Home

>

Download Bank Statement in PDF

Bank statements are essential when applying for personal loans as they serve as proof of income. Banks, NBFCs, or even online money lenders ask for your bank statements to approve your loan application.

Bank statements are available both online and offline. However, online statements are easy to get and upload. Since loan applications and digital lending apps such as Moneyview prefer statements in PDF format, we will explain how to download a bank statement in PDF format.

Most banks usually send monthly bank statements through mail to their customers. To receive the statement, the customer must be registered for the service.

If you have registered your email id with your bank, in most cases, you will receive the statement for the previous month in the first week of every month.

In case you are not registered, you can either contact your bank directly or enable the service through the bank’s app or website.

To check and download the bank statement from your email, please follow the steps below.

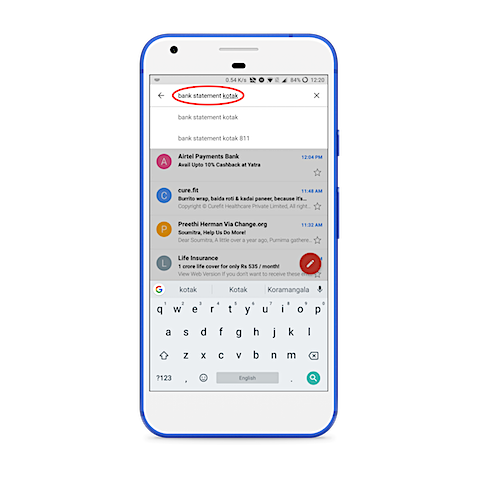

1. Goto your preferred email app on mobile (Gmail/Yahoo etc.)

2. Search for keyword ‘bank statement’ along with your bank’s name. For e.g.; ‘bank statement kotak’

3. Locate the email from the search result and open it.

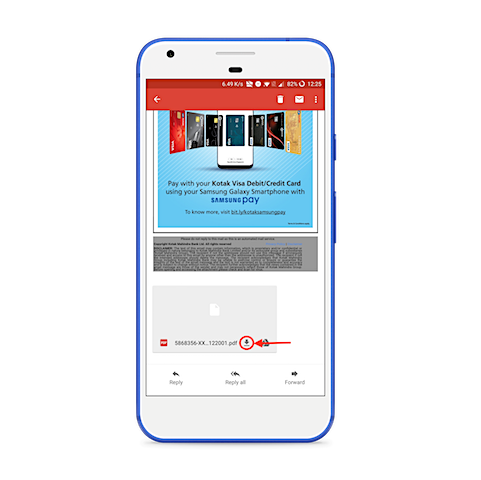

4. All bank statements sent through emails are password protected. Make sure you read the password instructions in the email to open the PDF file.

5. Download the PDF.

6. Use the password to check if the file is opening. You have to use the same password while uploading the PDF during Moneyview loans application.

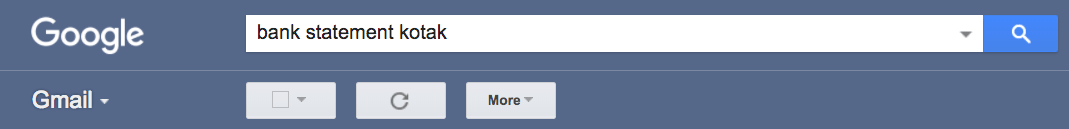

1. Search for the keyword ’bank statement’ with your bank name in your email client like – Gmail or Yahoo mail.

2. Check for the most relevant email within the search result. The subject for the mail should look like something below :

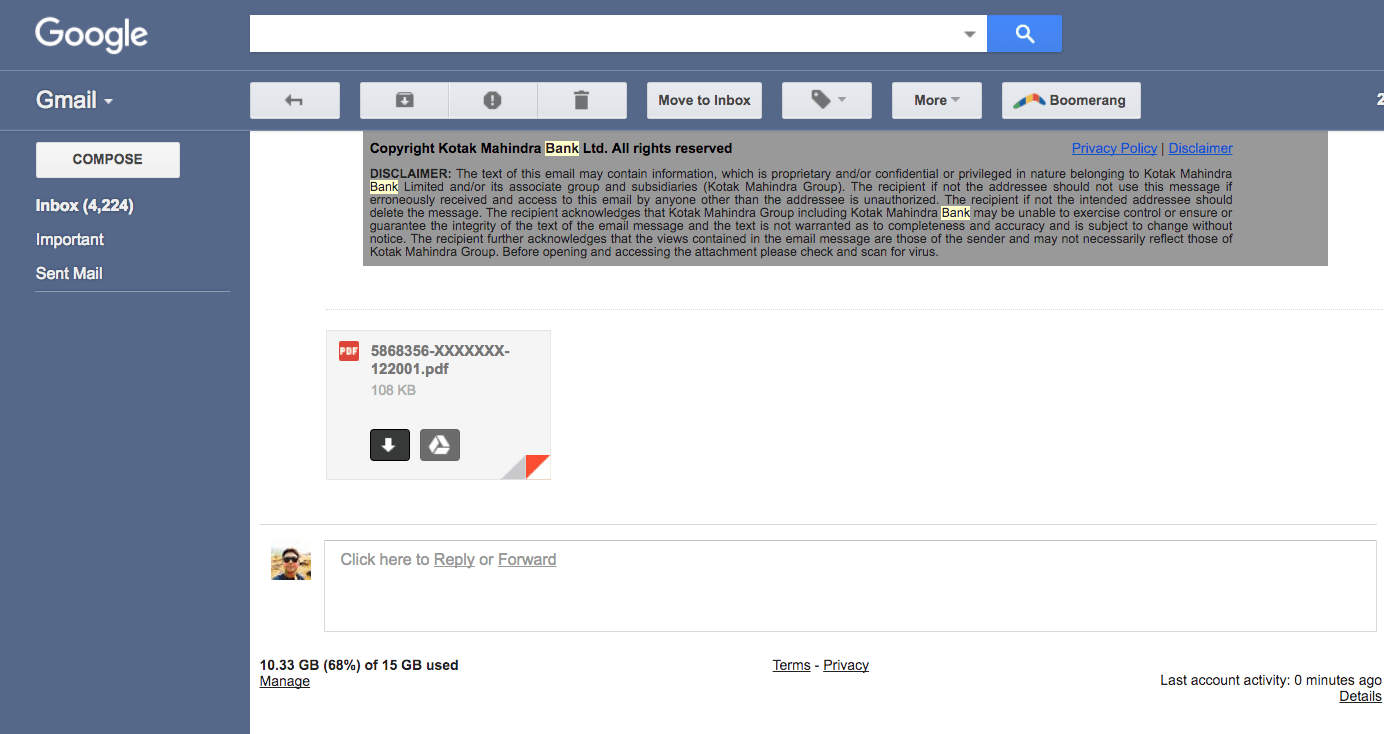

3. Read through the email and understand what password to use to unlock the PDF statement.

4. Download the attached PDF and use the password while uploading it on the Moneyview app.

If you have Netbanking access to your bank account, please follow the steps to download your bank statement in PDF easily

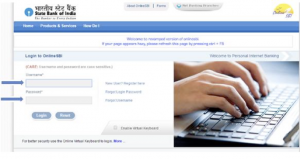

1. Login to the SBI Online Banking Portal

2. Under My Accounts -> Account Summary, you get an option ‘Account Statement’

3. Select the account you want the statement for, the statement transaction period, and the type of report.

The statement will be downloaded to your system or you can find it in the ‘File’ folder of your mobile device.

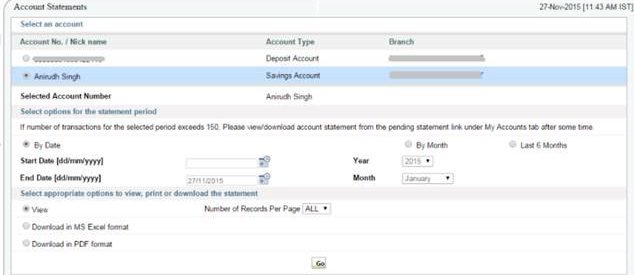

1. Login to ICICI Bank Netbanking portal

2. Click on the e-statement on your system or if you are downloading the statement on your mobile, choose the ‘mini-statement’ option

3. You can choose the PDF format while downloading

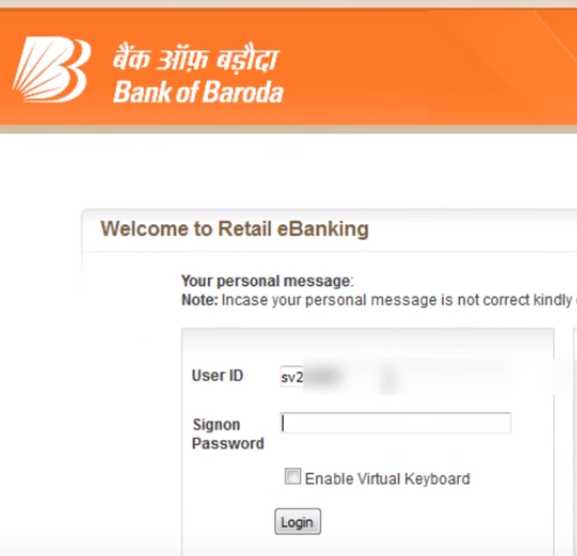

1. Log in to the Bank of Baroda net banking with your user/customer ID and password

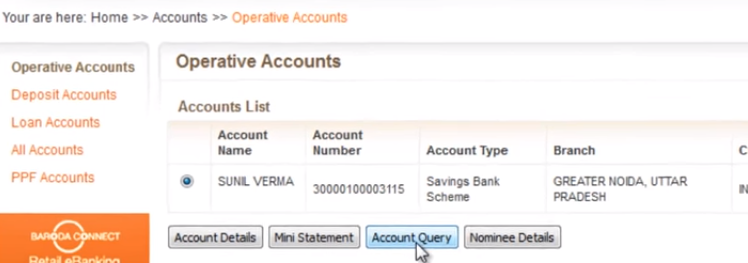

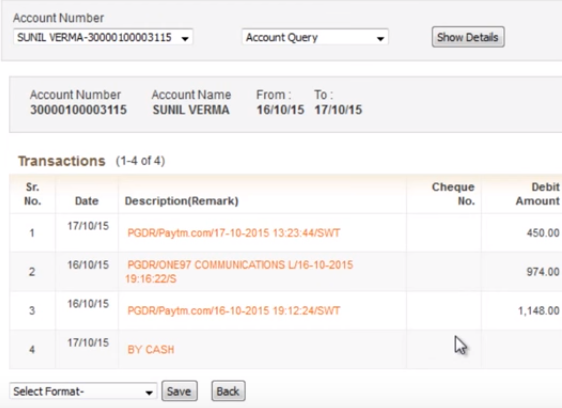

2. Select Accounts -> Operative Accounts -> Account Query

3. Select Accounts → select statement tenure → choose format

4. After choosing all the required details, download the statement to your device

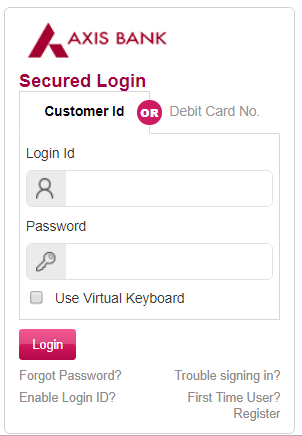

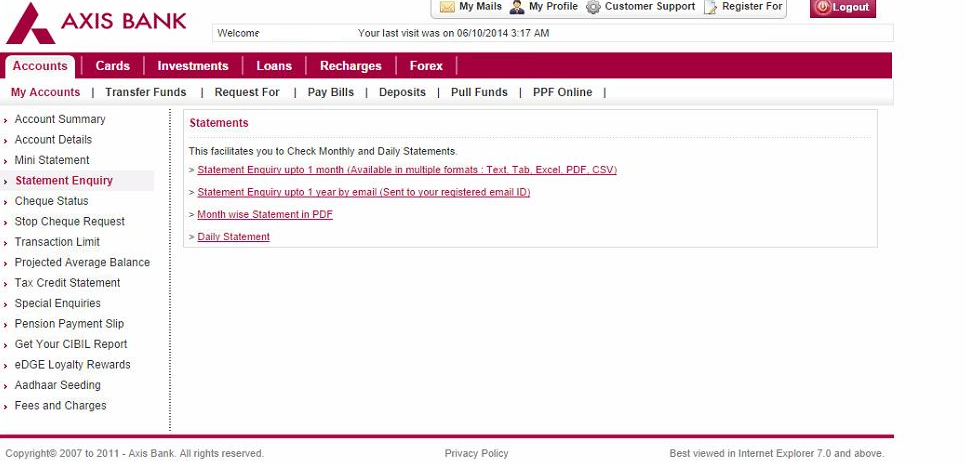

1. On the Axis bank page, go to support and click on ‘download your savings account statement’

2. Enter your mobile number registered with the bank and you will receive an OTP for validation

3. Enter the OTP and you will be directed to the accounts page.

4. Select your account type → account number → statement duration → download format

5. You can find the statement in your downloaded files

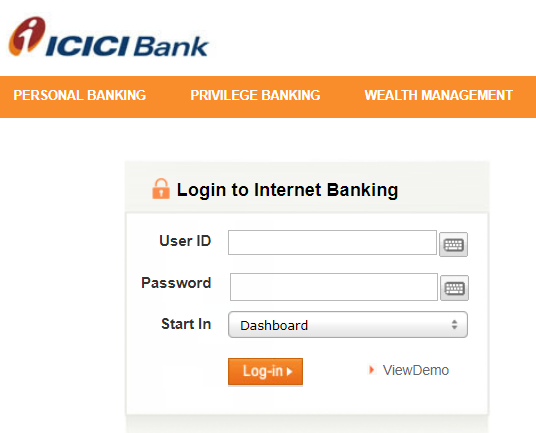

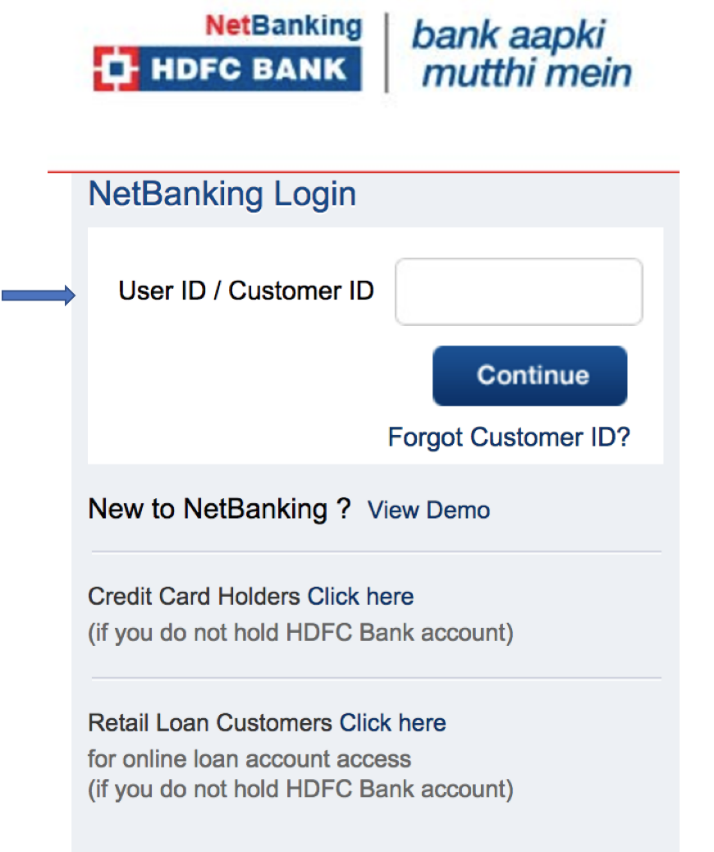

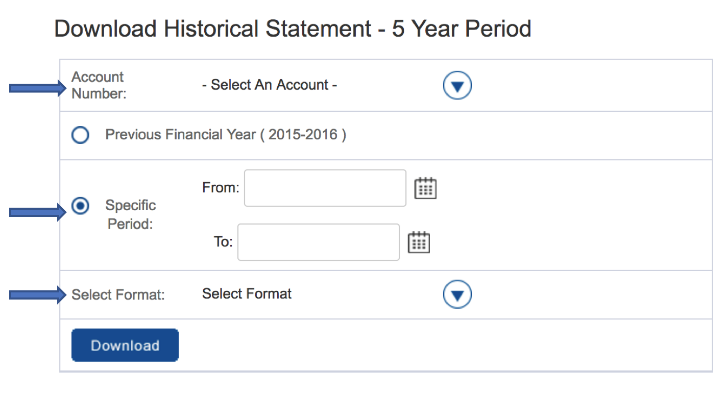

1. Log in to the HDFC bank portal

2. On the left-hand side menu, click on ‘Enquire’ --> Download Historical Statement

3. You will need to choose the account, select the time period, and then select ‘PDF’ as the format

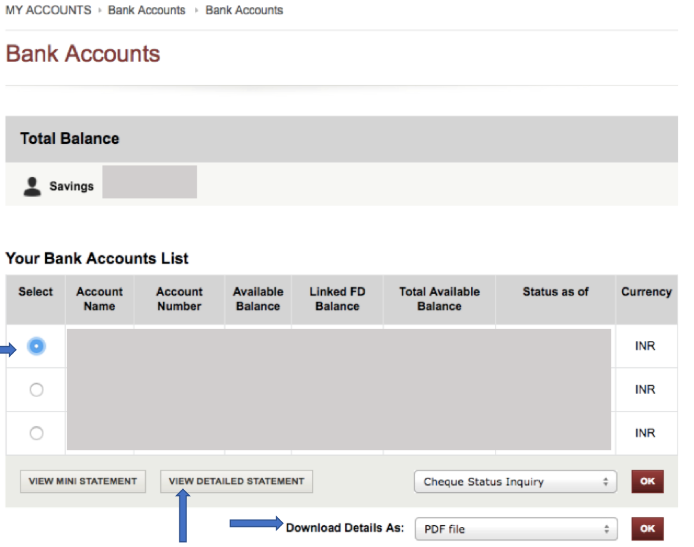

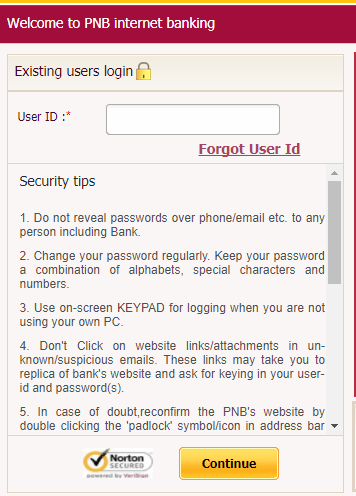

1. Log in to the PNB m-passbook with your user ID and MPin

2. You can view your mini-statement or download a detailed statement for your chosen interval to your device in PDF format

3. PNB allows you to download statements of savings, recurring, current, and overdraft accounts

4. When you are presented with the details, you can also select the option of the format to download the statement (Go to ‘Download Details as’ at the bottom right and select ‘PDF’)

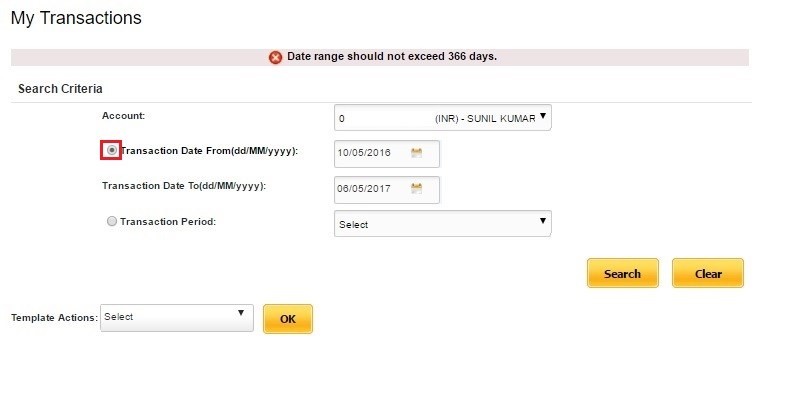

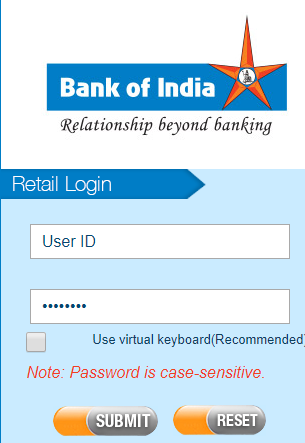

1. Log in to the Bank Of India net banking portal

2. After login, go to accounts and choose the account you want the statement for

3. Select the tenure of the statement and click download

4. You will be given the choice to download in various formats.

5. Choose PDF format and click download

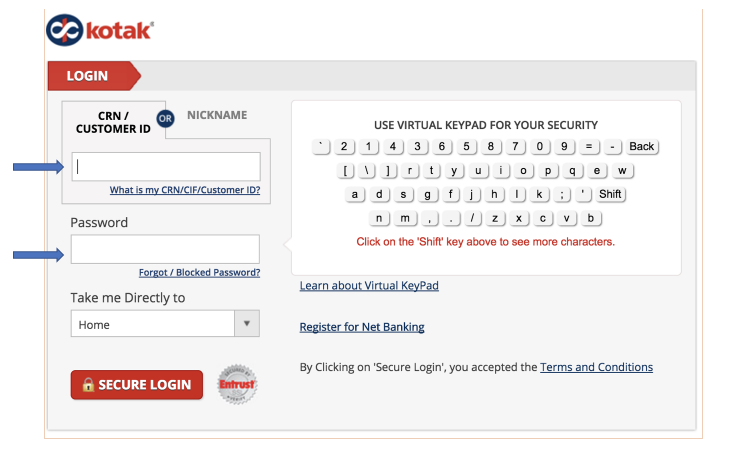

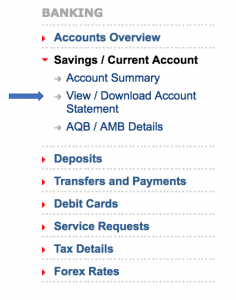

1. Log in to the Kotak Mahindra Net Banking portal

2. Under services, choose the ‘statement’ option

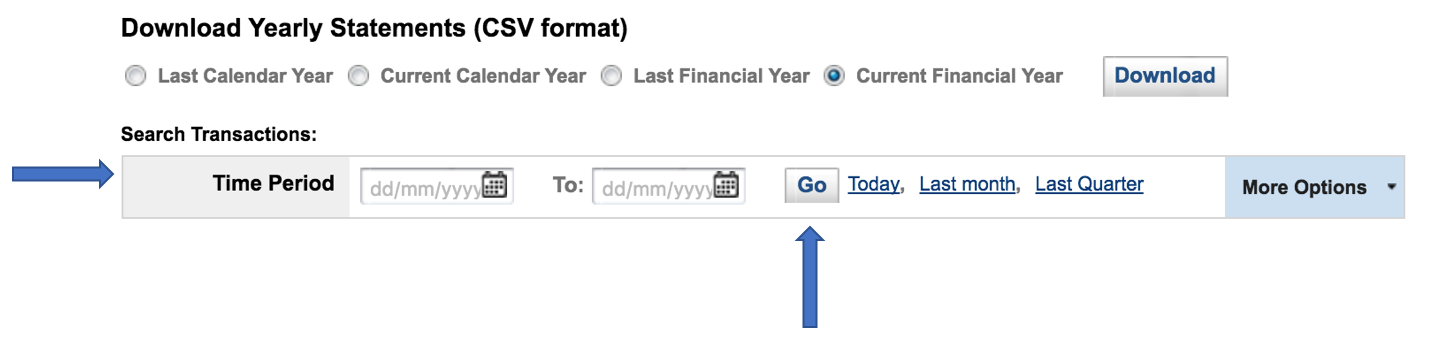

3. Now select the time period for the statement and click on Go. You will be able to download only 3 months statement at one time. So if you need 6 months statement, then you need to do this step two times

4. Select the account statement, its tenure, and download it in PDF format

1. Log in to the Canara Bank portal

2. You will see ‘Accounts’ tab on left-hand side menu. Click on it and click on ‘Account Statement’ option below it.

3. Select the account, start date and end date and click on download as per the selected file format

Hope this guide is helpful for you to download PDF of your bank statement.

Every bank provides its customers the option to download an e-statement or mini-statement. While the words vary, the process to download the statement is similar for every bank.

Log in with your credentials, select your account, choose the statement period and then choose the format you want to download the statement in.

We hope this article helps you successfully download your bank statement.

Go to your nearest bank branch and request a statement for a specific period. You have to provide a start date and end date, just like in the online method, and collect the statement from the bank.

Banking & Investment Tips

Credit Score Basics and Full Forms

Finance and Legal Term Differences

Finance and Banking Articles

Balance Enquiry Numbers Guide

CIBIL Score Check and Boost Guide

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?