4 Handy Strategies to Rewire Your Investment Brain

What is Investment?

The term investment is used, almost daily. But, how many of us actually understand the true meaning of investing? Is it about making more money? Is it about putting away one’s savings/excess money at the end of the month? When in doubt, listen to the experts. The world’s greatest investor Warren Buffett defines investing as:

“Transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power in the future”

What Buffett really means is to sacrifice current purchasing power for fulfilling much larger purchases in the future. This is not just a definition; it needs to be practiced and internalised. In the Indian context, the “real” inflation is about 7-8 %! Therefore, the rate of return of any investments we make in India should beat this, after taxes. If not, we are actually losing hard-earned money. So start looking at your investment’s return on inflationary basis to understand whether you are beating inflation or losing money!

Here are 4 handy strategies to follow while making investment:

Save and Spend

Let’s take a step back and look at the philosophy of saving. The now generation, is spending a lot more, thanks to better access to instant credit through credit cards, personal loans, e-wallets etc. Ever increasing societal and peer pressure of exhibition of wealth is also not helping the bills at the end of the month. Most of us want better clothes, better bikes, larger cars and houses in prime locations etc. This urge to maintain a lavish lifestyle often leads straight into lifetime debt. The philosophy should change from “Save after you spend” to “Spend after you save”. Spend prudently for a wealthy, peaceful future.

Invest your savings

Investments need to be looked at from two perspectives:

- Fixed Income: Bank deposits and certain bonds & funds belong to this category. The return on this income group is fixed and known. It is considered safe as it largely depends on the bank’s and central bank’s stability. The returns are less than inflation, so you would lose money here or at best keep up with inflation.

- Volatile Instruments: These are investment options that are unpredictable in the short term but have potential to give massive returns in the long term, creating disproportionately high wealth.

The perspective for the volatile instruments is in the long term. As one of the pioneers of value investing, Benjamin Graham said about the stock market:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine”

What he means is, ignore the short-term volatility and focus on long-term returns. At the same time, one should not invest large sums of money in volatile instruments for a short term as it can destroy wealth due to changes in the mood of the market. As a start, if one invests 30-50% of their savings for long term, it would set a perfect platform for wealth creation.

Power of compounding

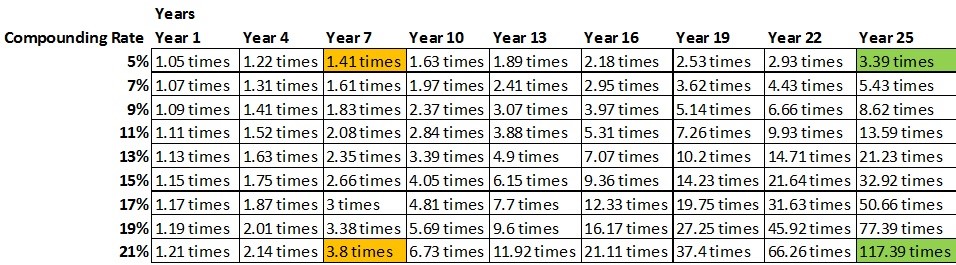

This leads to a concept I personally love and live by — Compounding. The power of compounding can be illustrated by the table shown below:

The table is self-explanatory; there is rate of return on the vertical column and number of years of investment on the horizontal column. The rate of return does not make much of difference till about 7 years, but after 25 years it makes a massive difference. A 21% compounded return over 25 years multiplies the investment over 100 times! A 5% fixed income return over 25 years is a meagre 4 times.

Money makes more money! This is the basic tenet of investment.

The Secret-Time

Everything needs time; you need at least 8-9 months to give birth to a baby. The same applies to prudent investments. Dangerous expectations lead to bad decisions. Make time by systematically investing into mutual funds, real estate, and gold and for immediate withdrawal into fixed income. Also, have very clear short-term and long-term goals while investing. Monitor your investments regularly.

This is the secret to be financially free and wealthy by the time you call it a day!

Arjun Balakrishnan is an investment fanatic who loves writing about investment topics. He regularly writes at Investment Gyaan.

Sensisble advice towards creating long term wealth! Looking forward to more …keep them coming..Fan of your blog too!

Thanks a lot ! Please keep the feedback coming .

[…] What is investing ? How shall one approach the art of investing ? Can money make you more money ? What does Buffet and Graham say about making money ? These are some questions answered in our blog post in “Money View”. Read More @ 4 handy strategies to rewire your Investment brain […]

You have said that one must wait. But 'how long' is 'long'?

Long time is normally a minimum of 5 years . It can be as long as a life time. The holding period really depends on the person as certain events in our life need massive spends (like a house or child's education ) , in which case one would need to liquidate part of the investments . As long we spend on useful things we should be fine.

Any one plz give me referral code of money view

Our team at Money View will be reaching out to you via email. Thanks for your comment.

[…] Make your own customized budget and start investing wisely. […]

Mr Balakrishnan.

Do u agree with the financial planners that at the age 50 we should allocate assets debt and equity 50:50 even the same will not be able to fulfil some of our goals. Pl respond if posible

Its a tough question to answer. At the age of 50, one needs to be more safe with the investments rather than risky. I would be more inclined to say protect your capital by investing in Deposits, Debts etc. May be a 15-20% allocation to equity is harmless but more importantly one needs to cover other aspects like medical cover, life insurance etc. I hope this helps.

Arjun

Nice post, Arjun.

Sacrificing current purchasing power for future happiness is the most sensible point here, and I believe it is the crux of your complete post. Unfortunately, as you rightly pointed out, we are saving less and spending more, something that could return to haunt us in the long run like it did in the US where savings came down from 8% of the GDP to less than 0.5% in about 10 years.