PPF, EPF or FD — Which is Better for Tax Planning?

Investing and tax planning go hand in hand. The amount of money you save in taxes can be re-invested to create more wealth in your compounding journey. Remember creating wealth is all about compounding.

In our previous post, we have mentioned tax saving investment options available out there.

In this article, we talk about some of the more conventional products such as Fixed Deposit (FD), Public Provident Fund(PF) and Employee Provident Fund (EPF) along with their impact on your taxes.

Long-Term Fixed Deposits (FD)

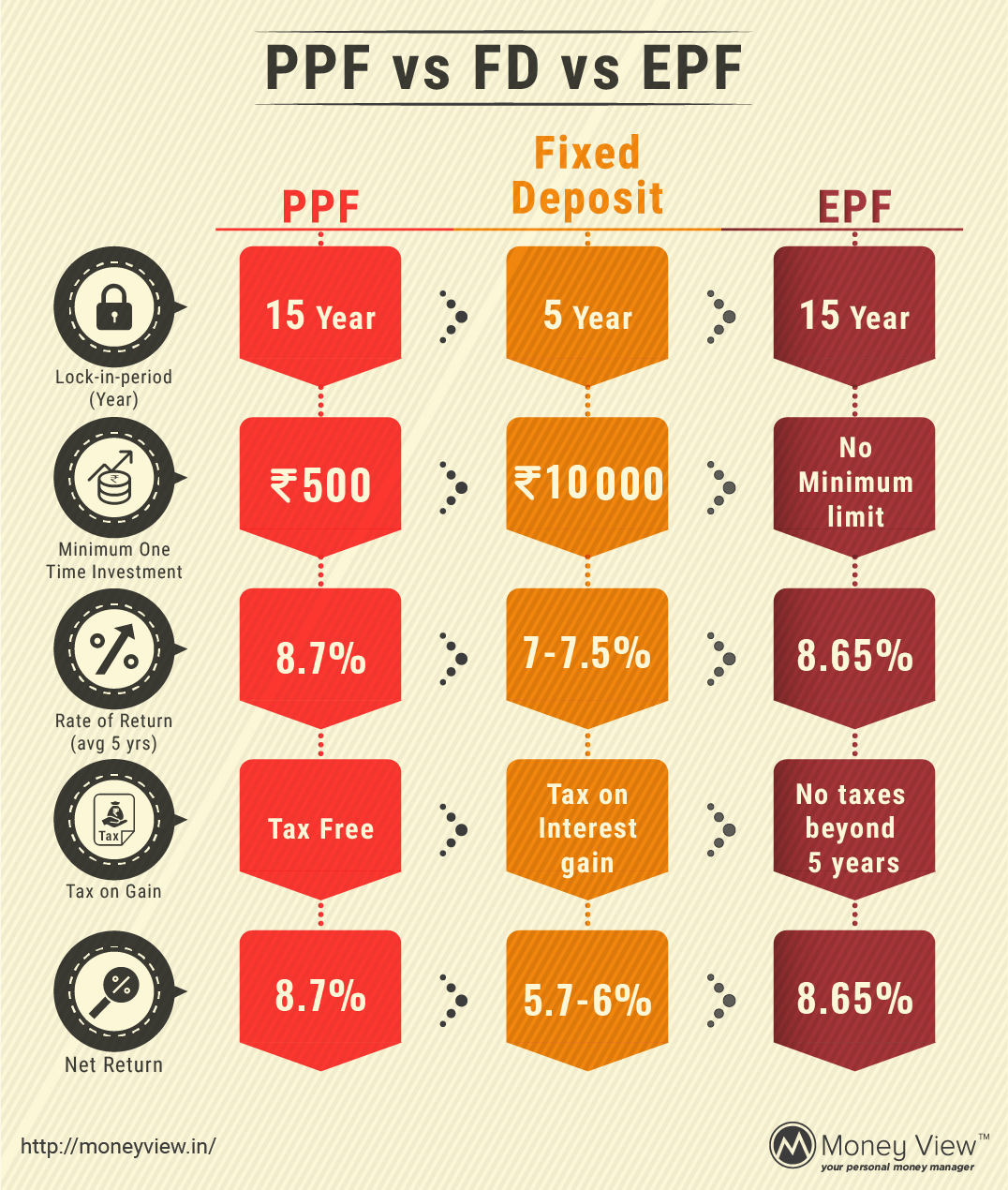

Long-term FDs are similar to the usual FDs except that their lock-in period is much longer (5 years) and the amount invested in the FD is not taxable. This comes under the 80C section of the income tax act and hence there is a limit of 1.5 lakh for the financial year. Bear in mind this 1.5 lakh includes other saving products that come under 80C. The current typical FD interest rate for 5 years and above is 6.5%.

An important point to note is that the interest (6.5%) from the long term FD is still taxable. Therefore, you will bear the taxes on the gains of your investment after 5 years. As the current interest rates are lower than before and are forecasted to go lower, a long term FD seems to be one of the less favourable options considering the returns will be quite low after the tax on gains.

Public Provident Fund

One of the oldest (introduced in the 60s) tax saving products, the Public Provident Fund (PPF) is often not given its due attention and is probably in the last of our investment preference list. PPF also falls under 80C section of the income tax act, which has an exemption limit of 1.5 lakh per year. The interest rate offered on PPF is attractive at about 8% (announced by government time to time) compared to the long term FD. The lock-in period for PPF is a massive 15 years, which basically means it is illiquid in nature. Though the rules allow you to make premature withdrawals, PPF is mainly a retirement planning product.

Hence, PPF should be part of one’s retirement planning as it is completely tax-free (even the gains) and the interest rates are on the higher side.

Employee Provident Fund

Whether we like it or not, almost all of us are part of the Employee Provident Fund (EPF) scheme. The great thing about the EPF is this forceful nature which protects the salaried class from bankruptcy. You contribute 12% of your basic and your employer contributes another 12% to deposit to your EPF account every month. EPF also falls under 80C, so you have a challenge balancing everything out. The interest rate from EPF investments is similar to PPF, about 8% which of course can change. The lock-in period for EPF is a minimum block of 5 years but withdrawal has restrictions much like the PPF. EPF is also oriented towards retirement planning.

One of the main drawbacks of EPF is the ongoing debate on whether the gains need to be taxed or not. The finance minister has tentatively rolled back the proposal of taxing 60% of the gains made during withdrawal which if implemented will come as a big blow to many of us.

Conclusion

Of the three products, long-term FD looks the weakest considering rate of return and the tax on the interest in FDs. The EPF is a product which you have little control over unless you can negotiate your pay structure. Therefore, PPF is probably the product one needs to consider for saving tax under 80C and plan for their retirement.

If retirement planning is not your concern, you can consider products like ELSS (Equity Linked Saving Scheme) mutual funds and bonds.

—————————————————————————————————————————————–

This article is the second in a 5-article series on ‘Guide to Saving Income Tax Legally’.

In this series, we will discuss everything from investment options which help save income tax to striking the right balance between different tax saving options.

Read previous articles:

What Investments can Help You Save Income Tax Legally?

Is Insurance a Good Way to Save Taxes?

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.

I plan to save taxes by investing 50,000k per year for the next five years (a total of 250,000k). Which is better: Mutual Funds (ELSS), ULP, or FD?

Your investments will be dependent on a number of factors such as your risk appetite and your financial goals such as savings, wealth creation, etc. If possible, try to diversify and invest in multiple avenues. However, we would suggest talking to a financial advisor for a customized approach.