An Overview of Investment Options to Save Taxes

We are pretty sure your employers are breathing down your neck for submitting investment proofs for the current year. Have you done the investment for minimizing your tax outgo? There is still time, fret not. As the final post in our series on tax saving we do an overview of tax saving investment options for you to make an informed decision.

Gazing into the Crystal Ball

Do not hurry into the next tax saving investment. Why? Because of long term impact of the decisions you make today. Think about the future — the next 5, 10 and 15 years. Think about the following:

- How much short term money is required (money that you would like to use within 3 years)?

- Amount required for a house, child’s education, marriage etc. Big ticket items which normally occur in the longer term

There may be other financial requirements, thus making it imperative that you write it down as a plan. We at Money View blog have published a number of posts on financial planning. You can start with these.

A gist of all tax saving products

Fortunately there are many tax saving products one can choose from. But unfortunately we are spoilt for choice. One of the many paradoxes in life. Some of the main products are:

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

- Equity Linked Saving Scheme (ELSS)

- Unit Linked Insurance Plans (ULIPS)

- Long Term Fixed Deposits (FD)

- Term Insurance

The ‘term insurance’ is purely an insurance product, with no financial benefit if the claim is not made. We will get to this later.

We have covered each of these terms in detail here: What Investments can Help You Save Income Tax Legally?

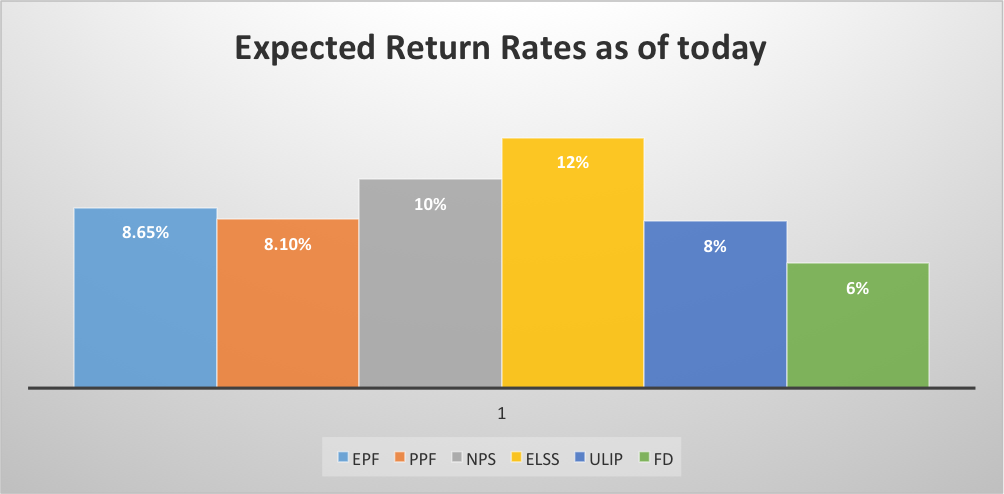

Let’s now see some interesting charts comparing the various products.

- It is clear from the above chart that the ELSS has the greatest expected rate of return. But there is a caveat, It is expected but not guaranteed. It is linked with the performance of the stock market. In the long term, the stock market is expected to give the largest return among all the investment avenues available.

- The other attractive instrument is the NPS. Under this scheme, the government invests your money into bonds and other securities. Hence the higher return. The caveat here is that one can use it post retirement only. We think it’s a simple yet effective option for a retirement fund. In fact under the new rules, there is an additional INR 50,000/- exemption if one invests the same in an NPS account.

- We will not comment much on EPF as it is almost out of your control and is a function of your salary structure.

- The PPF does offer an attractive return along with tax exemption under 80c. One should closely consider this and unlike NPS it is more liquid.

- The ULIP is barely attractive unless one wants to simplify their investment and insurance needs.

- Fixed deposits are more for liquidity rather than investment. It is the most liquid of all the instruments, but as interest rates are down post demonetization, it is expected FD rates will come down even further.

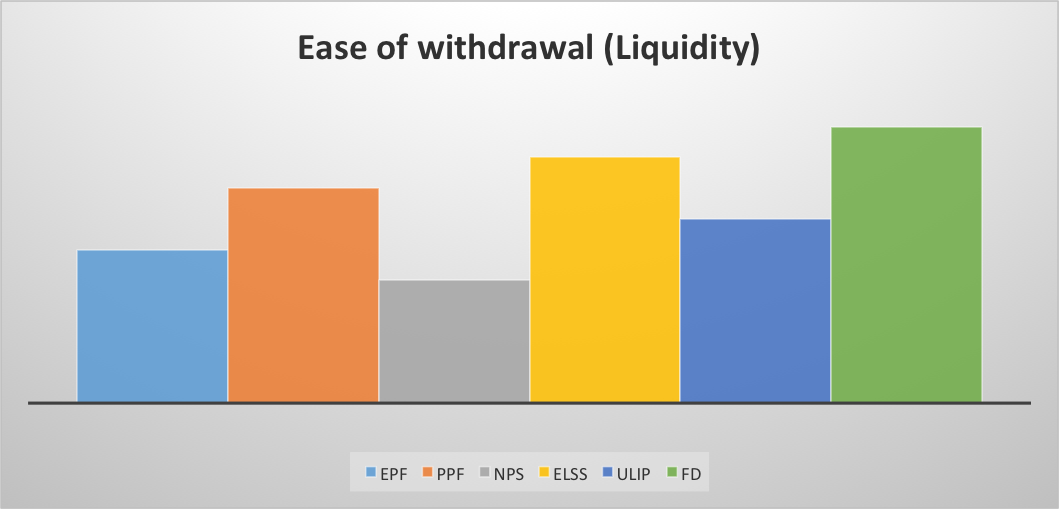

The chart below indicates the ease of withdrawal or what we term as liquidity.

Even though the FD is the most liquid, it does not yield high returns.

The second is the ELSS, which yields the maximum return in the long term. From these charts, it may be easier for you to pick instruments for a specific long term and short term goals.

Some of the good ELSS funds are

- Sundaram LT ELSS Fund

- SBI Tax Advantage ELSS Fund

- HDFC Long Term Advantage Fund

- ICICI Prudential Long Term Equity Fund

Note on Insurance

We have covered insurance in this detailed post Is Insurance a Good Way to Save Taxes?. It is important to stress that insurance should be looked at only from an ‘insurance’ perspective and not from an investment standpoint. Therefore term insurance products make the most sense as the premiums are the lowest. For investment we can opt for ELSS rather than ULIPs that combine insurance and investments. Of course in the end, if you already have a ULIP, it may make sense to complete your minimum tenure.

Planning

After all these facts, it’s time to plan your taxes effectively. We recommend the following:

- Get a term insurance. The premium rates depend on your age and health profile.

- Calculate EPF contribution and deduct from 80c limit to calculate investment gap required to claim full exemption.

- Generate Retirement corpus if required: NPS seems to be an attractive option. PPF can also be considered.

- Rest shall go into an ELSS fund. Though the risk is higher, due to a lock-in period, they are reduced. The returns can be handsome.

Please note you should have regular savings going into fixed deposits and recurring deposit accounts. This shall help you build your liquidity portfolio.

Conclusion

All this may be overwhelming, but worth the effort. Keep it simple!

——————————————————————————————————————————————–

This article is the last in the 5-article series on ‘Guide to Saving Income Tax Legally’.

In this series, we have discussed everything from investment options which help save income tax to striking the right balance between different tax saving options.

Read previous articles:

What Investments can Help You Save Income Tax Legally?

PPF, EPF or FD — Which is Better for Tax Planning?

Is Insurance a Good Way to Save Taxes?

Why ELSS is the Best Way to Save Taxes?

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.

Doesn’t the Tax saving FD has a lock in period of 5 years?? If so then how does it become more liquid than ELSS which has 3yrs lock in period??

It’s a very good article with nice explanation, one mistake that investors often make is choosing an investment just for the sake of availing tax benefits. Ideally, an investor should look out for 4 factors while making an investment –

1. Maximum tax savings

2. Minimum risk

3. Low cost of investment

4. Substantial returns