The Employee Provident Fund (EPF) is an employee savings scheme. Each employee has a unique PF number associated with their PF account.

EPFO, or Employees' Provident Fund Organisation, is a non-constitutional organization that encourages employees to save for retirement.

The contributions are made by both the employee and employer during employment, through deductions taken from their wages. The amount contributed to your EPF account will be paid out at retirement or if you cease working permanently due to disability.

EPF Account Number is the unique number assigned to each employee's EPF account. This number can be used by employees to check the status of their EPF account, view the balance in the EPF account, etc.

During the EPF withdrawal process, employees' PF Account Numbers are also required.

The EPF Account Number consists of 22 digits and is alphanumeric i.e, it is made up of both numbers and letters.

It contains information about the state, regional office, the employee’s current organization, and the employee.

The PF account number format is as follows:

Region Code: The first two letters of the PF account number represent the State.

Office Code: The next three letters stand for the regional office in a state.

Establishment Registration Code: The first seven numbers represent the employer’s PF registration code.

Established Extension Code: The next three numbers represent the establishment extension code for larger organizations.

PF Member ID: The last seven digits represent the employee’s PF member ID and are employee-specific.

|

PF Number - TN MAS 0000064 000 0054321 |

|

|---|---|

|

TN |

The state |

|

MAS |

The regional EPF office |

|

0000064 |

Employer’s Establishment ID |

|

000 |

The extension code |

|

0054321 |

Employee’s unique PF account number |

To monitor your PF account, you need to know your PF account number. If you are searching for ‘how to get PF account number’, you can follow any one of the following ways -

As your employer manages your PF account, you can find the details on your salary slip. Your monthly salary slip contains your UAN and PF account numbers. You will also find the details of the funds deposited in the account from your salary slip.

In case you do not get a salary slip every month, you can get in touch with your HR department. They will be able to tell you your PF account number.

You can also visit your nearest PF office to know your PF account details. You will have to provide your KYC details and submit a grievance redressal form. Once the grievance is processed, you will get the details of your PF account.

You can download the UMANG app and log in using your mobile number. Then follow these steps -

STEP 1: Log in to the UMANG app using your mobile number.

STEP 2: Select ‘EPF services’ → ‘Employee Centric Services’ → ‘View Passbook’.

STEP 3: Authorize the login using the OTP received on your registered mobile number.

Want to know how to check your PF account number using your PAN details? Just follow these steps -

STEP 1: Visit the EPF portal and log in using your credentials.

STEP 2: Enter your PAN, DoB, mobile number, and CAPTCHA code.

STEP 3: Click on ‘Get Authorization PIN’.

STEP 4: Click on ‘I Agree’ and verify the OTP received on your registered mobile number.

STEP 5: Finally, click on ‘Validate OTP and Get UAN’.

Searching for ‘how to know PF account number’ through the UAN portal? Then follow these steps -

STEP 1: Log in to the UAN portal using your password.

STEP 2: Go to ‘View’ → ‘Passbook’.

STEP 3: You can know your current PF account number.

Every time an amount is contributed towards the PF, employees receive a notification regarding this update. You can find your PF number in the notification.

Now let’s look at the steps on how to get the PF account number through the EPFO portal -

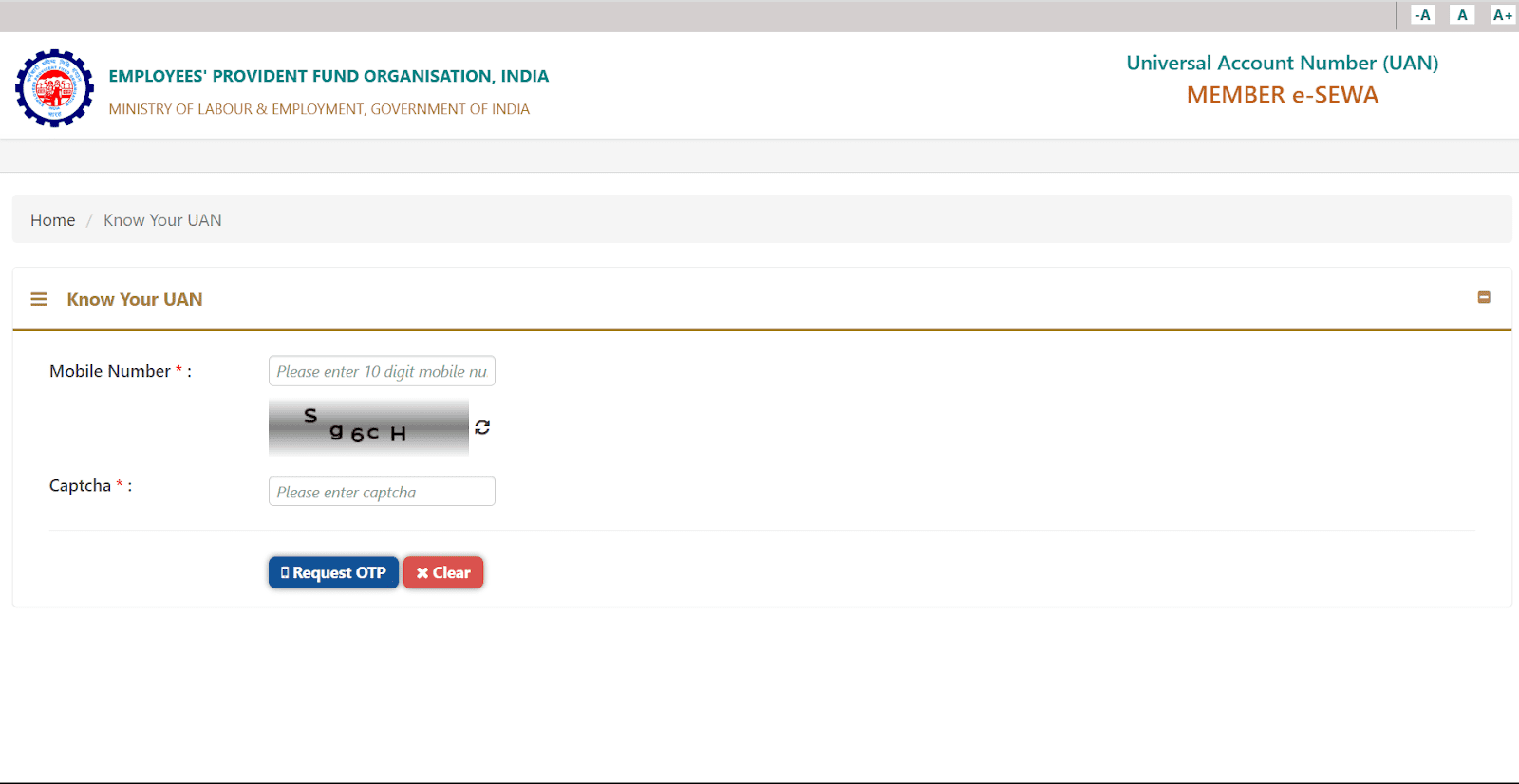

STEP 1: Go to the EPFO portal and click on ‘Know Your UAN’.

STEP 2: Provide your linked mobile number, enter the captcha, and then request OTP.

STEP 3: Enter the OTP sent to your mobile number, enter the captcha, and validate the OTP.

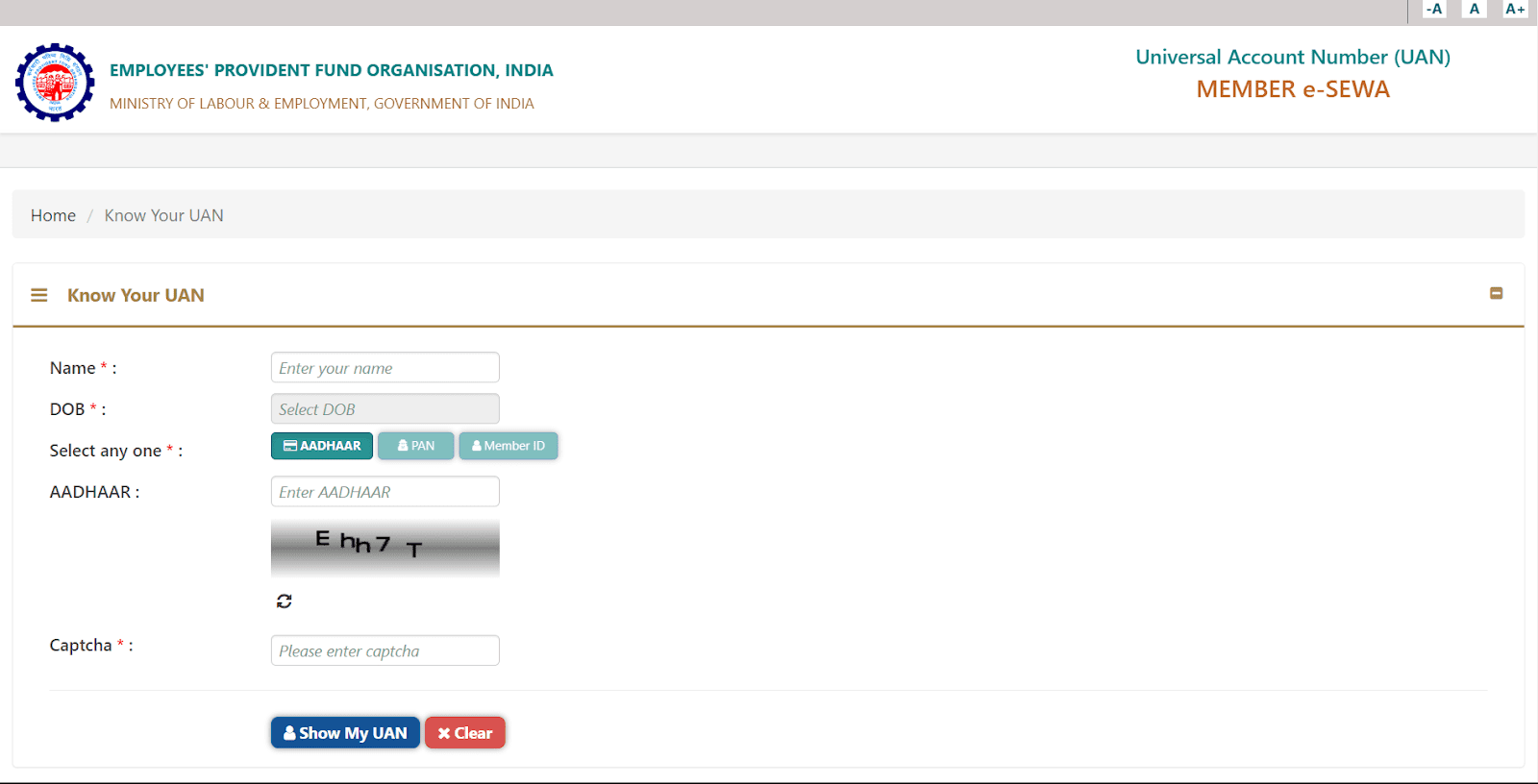

STEP 4: On the next screen, enter your details such as name, DOB, PAN/Aadhaar card number, and captcha.

STEP 5: Click on ‘Show My UAN’ and the screen will display your UAN.

STEP 6: Using this UAN, log in to your portal and check your PF number.

Your EPF account is beneficial in various ways -

To track your funds in the EPF account

To access the account through mobile apps and portals

For a smooth transfer of funds in the PF account at the time of job change

And in case you are wondering what is the purpose of a PF account, let’s discuss the benefits of having it -

Encourages long-term savings.

Eliminates the need to make a single, large investment. Deductions are made from the employee's salary on a monthly basis, allowing for significant savings over time.

EPF is the ultimate rainy day fund and can help employees during a financial emergency.

It aids in retirement savings and allows an individual to maintain a comfortable lifestyle.

Universal Account Number or UAN is a unique 12-digit number provided to EPF account holders. Using the UAN, EPF subscribers can easily check their fund balance and perform other activities such as PF withdrawal, merging two separate PF accounts, and more.

The UAN does not change even if the employee changes jobs. The new employer opens a new PF account under the same UAN and contributes towards EPF.

The PF account number changes under a new employer.

Difference Between UAN and EPF NumberThe UAN and EPF are related to each other, but not the same. Let’s look at the differences to understand them better -

|

If you are having any issues or have any grievances about your EPF account, funds, etc, you can reach out via the following channels -

|

EPFO Employee Grievance Redressal |

|

|

EPFO Employer Grievance Redressal |

|

|

EPFO Toll-free Number |

14470 |

|

Speedy Redressal of Grievance |

|

|

WhatsApp Helpline Numbers |

https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/WhatsApp_Helpline.pdf |

|

UAN/KYC Queries |

1800118005 (9:15 am to 5:45 pm) |

The Employee PF Number is a unique account number that employees use to verify the state of their EPF, and the balance of their EPF account, and to perform other tasks related to EPF.

It is important to know your PF number as it helps you plan ahead for your retirement. EPF members who are unaware of their PF account numbers can easily find out PF numbers by following the methods mentioned above.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?