Aditya received notice from the Income Tax Department in respect of non-filing of his Income Tax Return (ITR) during the previous year. The notice had been sent to him on the basis of certain financial transactions performed by him, but due to ignorance of the tax laws, he didn’t file his return earlier. This is not something uncommon these days. However, this is indeed the harsh reality of the Indian tax laws. Tax authorities expect the citizens to follow all provisions and file their taxes properly but at the same time, make the processes so complex that an aam aadmi, inspite of all the reasonable and genuine intentions he might have, does indeed find it tough to pay taxes and file returns properly. As per the last statistics available, only 3% of the Indians file their returns. Government is also keen to increase this figure to increase their tax base and one thing they are looking for is the simplification of the processes involved.

The New Solution by Money View

We at Money View have been continuously striving to untangle the financial complexities for our users. In our latest initiative, Money View has collaborated with www.myITreturns.com to offer mobile-friendly ITR filing. Income tax return filing is now just a few clicks away on your smartphone with Money View app.

How to Use the Feature

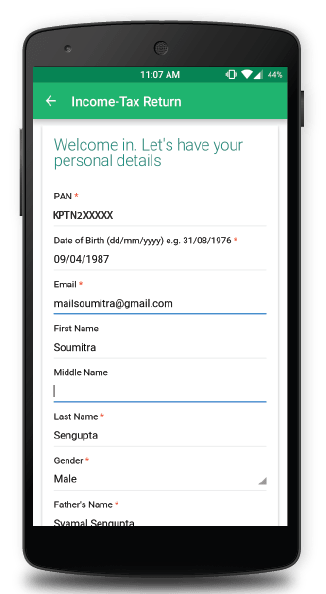

The feature can be accessed in the ‘Options’ menu on the app. Click on ‘Income Tax Return’ option and you are taken to this screen that will prompt you to register and proceed for e-filing.

This is powered by our partner (an authorized e-Return intermediary with the Income Tax Department). All this happens within the Money View App itself to offer seamless experience to our users.

As per the prevalent tax laws, one can file ITRs for two financial years and the feature allows you to file for both the years. The user can select the financial year as per the requirement.

Some Highlights of the New Feature are:

It is Free

The icing on the cake is that the filing comes to you at no additional cost. The return preparation and filing process is absolutely free if you earn less than Rs. 10 lakhs. If you earn higher than that, the charges are reasonable enough given the seamless, quick and easy experience the feature provides.

It is Simple, Easy and Quick

The task for salaried individuals is much simpler. All one needs to do is upload their Form-16, review the computation and the return is ready even before you feel thirsty in this hot summer.

Even if you think your return is little more complicated, Money View is here to make it easy for you. All you need to do is try out easy Self e-filing which prepares your return by asking you simple questions. Based on your answers, the feature shall ask you for further details as may be required and the return is prepared as soon as one reaches the end of the questions. The intelligent function also shows the % completion of this process and estimated time left to prepare the return at the bottom right corner of the screen. The feature shall also prompt you to fill all the necessary details and benefits which might get left out while filling out the return form in ordinary course like details of bank accounts, taking benefits of deduction available on Savings Interest etc.

It is Tested

Our team members have already prepared their Income Tax Returns during the testing phase of this new feature. We hope that our users will love how seamless, quick, easy and user-friendly this feature is in simplifying IT returns which have always been considered cumbersome and too technical for an aam aadmi.

Do try the new feature and share with us your thoughts and feedback.

Need to file form 16 available tax paid