Are you an entrepreneur looking for a loan, and want to know what a commercial CIBIL report is?

Read ahead to learn all about the commercial CIBIL report as well as how to check a company’s CIBIL score.

The CIBIL score and report of an enterprise, institution, or corporation is known as commercial CIBIL.

Individuals who take credit have a consumer CIBIL score and report. Similarly, a company that has been taking credit (under ₹50 Crore), can see their credit history, repayment behavior, etc. on their company CIBIL report.

With a better commercial CIBIL report, an enterprise will be able to procure loans at lower interest rates.

A commercial report has features similar to a personal CIBIL report. Let’s take a look at them -

Helps lenders figure out the creditworthiness of the company

Helps lenders work faster and make better decisions about loan amounts and interest rates

Helps lenders know what other loans the company has

The company's CIBIL score summarizes the company's credit report or the CCR in one number. The ranks are given based on the creditworthiness of your enterprise. The ranks range from 1 to 10, where a lower rank is considered better.

TransUnion CIBIL receives information regarding your credit repayment history from various lenders and compiles it to generate your CIBIL report. The commercial CIBIL score is calculated based on your credit utilization and repayment behavior.

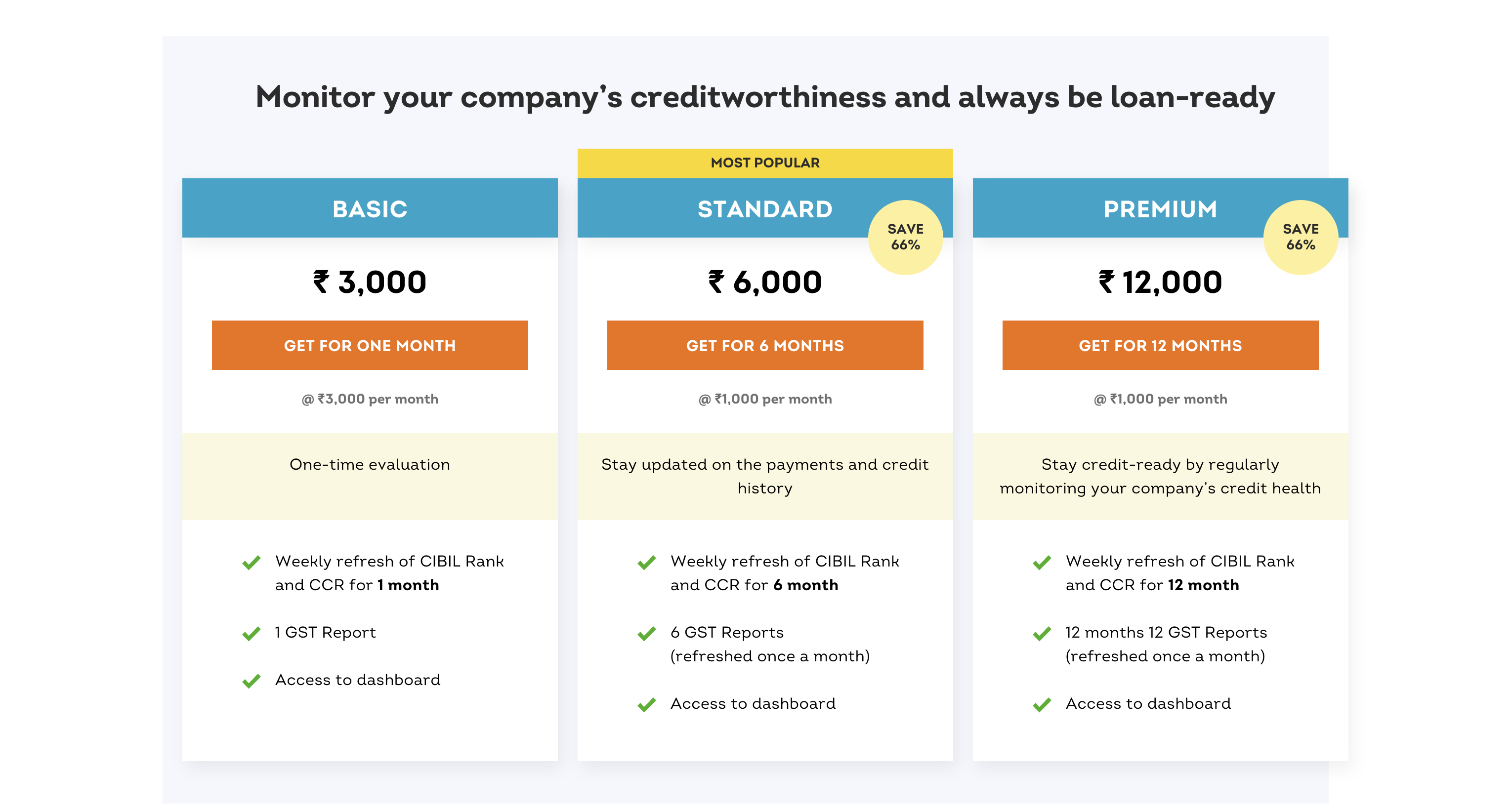

You can check your company's CIBIL report by yourself on the CIBIL website. Unlike the individual credit report, you cannot obtain a commercial CIBIL report for free.

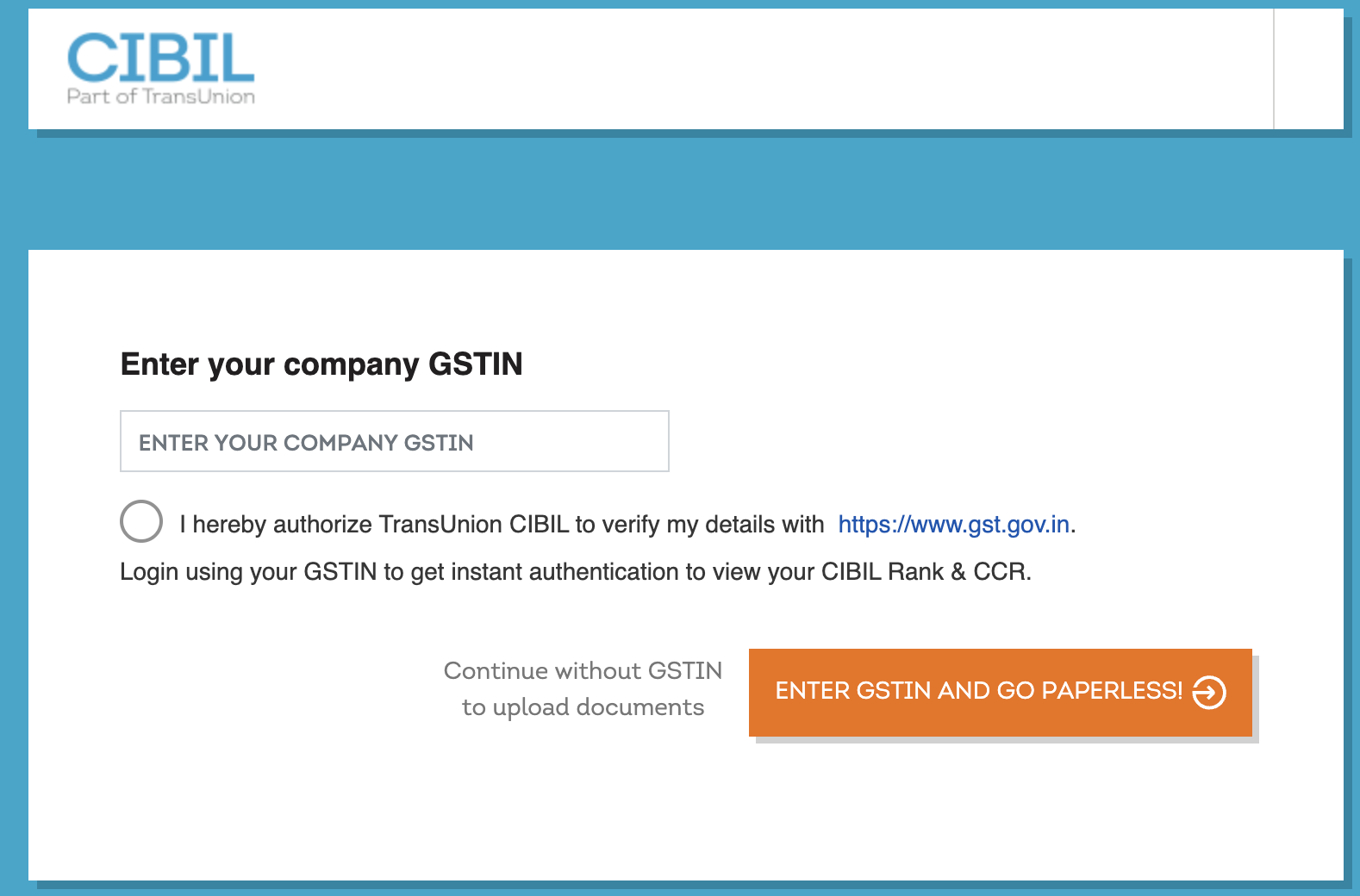

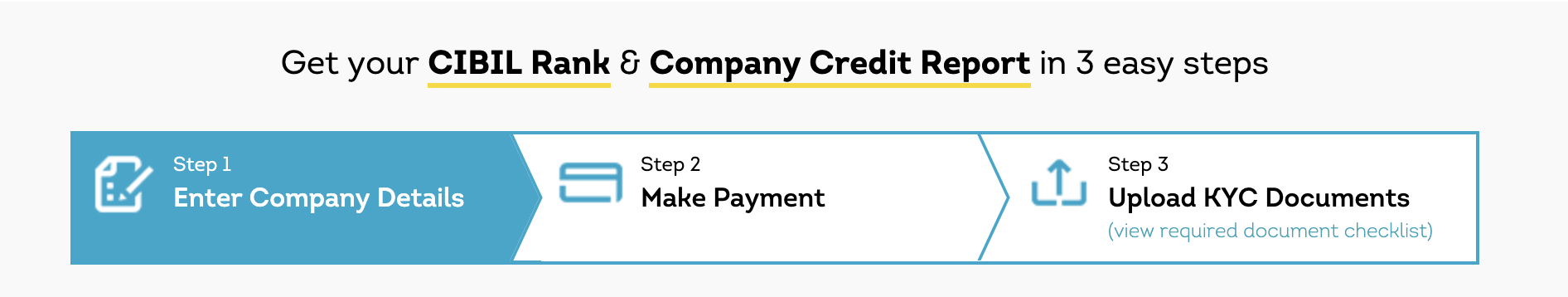

Here are the steps you can follow to make a payment and successfully receive your report at your company’s address -

A detailed CIBIL commercial report has the credit history of your company. Here are the main sections that are mentioned in your commercial CIBIL report along with the information they have -

Your company credit report is an overview of how you manage your organization’s finances. Here are some important factors that affect your company's CIBIL report -

The company profile refers to the size and life of a company. Companies that have been running for longer, generally have more stability, higher turnovers, as well as better financial history.

Thus, they might have a better CIBIL rank along with an appealing commercial CIBIL report.

This is directly connected to the EMIs paid for the past loans taken by the company. Managing your past dues and being punctual with EMIs will positively impact your company’s CIBIL report.

The credit utilization ratio refers to the loans you have out of the total credit available to you. If this ratio is high, it makes you look credit hungry and may impact your CIBIL report negatively. Thus it is a good idea to keep your CUR under control.

Your outstanding debts refer to the number of external ongoing debts you have. Having a huge sum of unpaid debt, or a new debt, is bound to affect your credit report negatively. Thus, it is crucial to keep only a feasible amount of dues.

Your company’s credit history involves the number of years for which you have actively taken and repaid loans. A longer credit history with timely payments is always better for your company’s commercial report.

You need consistency and patience to improve your CIBIL score and history. Here are some simple steps you can follow to improve your CIBIL report -

Pay your EMIs on time

Pay your company credit card bills in full by the due date

Maintain a balance between your assets and liabilities

Your CUR (Credit Utilization Ratio) should be within 30%

Maintain a long credit history

Know Your Credit Health Instantly

Just like how a credit score calculates the creditworthiness of an individual, a commercial CIBIL report calculates if a company will be able to repay the loans it is applying for. You can check your company’s CIBIL directly from the website.

Having a good CIBIL report will help you to get higher commercial loans at lower interest rates. Even the process of applying for the loan gets easier if you have a higher commercial CIBIL score.

The major difference between a consumer CIBIL and a commercial CIBIL is that the former is for checking an individual’s creditworthiness, while the latter is for companies and organizations.

Apart from this, commercial CIBIL ranks range from 1 to 10, 1 being the best rank one can have. Whereas, consumer CIBIL score ranges from 300 to 900, where a higher score is considered better.

CIBIL Score Check and Boost Guide

Credit Score Basics and Full Forms

Credit Tracker Related Other Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?