Union Budget 2018 and the Common Man

It would have been very appropriate to call the Union Budget 2018 as ‘a Budget of hopes’. Since this year’s budget was the last full budget by BJP Govt. before General elections next year, it was widely expected to be a populist budget. Finance Minister (FM) managed to hand out a balanced and growth-oriented budget which however was a bit tilted towards appeasing various sections of the society. Here’s how the Union Budget panned out for the common man:

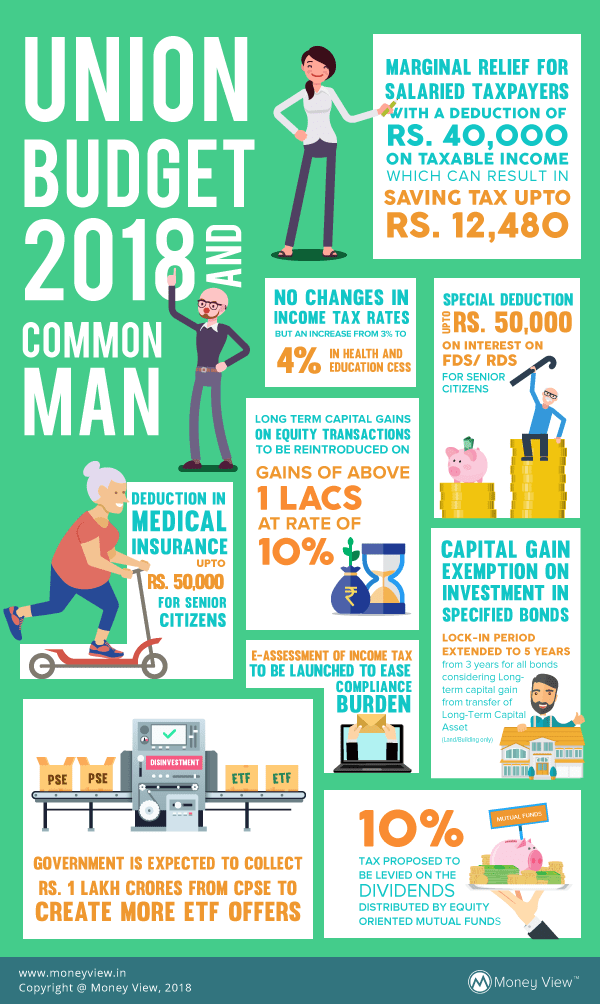

No Changes in Income Tax Rates, Increase in Cess Rate

Thrashing many hopes of tax relief, FM announced no change in the income tax rates, income tax slabs or even the basic exemption limit. To the contrary, the scope of education cess was enhanced to cover Health as well and also the rate has been increased to 4% from the present 3% under the new name of ‘Health and Education Cess’.

Marginal Relief for Salaried Taxpayers

FM, in his budget speech, mentioned some statistics about the tax collection from various categories of taxpayers. For the assessment year 2016-17, 1.89 crore salaried individuals have filed their returns and have paid a total tax of Rs. 1.44 lakh crores which works out to an average tax payment of Rs. 76,306/- per individual salaried taxpayer. As against this, 1.88 crores individual business taxpayers including professionals, who filed their returns for the same assessment year paid a total tax of Rs. 48,000 crores which works out to an average tax payment of Rs. 25,753/- per individual business taxpayer.

The focus seemed clear to appreciate the contribution of salaried taxpayers to the tax revenues. A standard deduction of Rs. 40,000 has been proposed to salaried taxpayers which can result in saving tax up to Rs. 12,480. However, in view of this standard deduction, Govt. has also taken away the benefit of transport allowance exemption (Rs. 1,600 per month) and medical reimbursements (up to Rs. 15,000 per year). While the effective tax relief may, therefore, look smaller, this ad-hoc standard deduction will benefit pensioners as well, as they do not get payouts in terms of allowances and reimbursements. As per FM’s Budget speech, the total number of salaried employees and pensioners who will benefit from this decision is around 2.5 crores.

Special Deduction for Senior Citizens on Interest on FDs/RDs

Budget 2018 has proposed a deduction equal to the interest on fixed and recurring deposits with banks, co-operative societies and post offices up to a maximum of Rs. 50,000/- for senior citizens under the proposed Section 80TTB of the Income Tax Act.

However, the senior citizen taxpayers availing this deduction shall not be eligible to claim an exemption for interest on Savings Accounts u/s 80TTA up to a maximum of Rs. 10,000. In view of the proposed deduction of Rs. 50,000, even the tax deduction requirements have been proposed to be suitably amended to be increased to Rs. 50,000/- from Rs. 10,000/-.

Increase in Deduction towards Medical Insurance for Senior Citizens

The limit of deduction for health insurance premium, preventive medical checkup and/or medical expenditure has been proposed to be raised from Rs. 30,000/- presently to Rs. 50,000/- under section 80D.

Capital Gains on Equity Transactions

Long-Term Capital Gains (LTCG) on the sale of equity shares and equity oriented mutual fund were exempt u/s 10(38) of the Income Tax Act 1961 till FY 2017-18. To be considered as long-term, the investment should have been held for more than 12 months by the taxpayer. Govt. has now proposed to re-introduce LTCG tax after 14 years at the concessional rate of 10% without the benefit of indexation. However, to protect small investors, gains up to Rs. 1 lakh per year shall be considered as exempt and only gains above Rs. 1 lakh shall be taxable @ 10% (plus applicable cess and surcharge).

Further, to avoid any perception of retrospective tax implementation, any gains on the existing investments till 31st January 2018 will stay out of the tax net which has been done by introducing special provisions for computation of cost of acquisition for the investment.

Capital Markets

Govt.’s target for disinvestment receipts for the year 2017-18 was Rs. 72,500 crores. With imminent transactions in sight, Govt. is expected to collect Rs. 1 lakh crores as disinvestment receipts during the current year. The target for the next year has been kept as Rs. 80,000 crores. In this regard, FM also informed that the Govt. has initiated the process of strategic disinvestment in 24 CPSEs, including strategic privatization of Air India.

Further, three public sector general insurance companies – National Insurance Company Ltd., United India Assurance Company Limited and Oriental India Insurance Company Limited will be merged into a single insurance entity and will be subsequently listed. With a superlative subscription to Bharat-22 ETF, the next year 2018-19 will see more ETF offers from Govt. including debt ETF. However, the structure/modalities of debt ETF are yet to be made clear.

Capital Gain Exemption on Investment in Specified Bonds

Presently, Section 54EC provides that Long-term capital gains from transfer of Long-Term Capital Asset shall be exempt if the gain amount should be invested in specified bonds within a period of 6 months from the date of transfer. The maximum amount to be invested was Rs. 50 Lakhs with a lock-in period of 3 years. The section is proposed to be amended to restrict the definition of Long Term Capital Asset, for this section, to Land or Building or both only. This implies that the Long Term Capital Gain on any other capital asset except Land or Building would not be eligible for exemption under Section 54EC. Further, the lock-in period of 3 years has been extended to 5 years for all bonds purchased on or after 01st April 2018.

Dividend Distribution Tax by Equity Oriented Fund

Currently, any distribution of dividend by equity-oriented funds is not liable for dividend distribution tax. However, in view of the withdrawal of the exemption of long-term capital gains on the sale of equity shares and equity oriented mutual funds, additional tax @ 10% is proposed to be levied on the dividend distributed by equity oriented mutual funds. This provision has been proposed to be brought in so as to provide equitable tax levy on growth and dividend plans of equity oriented mutual funds.

Easing the Compliance Burden by providing Enabling Provisions for E-Assessment

Presently, pilot projects for e-assessment proceedings were running across few cities by Income Tax Dept. However, it has now been proposed to introduce e-assessment across the country.Thus Section 143 (3A) is proposed to be inserted whereby the Central government will insert new scheme for scrutiny assessments. E-Assessment proceedings will result in issue and receipt of notices across electronic media and further requisition and receipt of information across the digital interface. The new scheme will be inserted with an object to impart greater efficiency, transparency and accountability through the elimination of direct interface, optimal utilization of resources and introduction of team-based assessment with dynamic jurisdiction.

While there has not been any major relief for the Common Man in the Budget, the budget is being seen as a growth-oriented and balanced budget. Let’s hope this brings the economy back to the path of higher growth. How do you rate the budget? Share your thoughts in the comments below.