Benefits of Moneyview Business Loan EMI Calculator

Highest loan amount

Our credit model generates the best personalized offer for you

Most affordable offers

Enjoy flexible loan tenures from 3 months to 60 months; choose a plan you like!

No surprises, 100% transparent

Check interest rate, total repayment & terms beforehand - leave no room for doubt or surprises!

Hassle-free, easy to use

The power of human experience & technology - all packed into our app to simplify lengthy processes just with a tap

How to Get a Business Loan from Moneyview

Fund your business dreams with Moneyview's instant personal loans. Follow the simple steps given below -

1

Sign up using your mobile number

2

Check your eligibility after entering the necessary details

3

Provide the necessary documents

4

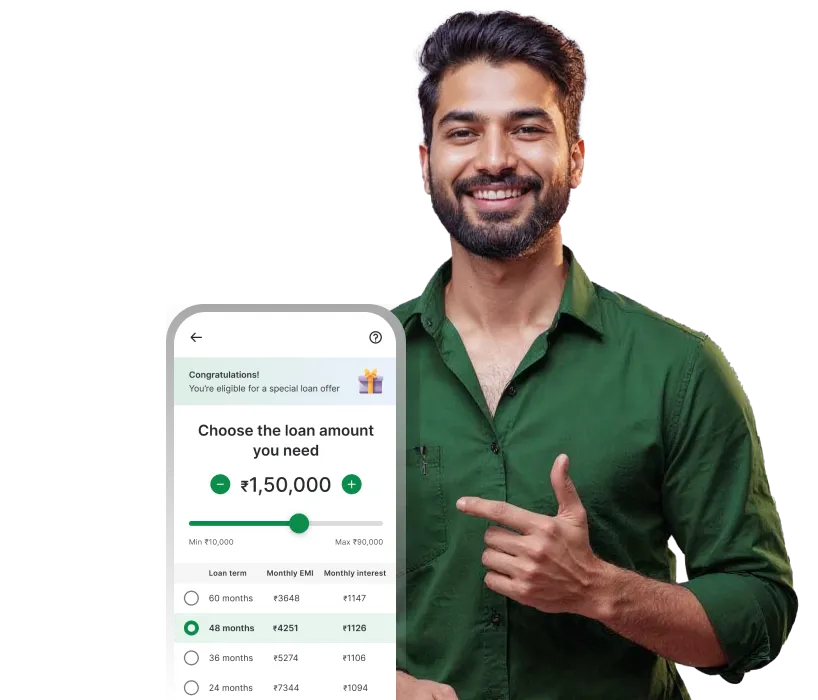

Choose the loan amount and tenure

5

Get the loan credited directly to your account

Interlinks

Formula to calculate business loan EMI

If you are interested in knowing the formula that is used to calculate EMI, you can check it out here-

E = P x R x (1+R)^N

————————

[(1+R)^N-1]

P - the principal amount that is borrowed

R - the rate of interest imposed

N - tenure in the number of months

For example, if Rs.110 Lakhs is the amount borrowed (P), 18% is the rate of interest imposed (R), and 36 months is the tenure (n), the EMI to be paid using the above formula will be:

110 Lakhs x 0.015 x (1+0.015)36 / [(1+0.015)^36-1] = Rs. 3,97,676 (per month)

Thus, the EMI for a Rs.110 Lakhs loan on 18% interest will be Rs.3,97,676.

The rate of interest (R) is calculated monthly i.e. it is calculated as (Annual Rate of interest/12/100) in this case (18/12/100 = 0.015)

Factors Affecting Business Loan Interest Rates

Credit Score

What credit score is considered high might again depend on your loan provider. You can show either your CIBIL or your Experian score as your credit score.

Type of Business

Business Experience

Whether the business itself is new or old will also play a significant role in deciding the rate of interest. If it is a new business, there will be significantly higher chances of it not doing so well, as compared to an up and running business.

Loan Amount and Repayment Tenure

Existing Debts

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Business Loan EMI Related FAQs

What is a business loan?

Are business loans secured loans?

Most business loans are secure i.e., they are provided against collateral. This can also reduce the interest rate charged on the loan.

However, if you are looking for an unsecured loan for your business wherein you do not have to provide collateral, you can apply for a personal loan from Moneyview at competitive rates.

Can I foreclose my business loan?

How does a Business Loan EMI Calculator work?

It is very easy to use a business loan EMI calculator. You just have to follow these steps-

- Enter your principal loan amount

- Enter your rate of interest

- Enter your repayment tenure

The Moneyview commercial loan calculator will display your monthly EMI amount as well as the total interest amount to be paid.

How is commercial loan EMI calculated?

Where P is the principal loan amount, R is the monthly rate of interest, and N is the tenure in number of months.

For example, if you have taken a loan of Rs.210 Lakhs at 18% rate of interest for 3 years(36 months), your EMI = [210 Lakhs x 0.015 x (1+0.015)^36] /[(1+0.015)^36-1] = Rs.90,381

How much business loan can I get on an income of Rs.40000?

The amount you can get as a personal loan depends on multiple factors, and not just your income. The main factors are -

- Your credit score - Higher the credit score, higher is the loan amount you are eligible for

- Age and experience - As an entrepreneur, both your experience and age would play a role in getting a loan. The stage your business is in will also be important

- Type of business - If your business is low risk, you might be able to get a bigger loan amount easily

- Debt-to-income ratio - If you have multiple loans running at the same time then the loan amount you get will be less

Depending on the above factors, your loan eligibility will be determined.

What is the maximum loan amount for business?

The maximum loan amount that you can get as a business loan will depend on multiple factors. Some of them are-

- Your credit score

- Your experience

- Your age

- Your income-to-debt ratio

Click here

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.