A common question that most people would have is regarding the impact of their loan application rejection, for example -

Does loan rejection affect credit score?

How does a loan affect your credit score?

Does getting rejected for a loan hurt credit?

Does being refused a loan affect your credit rating?

If you have questions such as the above, you’ve come to the right place. Continue reading to know more.

Banks and financial institutions submit credit related information of borrowers including outstanding amount, overdue status etc. to Credit Information Companies (CICs). This data can be viewed by the lenders and the borrowers themselves as well.

These companies provide you with a much simplified expression of your credit history in the form of credit score.

A credit score is what helps bankers and other financial institutions gauge your creditworthiness which in turn determines the conditions under which you are offered credit by these lenders.

Credit score is impacted by several factors, including but not limited to your repayment history, outstanding debt, credit mix, credit utilization, credit inquiries etc.

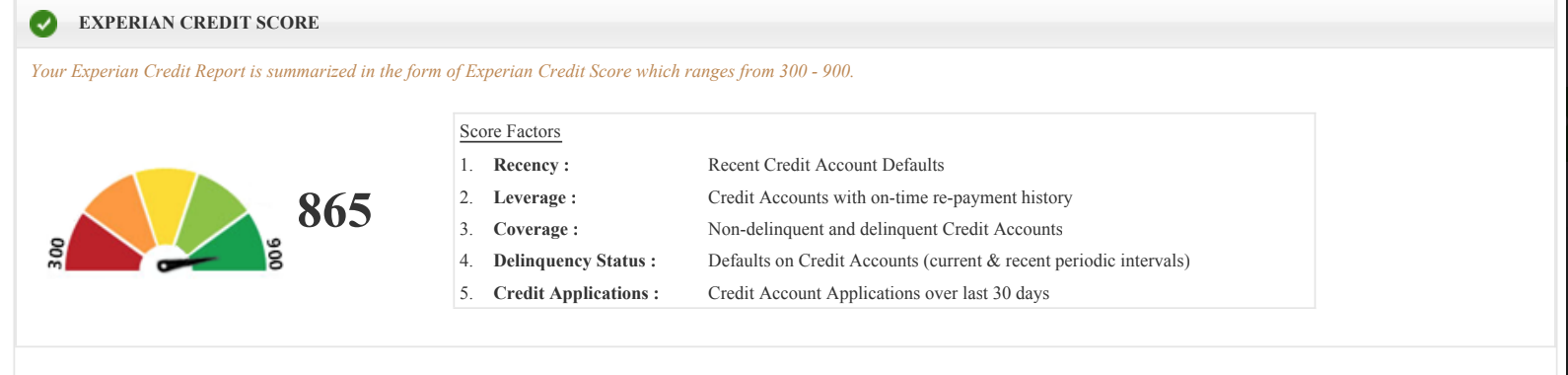

Here is a screenshot of an actual credit report shared by Experian reflecting Credit Score and the factors impacting the same:

All these factors can help measure prospective credit risk for a lender by the borrower.

Credit Score is measured on a scale of 300 to 900, wherein a lower score conveys a higher credit risk and similarly, a higher credit score shows a lower credit risk. In other words, higher the credit score, the easier it is to avail a loan.

Yes, and No.

While credit and loan applications over the past 30 days do tend to impact your credit score, there is no direct correlation between a loan rejection and credit score. This is because banks are not required to report the outcome of the loan/credit application in the credit history.

Therefore, if your question is - ‘Does being refused a loan affect your credit rating in India’, the answer is that loan rejection does not affect your credit score.

Additionally, your loan can be rejected for many reasons. These include -

Considering the above reasons, it is not possible for the other bankers to know why the loan application got rejected. As such, even if your loan application got rejected, it may not directly have any impact on your credit score.

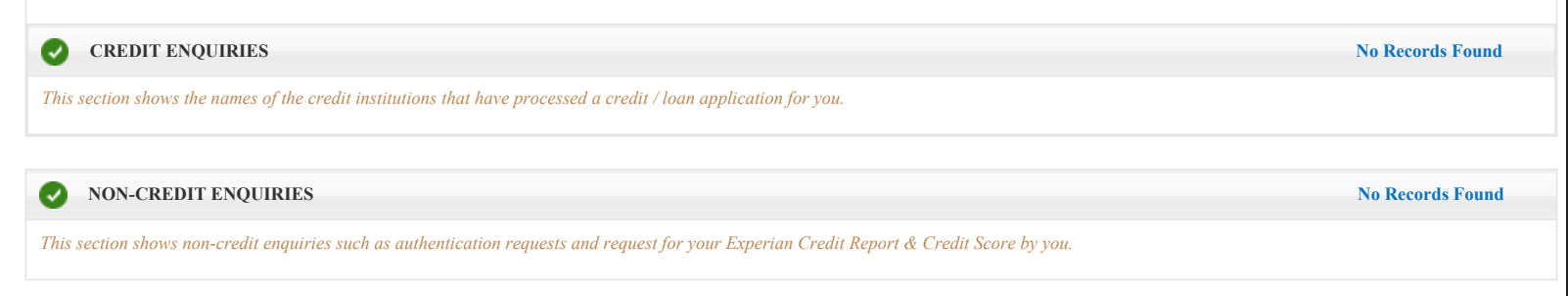

However, your credit report does reflect a list of recent loan inquiries along with details of your debts, repayment history etc.

The list of inquiries may or may not reflect the name of the inquiring bank and further, also does not specify the type of loan being applied for. Which is why, even if you have applied for multiple loans at the same time, you may be perceived as applying for the same loan multiple times.

In the same fashion, a high number of loan applications within a short span of time may result in loan rejections for various reasons. This can result in you being seen as a credit hungry individual which is not a good sign to lenders.

And this can have a negative impact on your credit score.

Loan rejections do not appear on your credit report. However, inquiries might.

There are two types of inquiries - soft and hard.

Soft inquiries are recorded when you view your credit report or a lender that you have availed from checks your credit report. Pre-approved loan offers can also lead to soft inquiry and these type of inquiries have no impact on your credit score.

Hard inquiries on the other hand show up when you have applied for credits or loans. While too many hard inquiries may make you seem like a credit hungry individual, the impact on your credit score is not extremely severe.

Know Your Credit Health Instantly

You must keep monitoring your credit report periodically through the website of any of the Credit Information Companies. Maintaining a high credit score is certainly beneficial for you as it impacts your access to credit facilities and may also help you avail the loan on favorable terms in case of better credit score.

Was this information useful?