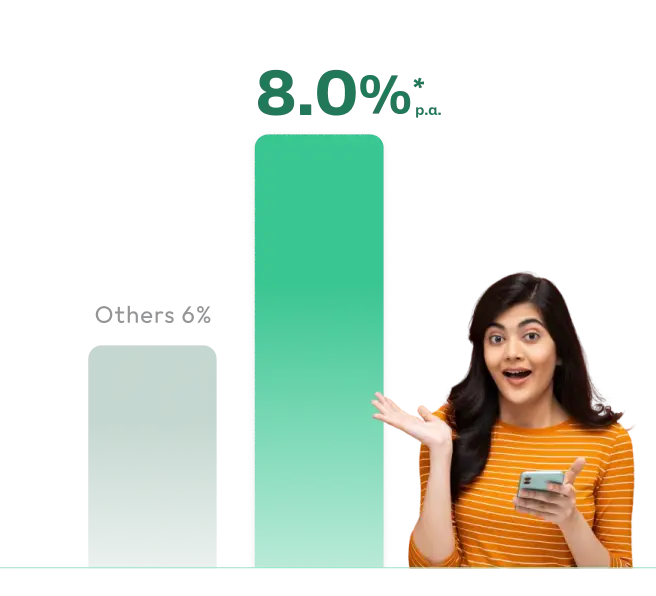

Book FD and Get up to 8.0% p.a.

Download appFrom Top Banks & NBFC partners

What makes FDs the most popular investment mode?

Best returns to beat inflation

No-Risk investment

Why Choose Fixed Deposit From Moneyview?

Direct FD with Bank & NBFC

Compare & Book FD from RBI-approved Banks & NBFC partners

Get started with any amount

Book FD as low as Rs 1000

Withdraw Easily

Easy withdrawal through the App

Your investments are 100% Insured

Up to Rs 5L by DICGC (RBI subsidiary)

Book FD Instantly- No Bank A/c needed

No paperwork, no bank visit, or a/c opening formalities. Book FD in minutes!

It’s super safe and secure

Fixed Deposit (FD) FAQs

What is a Fixed deposit (FD)?

Fixed deposit is a financial instrument where an investor deposits a sum of money for a fixed period and earns interest on it. The interest rates on FD(s) are fixed and guaranteed, making them a low-risk investment option.

The interest rates offered on FD(s) may vary depending on the financial institution with which FD is getting booked, tenure of FD and type of customer.

The interest rates offered on FD(s) may vary depending on the financial institution with which FD is getting booked, tenure of FD and type of customer.

How can I invest in FD in 3 mins?

You can invest in Fixed deposits in under 3 mins without opening a new bank account by following the below listed steps:

- Download the Moneyview app and login with Aadhaar linked mobile no.

- Click on the Fixed Deposits card on Superhome.

- Choose FD from a wide range of RBI-regulated Banks and NBFCs that best suits your financial needs.

- Provide your PAN, Aadhaar, Personal & Professional details to verify your identity.

- You will have to provide withdrawal bank details to verify your bank account; your FD amount will be credited to this account on maturity or premature withdrawal.

- Complete your payment using UPI or Netbanking.

*VKYC might be applicable in a few cases.

The Bank / NBFC will now finally approve and book your FD. However, for South Indian Bank, FD booking is not real time and may take up to 1-2 working days.

Note: Your FD receipt will be available via email directly from Bank / NBFC (all except Utkarsh Small Finance Bank) within 7 days of FD booking confirmation. You can also view / download FD receipt from the app. Also, returns are calculated from the date of booking and not from the date of payment.

Is it safe to book an FD on Moneyview?

Yes, booking a Fixed Deposit (FD) on Moneyview is completely safe.

When you make an investment, your money is transferred directly to the RBI-regulated Bank or NBFC you chose to book an FD

Additionally, a deposit (i.e. your deposit amount + interest earned) amount of up to ₹5 lakhs per depositor per bank is insured by DICGC (a wholly owned subsidiary of RBI) for all Bank FDs.

When you make an investment, your money is transferred directly to the RBI-regulated Bank or NBFC you chose to book an FD

Additionally, a deposit (i.e. your deposit amount + interest earned) amount of up to ₹5 lakhs per depositor per bank is insured by DICGC (a wholly owned subsidiary of RBI) for all Bank FDs.

Is it possible to withdraw from FD before maturity?

Yes, you can withdraw your FD before its maturity. The withdrawal conditions such as lock-in period and penalty may be different depending on the policies of the Bank or NBFC with which the FD was booked