Get a Loan up to

₹10,00,000 in Minutes

Apply Now to Enter Jackpot

Get started instantly

Apply for a personal loan from anywhere. It only takes a few minutes!

What makes us better?

Highest loan amount

Our credit model generates the best personalized offer for you

Most affordable offers

Enjoy flexible loan tenures from 3 months to 60 months; choose a plan you like!

No surprises, 100% transparent

Check interest rate, total repayment & terms beforehand - leave no room for doubt or surprises!

Hassle-free, easy to use

The power of human experience & technology - all packed into our app to simplify lengthy processes just with a tap

Shantanu Gupta

Feb 26, 2025

Thank you so much for the service! Your app claim fast loan approval. Got the amount in minutes.

Vikram Sher

Feb 26, 2025

Had a great experience regarding credit. They just provide you instant credit in times of need. Thanks a lot 😊 for helping me.

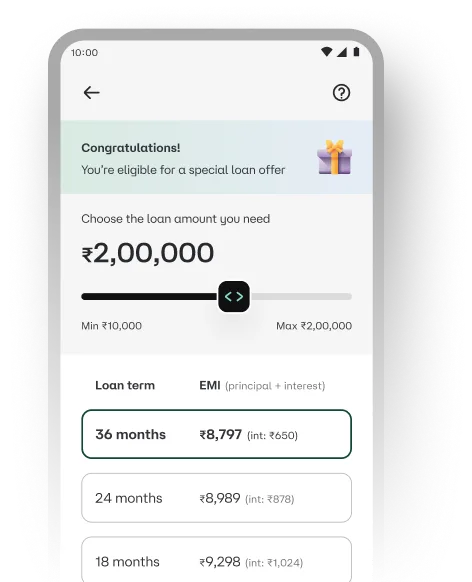

Our EMI calculator

makes it easier

Use our easy EMI calculator to plan your loan's EMI, interest & repayment schedule

Trusted by millions

We're present across the nook & corner of the country, making loans accessible, and simple!

0 Million+

Happy

Users

0 Cr+

Loan

Disbursed

0+

Locations

Served

Moneyview se Paisa

Toh Rukna Kaisa

Watch our latest campaign here

Frequently Asked Questions

Top 6 Reasons To Choose Personal Loans through Moneyview?

Get any amount from Rs. 5,000 to Rs. 10,00,000 instantly

Check your loan eligibility in just 2 minutes

Flexible repayment options that can extend up to 5 years

Instant loan amount disbursement directly to your account in just a few minutes after application approval

Affordable and economical interest rates, starting at just 1.16% per month (14% Annually*)

Hassle-free digital application process allowing you to apply for instant personal loans from anywhere

Eligibility Criteria For Personal Loans

The applicant's age should be 21-57 years.

They must be salaried or self-employed.

A monthly household income of Rs. 25000 or more.

The income must be credited directly to the bank account.

A minimum CIBIL score of 650 is required.

What are Interest Rates & Other Charges?

| Types of Loan Fees | Rates & Charges Applicable |

|---|---|

| Interest Rate | Starting from 1.16% per month (14% Annually*) |

| Processing Fee/Felicitation Charges | Starting from 2% of the approved loan |

| Interest on Overdue EMIs | 2% per annum |

| Part/Full Payment of the Loan (Loan Foreclosure) |

|

| Cheque Bounce | Rs.500/- for every bounce |

What are the Benefits of choosing Moneyview?

- Quick Disbursement - Any financial emergencies need to be addressed instantly. Hence, we ensure the funds are credited to your account within a few minutes of loan approval.

- Hassle-free Application Process - We aim to make borrowing simple. That's why our loan application process, from start to finish, is entirely digital, giving you the freedom to complete all the steps from the comfort of your home.

- Minimal Documentation - We mainly require your PAN, a selfie, and a mobile number linked to your Aadhaar. We may ask for additional documentation, depending on your profile.

Personal Loan Foreclosure Charges

It is possible to foreclose your instant personal loan after you have paid a certain number of EMIs. The foreclosure charges are as illustrated below -

| Charges | Amount Chargeable | |

|---|---|---|

|

Foreclosure Charges |

Nil but foreclosure can be done only after a minimum number of EMIs have been paid as illustrated below- |

|

|

Tenure |

Foreclosure |

|

|

Up to 6 months |

Not allowed |

|

|

7 - 18 months |

Allowed after 6 EMI payments |

|

|

Over 18 months |

Allowed after 12 EMI payments |

|

|

Part-prepayment Charges |

Part-prepayment is not allowed |

|

What Can You Use Personal Loans For?

Weddings

Medical emergencies

Travel expenses

Home Renovation projects

Education purposes

Business ventures

Big purchases

Household expenses

How to Track Your Loan Application?

Through Website:

On the official Moneyview website, click on Login

Enter your registered mobile number

Verify using an OTP

Go to the 'Dashboard' section

Scroll down to the 'Application Status' tab

Check the status of your personal loan application status

Through the Moneyview Loans App:

Log in to the Moneyview Loans app using your mobile number

Go to the Loans section

From there, you will be directed automatically to the 'Application Status' screen

Additionally, you can contact Moneyview customer support and inquire about your loan application status

Will There Be A Credit Report Inquiry When I Apply For An Instant Loan?

What Documents Do I Need to Get an Instant Personal Loan on Moneyview App?

Log in to the Moneyview Loans app using your mobile number

Go to the Loans section

From there, you will be directed automatically to the 'Application Status' screen