GST is Here – What You Need to Know

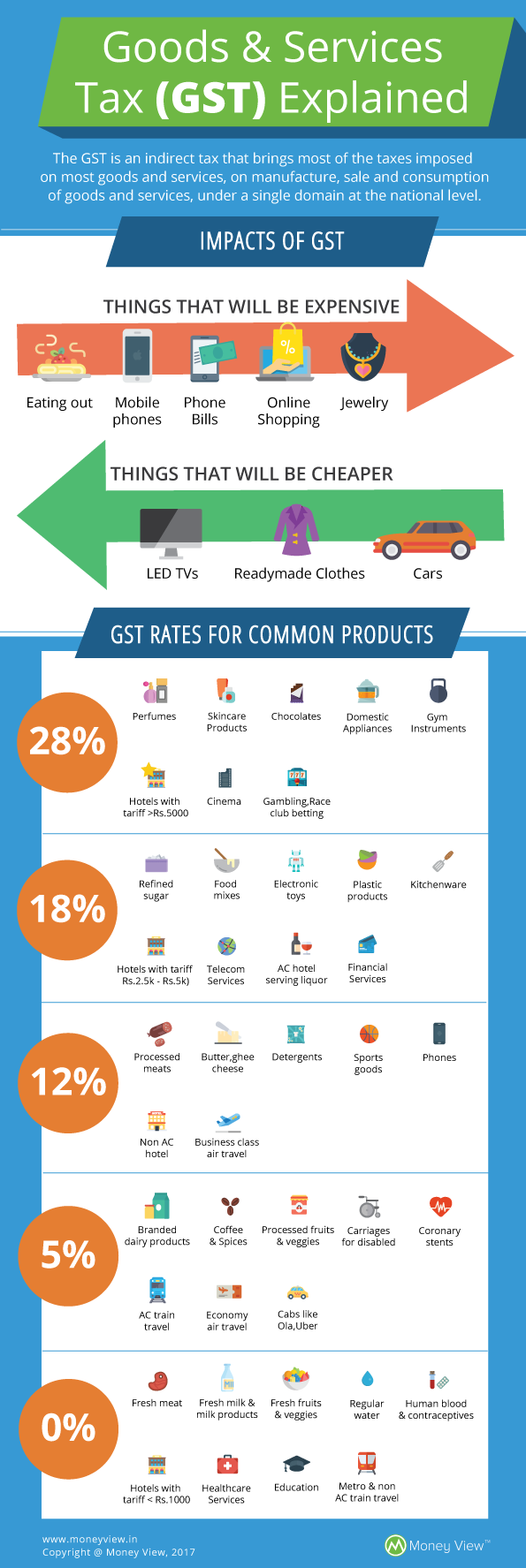

What seemed like a distant dream around 2 years back is a reality now. Read our previous article to understand more about GST and its journey till now. India is set to implement Goods and Services Tax (GST) by July 2017 or at latest by September 2017. This is one unified tax, which will replace multiple taxes like excise duty (charged on manufacture of goods), sales tax (charged on sale of goods), service tax (charged on services), entertainment tax (charged on entertainment services like movies), entry tax (charged on entry of goods in a particular state) etc. It is expected to provide a uniform and simplified way of taxes on goods and services.

Why Does GST Matter?

If you have ever checked your pizza bill, you may notice that several taxes are levied on your bill. VAT is levied on the total food bill. Service tax is also charged on the food bill. Over and above, there will be two more taxes in it, Krishi Kalyan Cess & Swachh Bharat cess. This causes a number of taxes in the same bill. In GST regime, all such indirect taxes will get replaced by one tax – GST. It will remove all barriers across states and make the country a common market.

How Does It Affect You?

The obvious thought in one’s mind after learning this was that since one is not a manufacturer of goods, elimination of excise duty does not impact one. Not being a trader, elimination of sales tax does not matter either. Why should I think about this tax? How does it affect me?

This is a type of indirect tax which affects our life indirectly since it is levied on every single item we consume or utilise in the course of daily life like restaurant food, mobile bills, movies, cars, readymade garments etc. GST is expected to benefit the ultimate consumers by eventually eliminating the cascading impact (tax on tax impact) that prevails due to multiple taxes.

Further, the government will introduce a cess on certain goods (tobacco products, coal, aerated water, motor cars), to be referred to as ‘compensation cess’. This additional cess will be used for compensating the states losing revenue on account of GST implementation. However, care has been taken to levy this cess only on discretionary spends on certain articles. Most of the services will be taxed at 18% and hence, tax on your telephone bills etc. will increase by three percent due to GST.

With the implementation of GST and its proposed tax slabs, watching movies, motor vehicles, FMCG products, processed food items, staying at hotels etc. will get cheaper while luxury goods, aerated drinks etc. will get dearer. Even for Gold, the GST rate has been decided at 3% as against the current rate of 1-2%. But this slight increase is still being cheered by the industry as the expected rate was in the range of 5-6%.

Perceived Implementation Challenges

Higher Compliance Burden

GST council has made efforts towards simplifications of the tax return forms and other compliance procedures. Still, the compliance burden seems to be quite big at least for small traders and SMEs. Each registered person is obliged to file at least 3 returns per month – one for sales/services, one for credit in purchases and one consolidating both the returns. These returns need to be provided invoice-wise. This will call for employing full-time accounting personnel to feed all business transactions into accounting systems. Also, one annual return is to be filed as a consolidated summary of all the returns at the end of the year. This means, a minimum of 37 returns will be filed by each registered person in GST regime.

State-wise Registration

Under GST, there is no concept of Centralised Registration. Thus, offices spread across different states will be required to register and make necessary compliances separately. Consider a business having locations all across the country in 29 States. It will be required to file a minimum of 1,073 returns per year under GST. That is a lot of paperwork.

What Next?

The big tax reform is nearing its destination, and it can be reasonably expected that the rates shall gradually decrease with the efficiency in the tax structure proposed. It is the time for manufacturers and traders to gear up for the perceived implementation challenges. Companies and businesses also need to realign their Income Tax and accounting systems and rejig their pricing strategies in view of the conceived tax advantages. Consumers can breathe a sigh of relief as they don’t have to track multiple taxes anymore.

Simardeep Singh is a Chartered Accountant based in Delhi. He loves sharing his knowledge about personal finance and investment. He blogs regularly at www.simardeep.com.

You put great information about GST, GST Registration, Compliance Management. Now GST implementations will roll-out in India in the month of July 2017.

Please guide me, How small business owner can be benefited from GST in India?

Thank for sharing.

Regards,

AlignBooks