Checking your credit score at regular intervals is a good way to monitor it. But do you want to check CRIF score and are unsure how to do it? Read on for more information on the process.

CRIF High Mark is a credit information bureau just like CIBIL and Experian. It started its operations in India in the year 2010 and now has become one of the most trustworthy credit score bureaus.

It is recognized by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). It calculates credit scores after its member credit organizations submit information related to customer payment behaviors.

Apart from India, CRIF High Mark is operational in 40 other countries.

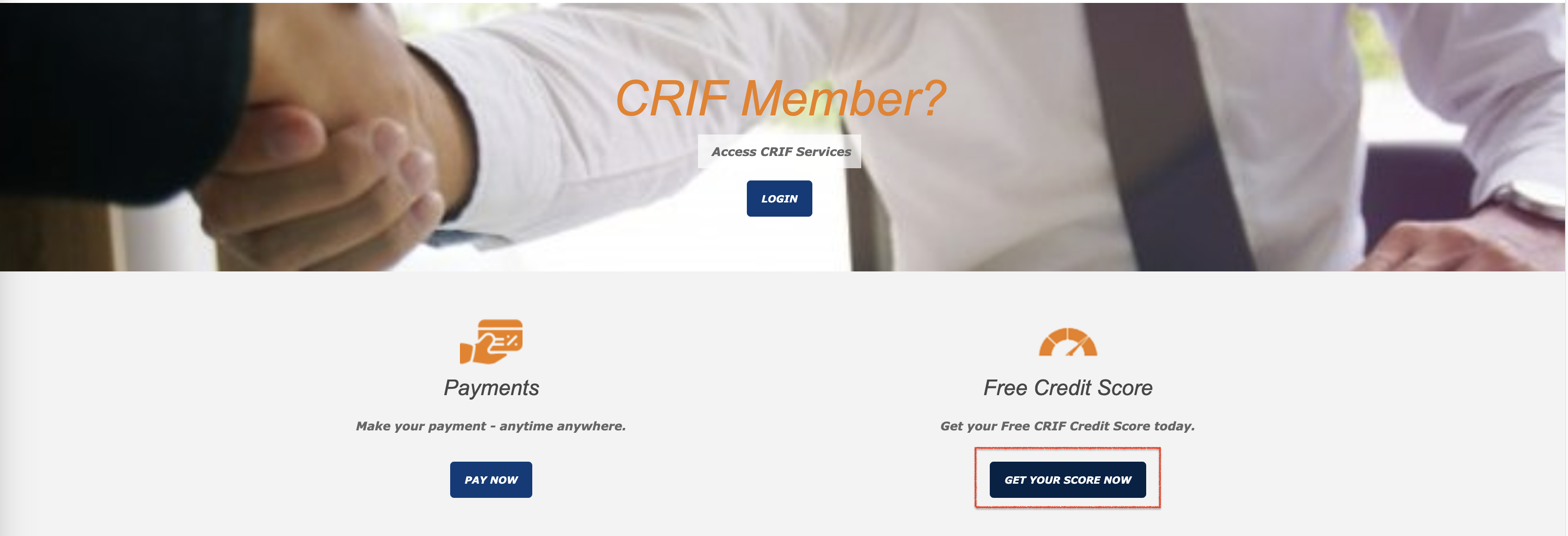

Checking your CRIF score online is a very easy process and is also free of cost. To complete a CRIF score check, follow these steps -

When you are filling out the form, you have to enter some of your personal information to generate your credit score and report.

The CRIF High Mark credit report includes information that tells about the credit behavior of the borrower. The most important part is the credit score, which is a 3-digit number summarizing credit behavior.

It ranges from 300-900, and a higher score is considered better. A score of 700-750 is considered ideal for most credit products. Other than the credit score, the following information is included in the detailed report -

Every time you pay an EMI, the lender institutions send information to the credit bureaus. This information is depicted in the credit history section, which involves if you delayed any payments, any fine was levied, or missed any payments.

This section has information about the total amount that you owe to various lenders. If you have multiple ongoing loans, this section will show details about them.

The length of credit history is the total number of years that you have actively taken loans and repaid them.

This refers to the versatility of your credit accounts. Having a good credit mix of secured, and unsecured loans, and credit cards is a good way to improve your credit report.

In this section, the latest or current credit that is active in your name will be shown.

These are the factors that affect the credit report and the score. Your score may reduce if any of these factors have taken a hit.

Know Your Credit Health Instantly

A good credit score is very important when you apply for any kind of credit product. It helps the lender get a bird’s eye view of your financial behavior.

There are many things you can do to maintain and improve your CRIF credit score. Keeping a close check on your credit score is one of those steps. Now that you know how to check CRIF score for free, you can easily monitor your score and see how your financial behavior affects it.

But even if you have a low credit score it is not impossible for you to get a personal loan. At Moneyview, you can get instant personal loans even with a CIBIL or Experian score of just 650. To know more or apply, check out the Moneyview website or download Moneyview app.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?