Home

>

Download ITR Online

Income Tax Return (ITR) is a form that must be submitted to the Income Tax Department of India. It contains information about the individual's income and the taxes that must be paid on it throughout the year. The information filed in ITR should be for a specific fiscal year, beginning on April 1st and ending on March 31st of the following year.

Aadhaar-based OTP

Net Banking

Bank Account

Demat Account

ATM

Digital Signature Certificate

The condition is that your mobile number must be linked to your Aadhaar, and also your PAN-Aadhaar must be linked.

Follow the below steps to e-verify your ITR through Aadhaar OTP

Log on to the e-filing portal

Under the ‘e-file’ tab on the dashboard, click on ‘Income Tax Returns’ and then select ‘e-verify ITR through Aadhaar return’

Next, select ‘I would like to e-verify using OTP on the mobile number registered with Aadhaar OTP verification‘

Click on ‘I agree to validate my Aadhaar Details’, and generate Aadhar OTP for ITR

Enter the OTP for verification and submit it

On successful submission, you will be notified.

ITR e-verification is possible through net banking as well. You can e-verify following the below steps.

Choose ‘Through Net Banking’ from the e-Verify page and click ‘Proceed’

Click ‘Continue’ after choosing your preferred bank to use for e-Verification

Read the disclaimer and click ‘Continue’

Note: Following this, a page allowing you to log into your bank account through Net Banking will open

Enter your Net Banking user ID and password to access your Net Banking account

To access e-filing via your bank's website, click the generated link

You will be directed to the e-filing site and logged out of internet banking.

You will be redirected to the e-Filing Dashboard upon successful login. Click on ‘e-Verify’ after going to the relevant ITR, Form, or service. Your ITR, Form, or Service will be successfully e-verified.

Post verification, a success message page is displayed. You will also get a Transaction ID that you should make a note of for future reference. A confirmation message will be sent to the email address and mobile number you registered with on the e-filing portal.

On the e-Verify page, select ‘Through Bank Account’ and then click ‘Continue’

EVC will be generated and sent to the mobile number and email address associated with your pre-validated, EVC-enabled bank account

Enter the EVC generated on your mobile phone and email address associated with your bank account in the Enter EVC field, then click ‘e-Verify’

A success message page will be displayed along with the Transaction ID and EVC. Please take note of the Transaction ID and EVC for future reference. You will also receive a confirmation message via the email address and mobile number you submitted with the e-filing portal.

Demat account e-verification can be done the following way:

On the e-Verify page, opt for ‘Through Demat Account’ and then click ‘Continue’.

Provide the EVC received on your mobile number and email ID linked with your demat account into the Enter EVC text field and click ‘e-Verify’.

A success message page is shown along with the Transaction ID and EVC. Please take note of the Transaction ID and EVC for later reference. You will also receive a message of confirmation at the email address and mobile number you entered with the e-filing portal.

If online methods are not available to you, then you can also make use of this offline method.

Go to your nearest ATM of your bank and insert your ATM card

Note: This service is only offered by a few banks

Enter your PIN and choose ‘Generate EVC for Income tax Filing’

Your email address and mobile number that you registered with the e-filing portal will receive an EVC (Electronic Verification Code)

Note: Your PAN needs to be linked to your bank account, and it also needs to be registered on the e-filing portal.

The generated EVC can be used to e-verify the return by selecting 'I already have an Electronic Verification Code (EVC)' as the preferred method of e-verification.

Axis Bank Ltd, Canara Bank, Central Bank of India, ICICI Bank, IDBI Bank, Kotak Mahindra Bank, and State Bank of India are among the banks that offer the Bank ATM option for generating EVC.

E-verification through a Digital Signature Certificate(DSC) is possible only while filing your ITR. You can’t choose DSC if you want to e-verify later.

If you wish to e-verify your ITR immediately after filing, you can use DSC the following way.

On the e-Verify page, choose ‘I would like to e-Verify using Digital Signature Certificate (DSC)’

Next, choose ‘Click here to download emsigner utility’ on the ‘Verify Your Identity’ page

On the 'Verify Your Identity' window, select 'I have downloaded and installed emsigner Utility' and then click Continue

On the ‘Data Sign’ screen, choose your Provider, Certificate, and Enter the Provider Password and Click ‘Sign’

After successful verification, you will see a success message and your Transaction ID, which you should keep a note of for future reference. Additionally, you will receive a confirmation message on your registered mobile number and email address.

Online filing of income tax returns has become very simple and convenient in recent years, allowing individuals to do it themselves rather than relying on a tax practitioner. Filing an income tax return is a requirement for everyone.

However, no filing is required for individuals under the age of 60 whose gross total income before deductions are less than Rs. 2.10 Lakhs. This limit is Rs. 3 lakh for resident senior citizens (aged 60 to 80 years) and Rs. 10 Lakhs for resident super senior citizens (aged above 80).

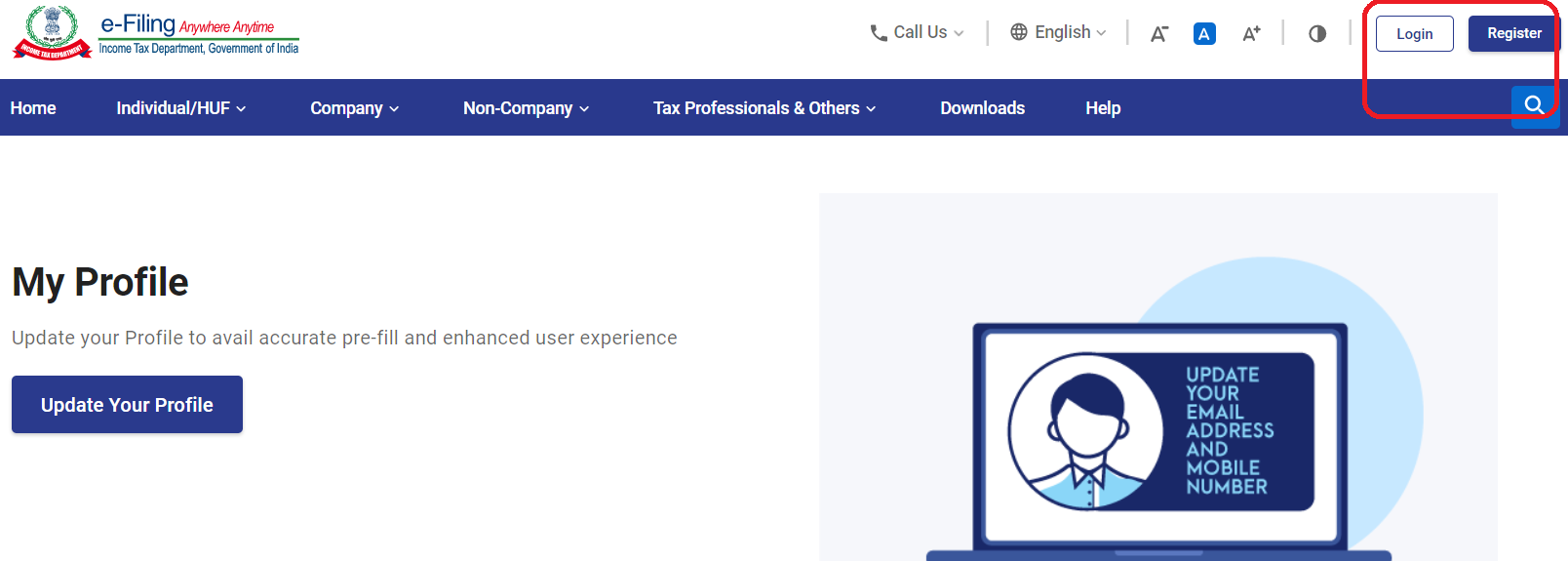

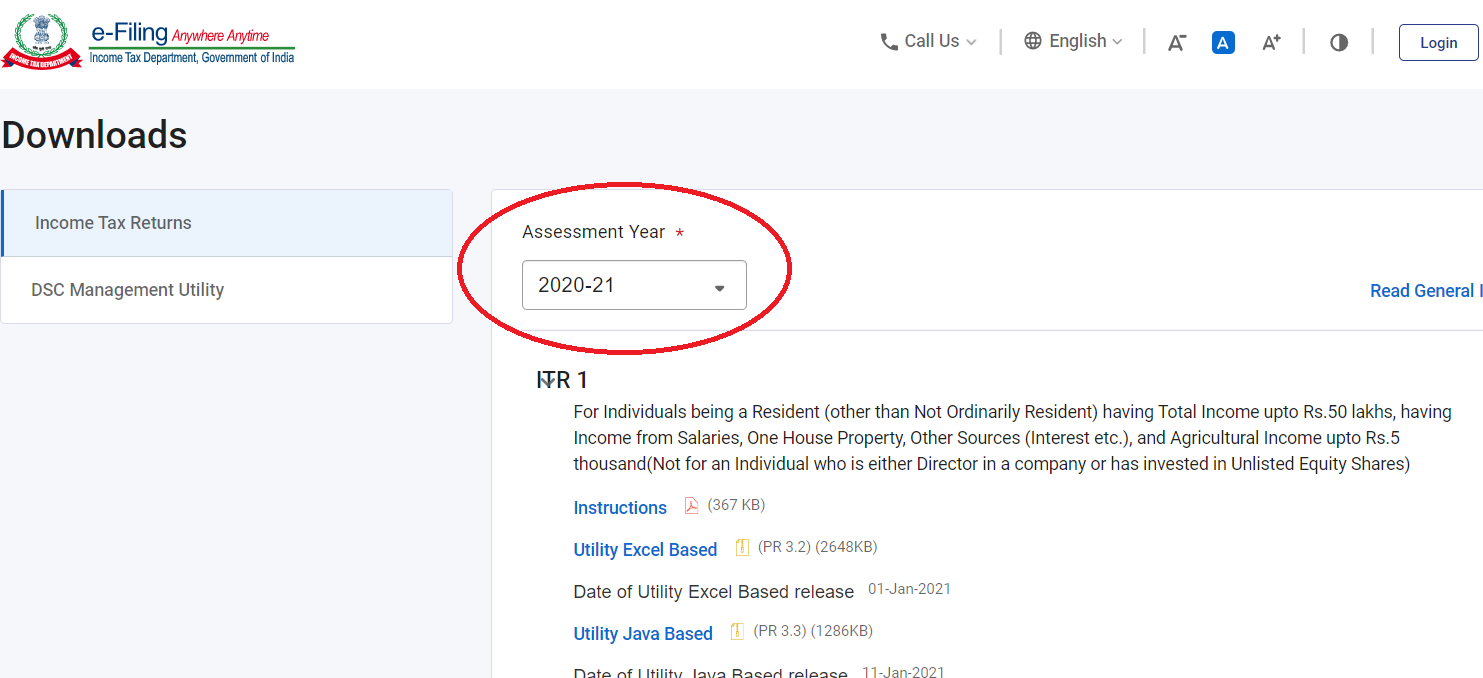

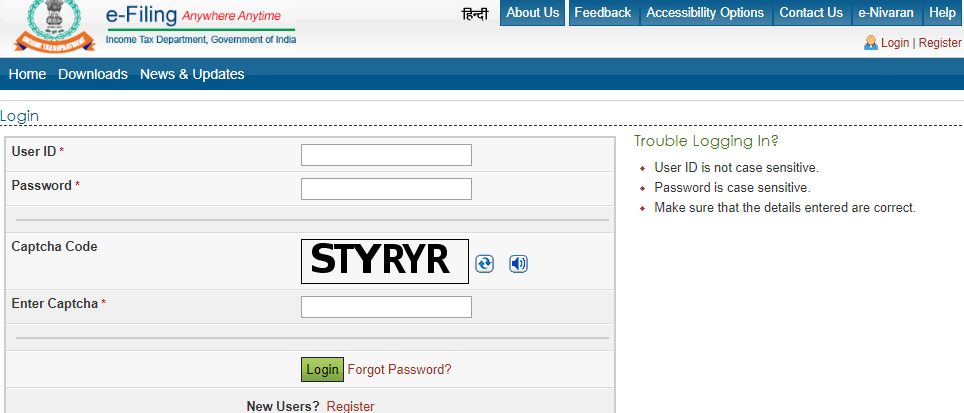

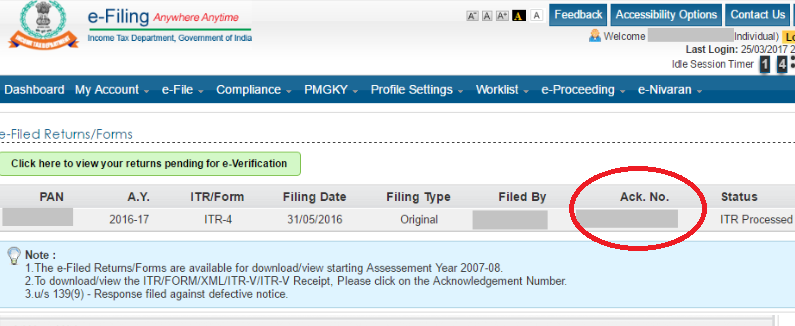

Follow the steps listed below to download income tax return:

The Income Tax Department has prescribed seven types of ITR forms: ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7, and the form's applicability is determined by the nature and amount of income as well as the type of taxpayer.

| ITR Form type | Applicability |

|---|---|

| The interest rate is higher. | The interest rate is lower. |

| ITR- 1 | To be filed by residents with a total income of up to 50 lacs from the following sources:

|

| ITR-2 | Individuals and HUFs who are not eligible to file form ITR-1 and do not have income from profits and gains from business or profession must file this form. |

| ITR-3 | Individuals and HUFs with profits and gains from a business or profession must file this form. |

| ITR-4 | To be filed by resident individuals, HUFs, and firms (other than LLP) with total income up to 50 lacs and income from business or profession computed under section 44AD, 44ADA, or 44AE. |

| ITR-5 | To be filed by persons other than

|

| ITR-6 | This is for companies that do not claim an exemption under Section 11 |

| ITR-7 | To be filed by persons and companies who are required to furnish returns under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only |

The assessee can now check his return with the computation sheet to see the variance and respond to the department accordingly. Where demand is raised manually outside the system, the assessee must request a resend of the intimation through the portal or contact the jurisdictional Assessing Officer.

Given below is the detailed procedure

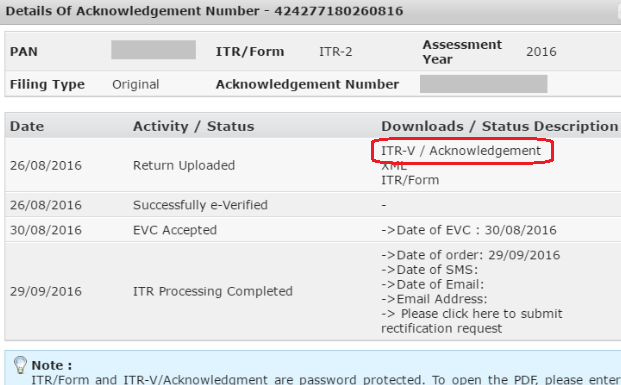

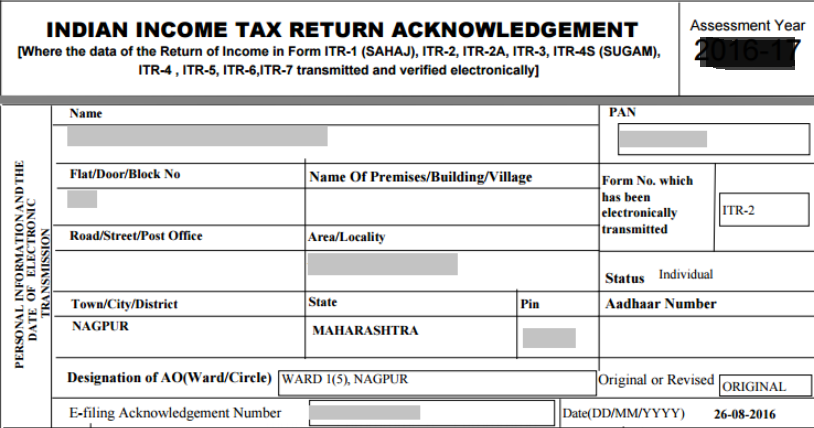

ITR-V is the acronym for Income Tax Return Verification, and it is generated by the IT department for taxpayers to verify the legitimacy of their e-filing.

It only applies to those who file without using a digital signature. It is now simpler than ever to obtain your ITR-V from the convenience of your own home or office.

The process to download ITR-V is summarised in the steps below:

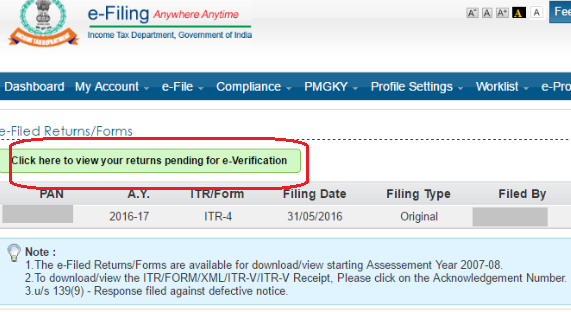

To e-verify, go to the ‘Click here to view your returns pending for verification’ option.

Every Indian citizen whose gross total income exceeds the taxable limit in a fiscal year is required to file an income tax return, as is common knowledge (ITR). According to tax experts, filing income tax returns is required where an individual's gross total income exceeds Rs. 2,50,000. The importance of filing the ITR on time cannot be overstated, given the consequences of failing to do so. Filling out ITR also has several long-term benefits, so it is recommended for all wage earners to do so.

Yes. You can verify ITR online by the following methods.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?