When you apply for a loan, the lender or the bank checks your credit score. They may choose to check either your CIBIL score, Experian score, or both.

In case you were searching for how to do an Experian credit score check online and for free, read ahead.

It acquired the license to operate in India in 2010 and is recognized by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). It provides credit scores for both individuals and companies which is known as the Experian credit score.

Searching for ‘Experian CIBIL score check’ instead?

Please note that Experian and CIBIL are two separate credit information companies and they generate different credit scores. Your scores might vary slightly based on their individual credit assessing algorithms.

Experian credit score helps the lender to understand your creditworthiness. Thus it is always a good idea to check your score by yourself before applying for a loan.

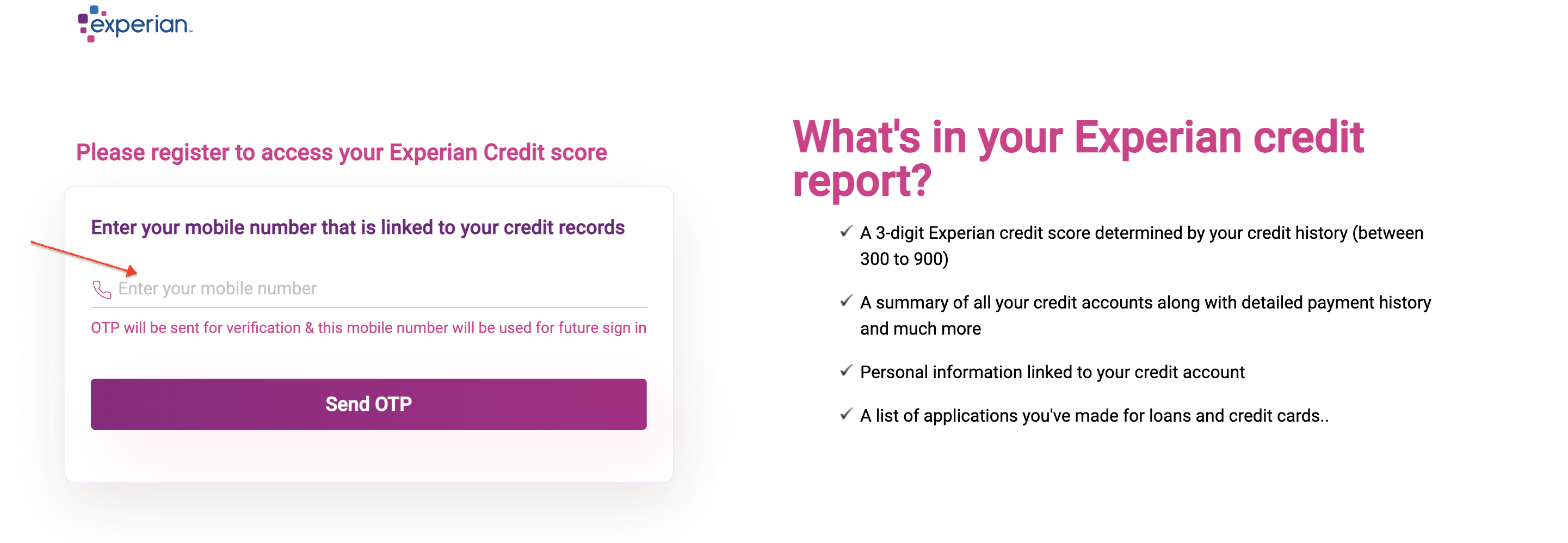

Here are the steps to complete an Experian credit score check online -

The Experian credit score range is from 300-900 and a higher score is considered better. And a higher score translates to higher creditworthiness.

Here is a table that tells you what the scores translate to in terms of creditworthiness -

| Experian Score Range | Creditworthiness |

|---|---|

|

750 - 900 |

Excellent |

|

700 - 749 |

Good |

|

650 - 699 |

Fair |

|

600 - 649 |

Doubtful |

|

Below 600 |

Immediate Action Needed |

Credit reports in general help the lender understand your credit behavior. A credit report is much more than your 3-digit credit score.

The credit score is just an overview of your creditworthiness. But the credit report contains other information like your credit age, number of loan inquiries, active loan accounts, payment history, etc.

A good credit score can help you get a loan much more easily. It also helps you to negotiate interest rates, and get a loan on terms that are comfortable to you. Thus, you should take calculated steps to improve your Experian credit score.

Here are a few tips and tricks to improve your Experian credit score -

Know Your Credit Health Instantly

A good credit score is very helpful when applying for any credit product. The Experian credit score is one of the most used credit scores in India, and banks and lenders often use it along with the CIBIL score.

If you happen to have a low Experian credit score, you can work on improving it with good financial planning. It takes time to increase your credit score, but it is worth the hard work. A good credit score paves the way for easier loan approvals and lower interest rates.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?