6 Jan 2026

A life insurance policy aims to give financial protection to the survivors of the policyholder in the event of the death of the insured. But did you know that you can get loans against your LIC policies? Read ahead to know more!

News Update

LIC has introduced its new Smart Pension Plan, a single-premium immediate annuity scheme offering flexible payout options and choices for single-life or joint-life coverage. The plan allows entry starting at age 18 (up to age 65-100 depending on the annuity option), and a minimum purchase price of ₹1,00,000.

A loan against an LIC policy is a loan that can be availed against the security of your LIC policy. The policy gets assigned to the lender till the loan is paid back in full by the borrower. If the borrower is unable to pay the loan back, then the lender gets all the benefits that are accrued to the policy.

During the term of the loan, the insured will continue to pay premiums on the policy, as usual, the life cover will also continue.

A loan against an insurance policy is also available when the insurance policy is available from a private insurer.

Life Insurance Corporation or LIC is the biggest insurer in India which issues term plans as endowment policies. The same is done by many other private sector insurers like ICICI Prudential, HDFC Life, SBI Life, etc.

Life insurance policies can either be term policies or policies with a surrender value. Only endowment or money-back policies are allowed to be given as collateral/security against a loan.

You can take loans against different kinds of policies, like, term insurance plans, endowment, money back, whole life, or unit-linked insurance plans. This is because, in terms of insurance plans, the sum insured is payable only when there is the death of the insured. Unit-linked Insurance Policies that have values linked to the stock markets also may not be accepted as security for a loan by all lenders.

In other words, only those policies that have a guaranteed surrender value can be eligible for availing a loan. The surrender value of an insurance policy is the value payable when the policy is surrendered on any date.

For Example:

The payback may happen on 15 years of policy payment, getting to a certain age like 50, 60, etc. The maturity benefit (sum insured) in a moneyback policy can also be paid in installments. In addition to payment of maturity benefits, the sum insured as a lump sum amount is paid in case of the death of the insured.

The following table will tell in detail about the available endowment policies and their loan features -

| Policy Name | Loan Eligibility | Maximum Loan Amount | Interest Rate |

|---|---|---|---|

|

LIC’s Bima Jyoti |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% For paid-up policies: Up to 80% |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly |

|

LIC’s Bima Ratna |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly |

|

LIC's Dhan Sanchay |

Should have paid 2 years’ premium, under regular/limited premium payment. Any time after three months from the date of policy issuance or the expiry of the Free-look Period, whichever is later. |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly |

|

LIC’s Jeevan Azad |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly or the yield earned on the Corporation’s Non-Linked Non-participating fund +1.00%, whichever is higher. |

|

LIC’s Amritbaal |

Should have paid 2 years’ premium, under regular/limited premium payment. Any time after three months from the date of policy issuance or the expiry of the Free-look Period, whichever is later. |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +300 basis points, compounding half-yearly or the yield earned on the Corporation’s Non-Linked fund +100 basis points, whichever is higher. |

|

LIC’s New Endowment Plan |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Based on the method approved by the IRDAI |

|

LIC’s New Jeevan Anand |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Based on the method approved by the IRDAI |

|

LIC’s Single Premium Endowment Plan |

After completion of one policy year |

Up to 90% of Surrender Value |

Based on the method approved by the IRDAI |

|

LIC's Jeevan Lakshya |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Based on the method approved by the IRDAI |

|

LIC’s Jeevan Labh |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Based on the method approved by the IRDAI |

|

LIC’s Aadhaar Stambh |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly or the yield earned on the Corporation’s Non-Linked Non-participating fund +1.00%, whichever is higher. |

|

LIC’s Aadhaar Shila |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value For paid-up policies: Up to 80% of Surrender Value |

Up to 10-year G-Sec Rate p.a. +3.00%, compounding half-yearly or the yield earned on the Corporation’s Non-Linked Non-participating fund +1.00%, whichever is higher. |

|

LIC Jeevan Umang |

Should have paid 2 years’ premium |

For in-force policies: Up to 90% of Surrender Value |

Based on the method approved by the IRDAI |

A loan against a LIC policy can be availed from the insurer, Life Insurance Corporation of India, or LIC Housing Finance. Many banks also offer loans on LIC policies or policies issued by other private insurers

Some of the banks that allow loans against LIC policies are:

Kotak Mahindra Bank

Axis Bank

State Bank of India

HDFC Bank

The Life Insurance Corporation of India charges 9.00-10.00% interest based on the insurance plan. Whereas banks charge between 10.00-15.00% interest on a loan against an insurance policy.

The Life Insurance Corporation of India charges 9.00-10.00% interest based on the insurance plan. Whereas banks charge between 10.00-15.00% interest on a loan against an insurance policy.

Please note that most banks offer loans or overdrafts against LIC or other insurance policies only to existing account holders.

There are two ways of availing of a loan against a LIC / Insurance Policy - online and offline. Let us look at them in detail -

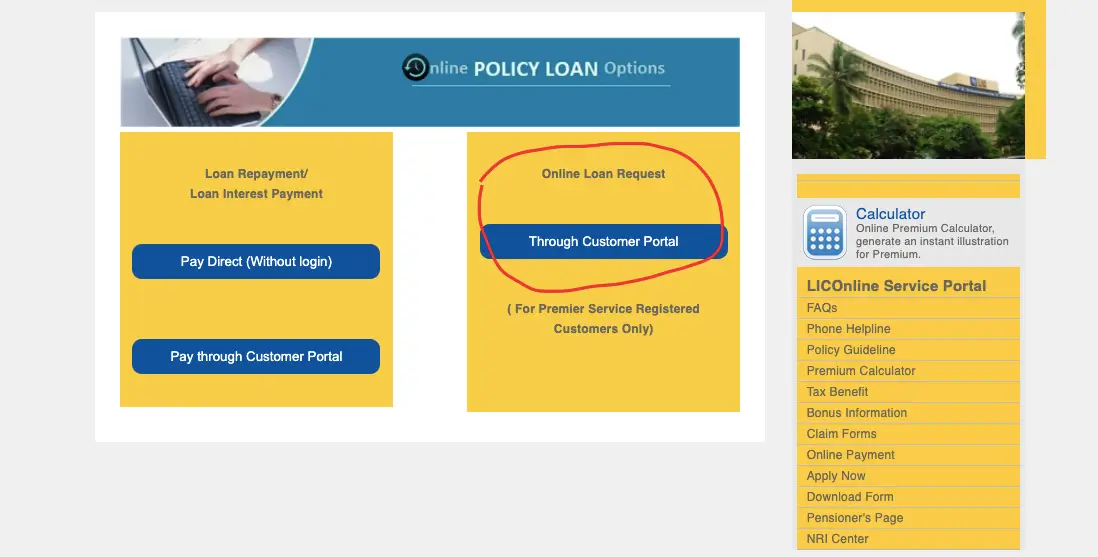

You can get a loan against an insurance policy online only through insurance companies. LIC offers an option to its subscribers to apply for a loan on its online portal.

The steps are mentioned below -

STEP-1: Register yourself on the LIC portal.

STEP-2: Go to ‘Online Services’ → ‘Online Loans’ option.

STEP-3: This will take you to the ‘Online Policy Options’ where you can place a request for a loan under the ‘Online Loan Request’ tab.

STEP-4: After placing the request, you may need to upload your KYC documents for verification.

To get a loan by offline method, you would need to follow the steps mentioned below -

STEP-1: Approach the nearest LIC office or a bank branch with the required documents like the policy document and the KYC documents like your identity and the address proof.

STEP-2: Sign the required application form and get the particulars of the loan like the interest charged, tenure of the loan, etc.

STEP-3: Finally, you get the loan in a lump sum or as an overdraft.

Get Funds in Your Account in Minutes

You can get an amount up to 70-90% of the surrender value of the policy. However, this will vary based on your policy and lender.

Normally LIC offers relaxed payment options for a loan against its policy. The loan repayment could be done in the following ways -

Pay interest and the principal in loan EMIs

Pay only the interest regularly and pay the principal in due course

Pay the interest regularly and adjust the outstanding loan amount (principal) against the maturity benefits

However, when you avail of a loan from a bank, you would have to pay back the loan in regular EMIs.

There are some important features and benefits that you should keep in mind before availing a loan against an LIC policy:

An LIC loan comes at a cheaper rate than a personal loan (10% onwards) or a credit card interest rate (36-48%)

Like a personal loan, a loan availed against an LIC policy can be used for any purpose

Availing a loan against a LIC/Insurance policy does not require a credit score. This can come across as one of the greatest advantages for an individual with a bad credit score or no credit history

The life cover on the policy will continue in spite of availing the loan. In case of the death of the insured (borrower), the death benefit will be paid after deducting the quantum of the outstanding loan

The processing time for a loan against an insurance policy is minimal especially when it is obtained from the insurer

Due to the various kinds of repayment available, the financial burden is lesser

A loan can be availed only after the policy accumulates a certain surrender value. This means it would be difficult to avail of a loan against the policy during the initial years

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?