How to Get a Mortgage Loan through Moneyview

1

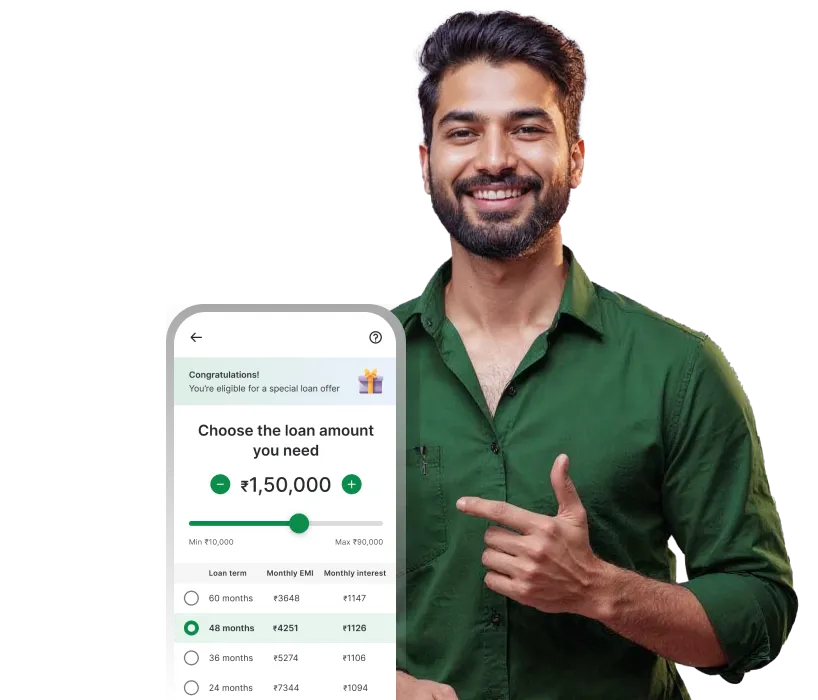

Enter personal details and submit application

2

Lending partner calls you to confirm details

3

Site visit and in-person discussion

4

Loan approval and get funds disbursed

Interlinks

Formula to calculate mortgage loan EMI

The formula to calculate your mortgage loan EMI is as follows -

E = P x R x (1+R)^N

————————

[(1+R)^N-1]

P - the principal amount that is borrowed

R - the rate of interest imposed

N - tenure in the number of months

For example, if Rs. 20,00,000 is the amount borrowed (P), 9% is the rate of interest imposed (R), and the 60 months is the tenure (n), the EMI to be paid using the above formula will be:

20,00,000 x 0.0041 x (1+0.0041)24 / [(1+0.0041)24-1] = Rs. 41,517 (per month)

The rate of interest (R) is calculated monthly i.e. it is calculated as (Annual Rate of interest/12/100) in this case (5/12/100 = 0.0041)

Factors that affect mortgage Loan EMI

Credit Score

Loan Amount

Repayment Tenure

Type of Property Being Mortgaged

Borrower Profile

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Mortgage Loan EMI Related FAQs

What Is A Mortgage Loan?

Can I Foreclose My Mortgage Loan Payments?

What If I'm Unable To Pay My Mortgage Loan EMI?

Click here

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.