Benefits of Moneyview Personal Loan EMI Calculator

Highest loan amount

Our credit model generates the best personalized offer for you

Most affordable offers

Enjoy flexible loan tenures from 3 months to 60 months; choose a plan you like!

No surprises, 100% transparent

Check interest rate, total repayment & terms beforehand - leave no room for doubt or surprises!

Hassle-free, easy to use

The power of human experience & technology - all packed into our app to simplify lengthy processes just with a tap

Steps to apply for personal loan

1

Sign up using mobile number

2

Enter basic information & check eligibility

3

Verify your profile by uploading KYC documents

4

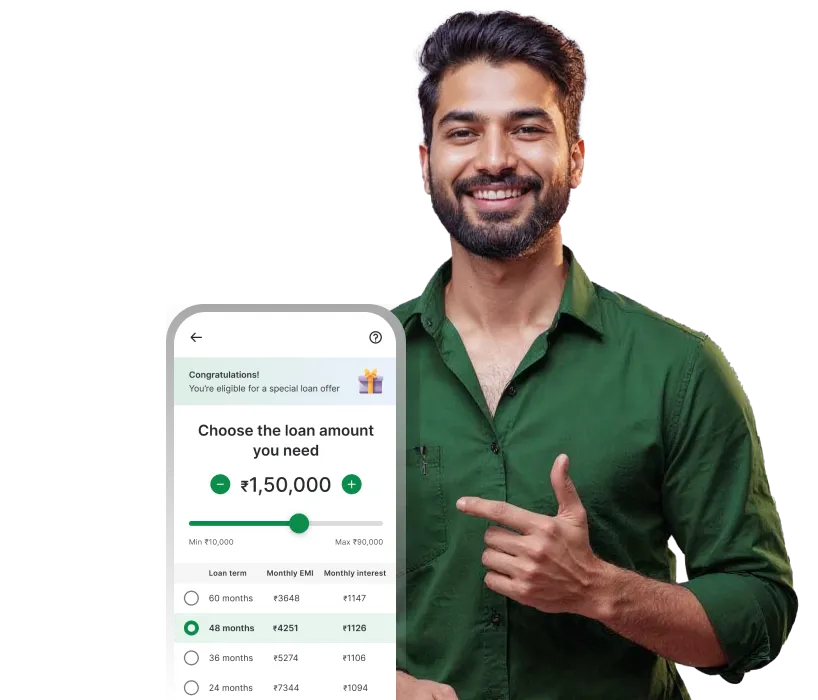

Choose your loan amount and tenure

5

Get loan disbursed directly into your bank account.

Interlinks

Formula to calculate personal loan EMI

The formula for calculating EMI is as follows:

E = P x R x (1+R)^N

————————

[(1+R)^N-1]

P - the principal amount that is borrowed

R - the rate of interest imposed

N - tenure in the number of months

For example -

- Rs. 10 Lakhs is the amount borrowed (P)

- 10.5% is the annual rate of interest imposed

- 60 months is the tenure (n)

Then the EMI to be paid using the above formula will be:

10 Lakhs x 0.00875 x (1+0.00875)^60

———————————————— = Rs.21,494

[(1+0.00875)^60-1]

Note: The rate of interest (R) is calculated monthly i.e. it is calculated as (Annual Rate of interest/12/100) in this case (10.5/12/100 = 0.00875)

How is personal loan interest calculated?

Personal loan interest is typically calculated using compound interest, which means interest is earned not only on the initial loan amount but also on the accumulated interest over time.

The formula for compound interest is: A = P(1 + r/n)^(nt)

A = the amount of money accumulated after n years, including interest.

P = principal amount

r = Interest rate

n = number of times that interest is compounded per year

t = time period the money is invested for, in years

Calculating personal loan interest becomes easier with the following tools.

Personal Loan Calculators: These online tools let you input the loan details and instantly see the estimated monthly payments and total interest paid.

Loan Amortization Schedules: These charts break down each payment into principal and interest portions, showing how the loan balance shrinks over time.

Factors that affect personal Loan EMI

Credit Score and Rate of Interest

If your credit score is high i.e. above 700 then it becomes easy for you to procure a loan at lower rates of interest and at a repayment tenure that is to your advantage. Lower the rate of interest then lower is the EMI payment to be made

Loan Amount

Repayment Tenure

However, taking a longer repayment term can also be a disadvantage as the overall interest paid increases.

Existing Debt

Type of Interest Rate

Age and Income

If you do not have a steady income then lenders will be wary of lending as they are unsure of your repayment ability. This is why even if you get a loan, the interest rate will be higher.

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Personal Loan EMI related FAQs

What is the EMI for 2 lakh personal loan ?

Your EMI will depend on three factors -

- The amount being borrowed

- Rate of interest

- Repayment term

In this case, let us assume that your rate of interest is 16% per annum with a repayment term of 8 months. The easiest way to find out your EMI is to use the Moneyview Personal Loan EMI Calculator

Using this calculator, the EMI for 2 lakhs personal loan is Rs. 26,523 with the interest amount coming up to Rs. 12,185.

The EMI schedule or amortization table for this example is -

| Month | Opening Balance | Interest | Principal | Closing Balance |

|---|---|---|---|---|

| Jan 23 | ₹ 2,00,000 | ₹ 2,667 | ₹ 23,856 | ₹ 1,76,143 |

| Feb 23 | ₹ 1,76,143 | ₹ 2,349 | ₹ 24,174 | ₹ 1,51,969 |

| Mar 23 | ₹ 1,51,969 | ₹ 2,026 | ₹ 24,496 | ₹ 1,27,472 |

| Apr 23 | ₹ 1,27,472 | ₹ 1,700 | ₹ 24,823 | ₹ 1,02,649 |

| May 23 | ₹ 1,02,649 | ₹ 1,369 | ₹ 25,154 | ₹ 77,494 |

| Jun 23 | ₹ 77,494 | ₹ 1,033 | ₹ 25,489 | ₹ 52,005 |

| Jul 23 | ₹ 52,005 | ₹ 693 | ₹ 25,829 | ₹ 26,175 |

| Aug 23 | ₹ 26,175 | ₹ 349 | ₹ 26,173 | ₹0.00 |

How is personal EMI calculated ?

The formula for calculating personal or personal loan EMI is as follows:

E = P x R x (1+R)^N

————————

[(1+R)^N-1]

Where P stands for the principal amount that is borrowed

R represents the rate of interest imposed

N is the tenure in number of months

How do I calculate monthly installment?

A loan is repaid in the form of monthly payments known as EMI or Equated Monthly Installments. This amount comprises the principal and interest components and will depend on the amount borrowed, the interest rate imposed, as well as repayment term.

EMI can be calculated in two ways -

- You can either use the formula given above

- You can use the Moneyview Personal Loan EMI Calculator online

What is the formula to calculate EMI in Excel?

In order to calculate EMI in Excel, you will need to use the following formula -

=PMT(RATE,NPER,PV,FV,TYPE)

Where

- RATE stands for rate of interest applicable on the loan

- NPER is the total number of monthly installments/ loan tenure

- PV represents present value/ loan amount/ principal amount

- FV is future value or cash balance once last payment has been made. This can be omitted and the value will be counted as zero (0).

- Type is zero (numerical 0) or 1 – this indicates when the payment is due. If payment is due at the end of the month, the type will be equal to zero. If the payment is due at the start of the month, then the type will be set as 1.

This way, using the above formula, you can easily use Excel to calculate your EMI.

Which bank is best for personal loan?

The best bank or lender for your personal loan is dependent on a number of factors such as your eligibility, interest rate being charged, ease of availability, disbursal time, etc.. Some of the top banks that provide personal loans are SBI, Axis Bank, ICICI Bank, Citibank, Canara Bank, etc.

However, today there are a number of fintech players in the market today that offer instant personal loans easily. No longer will you have to submit multiple applications or documents physically, nor will you have to wait days for a loan.

Moneyview is one of the top digital lending apps that offers instant personal loans of up to Rs. 10 Lakhs and requires minimal documentation. Not only that, once your loan application is approved, your loan will be credited to your bank account within 24 hours.

How can a personal loan calculator help you when taking out a loan?

Let's understand how a personal loan calculator can help you make informed borrowing decisions.

1. Calculating Your EMIs

The most immediate benefit of a calculator is its ability to estimate your monthly payment, the EMI. Simply input the loan amount, interest rate, and loan term, and you will get the EMIs for your loan repayment tenure displayed in just a few seconds.

This can help you with repaying the Personal Loan EMIs easily and aid you to assess if the loan fits comfortably within your budget.

2. Comparing Loans

Every lender offering personal loans provides unique terms and rates. Comparing them manually can be difficult. Use the calculator, and enter the details of different offers, and it instantly lays out the total cost of each loan, including interest and fees. This clear picture allows you to identify the most affordable option.

3. Calculate With Varying Factors

Change the variables like loan amount, interest rate, or repayment term, and see the immediate impact on your monthly payments and total loan cost. This flexibility helps you make informed choices about your finances

Moneyview's personal loan EMI calculator can help you calculate your loan EMIs instantly and will provide you with a detailed loan amortization schedule in just a few clicks. Simply set the values of your principal loan amount, interest rate, and loan tenure and you will receive the EMI details in mere seconds.

How to reduce personal loan EMI?

It is possible to reduce personal EMI by using the following methods.

1. Part-Prepayments

Many lenders allow you to make lump sum prepayments on your loan after you've paid a particular number of monthly payments. This minimizes the outstanding principal, resulting in reduced interest and lesser EMIs over time.

2. Opt for a Balance Transfer

If you have a high-interest personal loan, try shifting it to a lower-interest lender. This can considerably reduce your EMI and possibly shorten the term of your loan. However, before making a decision, evaluate transfer fees and other charges.

3. Increase Your Loan Tenure

While this lengthens your repayment period and causes you to pay more overall interest, it can drastically reduce your monthly EMI. If you're having trouble managing your bills right now, this could be an alternative.

4. Negotiate with your Lender

In some cases, you might be able to negotiate a lower interest rate or reduced fees with your current lender, especially if you have a good credit history and payment record.

5. Consider Debt Consolidation

If you have multiple high-interest debts, consolidating them into a single personal loan with a lower interest rate can simplify your payments and potentially reduce your overall EMI.

Click here

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.