Top 10 Mobile Banking Apps in India

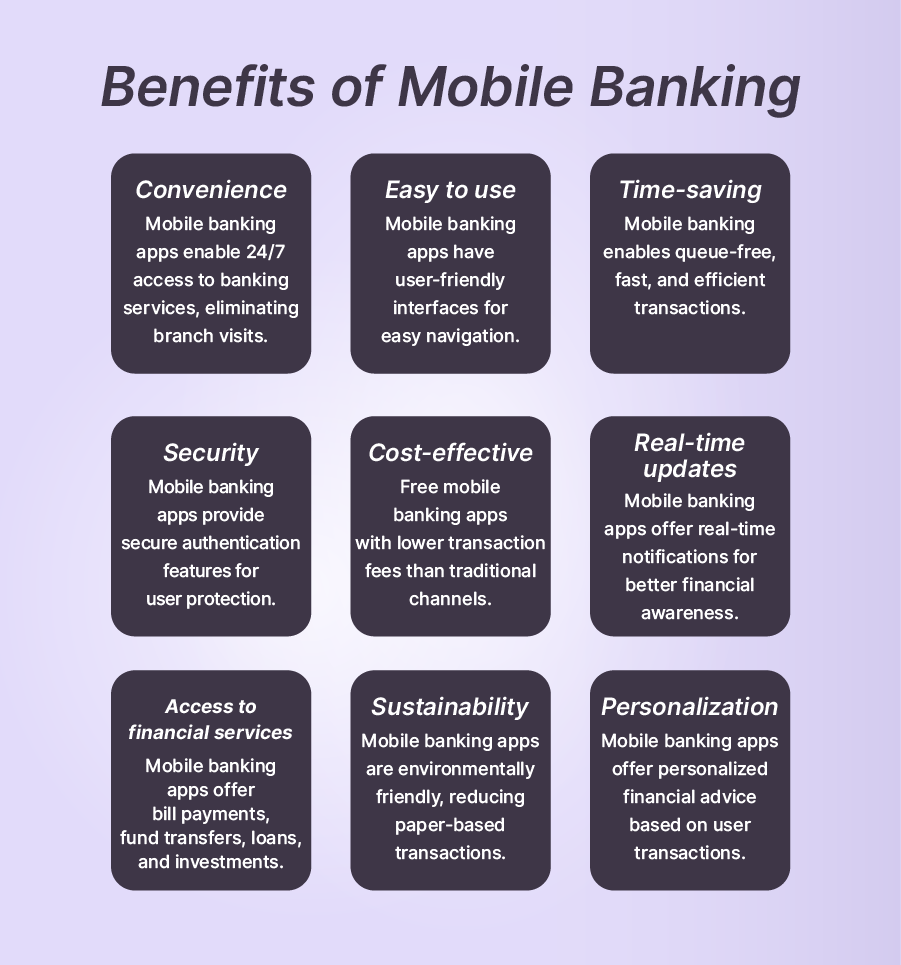

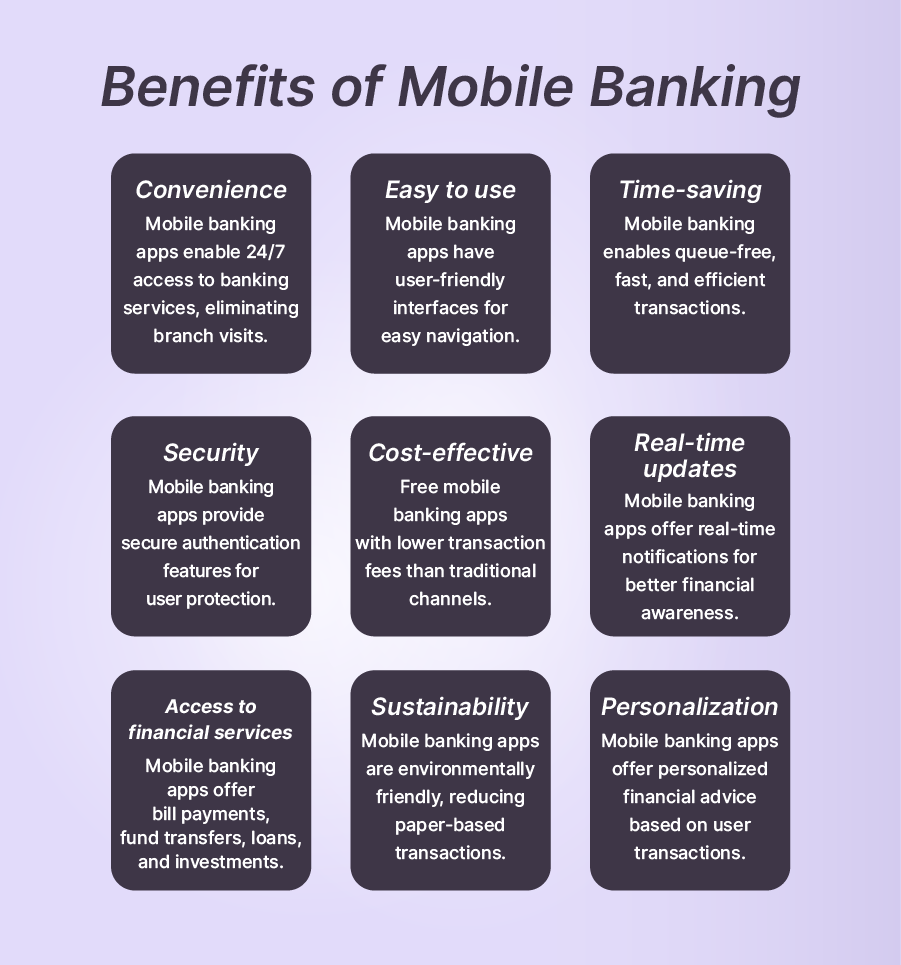

In the last few decades, we have seen massive progress in technology. The digital era is all around - from desktops to laptops and iPads, software to applications, and mobile phones to Android gadgets. The use of a mobile banking app is common these days. A mobile banking app offers speed, flexibility, and ease while doing online transactions.

Now, many people in India are not comfortable with traditional banking anymore. Hence, they have adopted mobile banking. As a result, almost every PSU bank and private sector bank is providing mobile banking apps for online transactions. This reduces the requirement for a laptop or desktop and above all, you don’t need to visit the bank physically for performing any banking task.

After downloading and installing a mobile banking app on your mobile device, you can perform all banking tasks according to your feasibility. Here, we have compiled the top 10 mobile banking apps in India along with the crucial features a mobile banking app should have.

List of Top 10 Mobile Banking Applications in India

1. Kotak-811 & Mobile Banking

In our list of top 10 mobile banking apps in India, Kotak-811 is number one. The prime reason behind this is you can open a zero-balance savings account with Kotak-811 with an internationally enabled virtual debit card. The app has an attractive UI with many in-app features. Recently, Kotak Mahindra Bank has launched the first WhatsApp banking in India as well.

2. HDFC Bank Mobile Banking

- HDFC is considered one of the largest Indian banks. Its mobile banking application allows all customers to check their account summary, make credit card payments, transfer funds, and pay utility bills. The application enables customization of the ‘My Menu’ tap on the app where the most commonly used services are available.

- This mobile banking app is available in Hindi as well and features a LITE version that has compatibility with lower internet speeds. Although the LITE version doesn’t feature everything like the regular one, it covers the most commonly used services.

3. YONO Lite SBI

Previously known as SBI Anywhere Personal, YONO Lite SBI is the mobile app for State Bank of India account holders. This application supports Punjabi, Gujarati, Tamil, Hindi, and English languages. Having lots of features, this mobile banking app is easy to use and secure. Alongside click-based transactions, you can utilize voice-assisted transactions also in this application.

4. Axis Mobile

- Due to its amazing stability, the Axis Mobile application is extremely famous. This banking app allows all customers a lot of services and functions. Along with the basic funds transfer and checking account statements, users can schedule credit card payments for a particular date according to their suitability through this app, change credit card payments to EMIs, deactivate debit cards temporarily, set limits on purchases through debit cards, block cards, and replace them.

- Application users also can set auto-pay bills and standing instructions for more than 200 utility services. Through this banking app, you can make a Favorite list with the 10 most common transactions done on the app. Moreover, customers can tweet and email feedback straight from the application and ask for a call back from the customer care representative.

5. IDBI Bank GO Mobile+

- IDBI Bank GO Mobile+ application boosts the customer banking experience with a tailored, simple UI offering an extensive array of services and features. IDBI mobile banking enables users to avail of multiple banking services anywhere and anytime.

- Consumers of IDBI bank can sign up and log in to this app and check account statements, and payments, make bill payments, transfer funds, and more. Furthermore, customers can also recharge prepaid mobile or make utility bill payments through this app.

6. Baroda M-Connect Plus

- The M-Connect Plus app of Bank of Baroda is an extremely user-friendly mobile banking app. It enables customers to make credit card payments, pay utility bills, and transfer funds immediately. Moreover, the app enables consumers to make cash withdrawals without using a card from BOB ATMs.

- The app gives a complete view of account details and transaction history and allows consumers to ask for a new cheque book. One of the most noteworthy features of M-Connect Plus is that it is now available in seven regional languages. And this enhances its availability among all consumers across the nation.

7. iMobile Pay by ICICI Bank

- iMobile Pay, the mobile banking application of ICICI Bank is one of the highest-rated banking apps in India. This app enables its consumers to pay credit card bills, transfer money, open RDs & FDs, pay utility bills, and handle Life Insurance policies.

- Moreover, this banking app helps customers transfer money immediately through UPI payments, locate ICICI Bank ATMs, and transfer money to a mobile number or email ID. The latest update of this app reflects bug fixing and allows users to avail immediate personal loans against their credit cards, check loan eligibility, and upgrade debit cards.

8. CANDI – Mobile Banking App!

CANDI – Mobile Banking App of Canara Bank is introduced by the bank with the big goal of executing ‘One Bank, One App’. This multi-channel app supports many banking services incorporating opening an FD or RD, money transfers, loan payments, EMI payments, and more.

9. BOI Mobile

- BOI Mobile is the official mobile banking app of the Bank of India. This is the most secure and detailed app that provides any type of banking facility you need on your mobile. You just need to sign up to avail yourself of the mobile banking services of the Bank of India.

- BOI Mobile allows its users to view and make transactions from all their accounts incorporating Deposits and Loans. Also, you can check your account balance, passbook, and email detailed bank statements, transfer money to any bank account through RTGS, NEFT, or IMPS, and get customized offers on your mobile.

- BOI Mobile boasts the Favorite feature that helps you transact the fastest way. You can fast access and finish your transactions for money transfers by tagging a transaction as a favorite. Moreover, this mobile banking app offers multiple banking services like locating an ATM, checking the status of or stopping your cheque facility, tracking your service requests, ordering a cheque book, and so forth.

10. PNB ONE

PNB ONE is the official initiative of Punjab National Bank. It integrates several banking procedures being served through one platform. This mobile banking app allows you to check account statements, transfer money, handle credit and debit cards, invest in term deposits, and several other amazing services just a click away.

Quintessential Features of a Mobile Banking App

- Payment System – The best mobile banking app in India should include every payment system available these days. For instance, the app should incorporate IMPS, BHIM-UPI Payment system, NFC Technology, RTGS or NEFT, QR Payment, etc.

- Security – Before installing a mobile banking app, you need to consider security also. It must have a two-factored and secured registration process. There should be smartphone-specific application installation and biometric authentication must also be there.

- Credit Card Handling – The best mobile banking app in India should have an individual Credit Card segment for seamless handling of credit card transactions.

- Beneficiary Handling – The application should enable beneficiary adding for IMPS, UPI payment, or NEFT payments so you don’t need to make a similar payee for transactions done again.

- Notification – T The app should notify all updates, banking transactions, or offers through email, SMS, or the notification center of your mobile.

- Branch or ATM Locator – A good mobile banking app should have the feature to locate the nearest branch or ATM.

- AI-Enabled Chatbot – The app must have an in-app chatbot for fixing user-specific issues.

- Bill Payment System – A banking app must include Bill payment and register features. For instance, the best mobile banking app in India must allow for registering bills like Mutual Fund online SIP UIN, LIC Premium, Visa Credit Card Bill, etc for seamless banking from home.

- Non-Traditional Banking Facilities – The app must integrate some non-traditional facilities like NPS or PPF account opening, budget tracking service, flight or hotel booking, IRCTC rail ticketing, purchasing movie tickets from the app, etc.

- Other Traditional Facilities – A good banking app should incorporate all conventional banking facilities, such as PIN generation, ATM card issuing, blocking, cheque book requests, balance inquiry, current offers section, linking multiple accounts, tracking your deliverables, etc.

Which One is the Best Mobile Banking App in India?

All the aforesaid apps meet the needs of a perfect banking app. We have only compiled the list of the top 10 mobile banking apps in India. Aside from these apps, many other banking platforms are also there to meet your requirements. So, consider all the parameters while choosing the best mobile banking app in India and download it on your iOS or Android mobile device.