A Beginner’s Guide to EPF

Whether you just started working or you have been employed for a while, chances are you’ve heard of EPF. But why exactly is this financial scheme so popular? How does it work?

Let us explore the various benefits of EPF investments in this week’s blog.

What is EPF?

A financial product that combines the benefits of a retirement, investment, and insurance plan, EPF or Employee Provident Fund is a savings tool promoted by the Indian government for employees in the service sector.

Under this scheme, you, as an employee will contribute a certain part of your salary while your employer will also contribute equally. This amount is then deposited with the EPFO or Employee Provident Fund Organization which manages this scheme.

Your EPF consists of three different components –

- The wealth generation aspect which is where your retirement benefits accumulate

- EPS or Employee Pension Scheme which generates pension for employees after they turn 58 years old

- EDLI or Employee Deposit Linked Insurance Scheme which is the life insurance cover

With just one scheme, you can avail the benefits of three different plans and the best part is that you need not register or apply for these schemes separately.

How Does EPF Work?

As mentioned above, a certain part of your salary will be deducted towards your EPF and an equal amount is contributed by the employer. A certain amount of interest is also accumulated each year. The interest rate varies as decided by the government at the start of every financial year and is currently 8.5%.

The deduction towards EPF is 12% of your basic salary (please note that the ‘basic salary’ component in this case will not include your conveyance allowance, HRA, or other special allowances). And as the employer matches this contribution with another 12%, 24% of your basic salary will be directed towards your EPF account.

Let us explain this with an example. If Mr. A earns Rs. 30,000 per month(basic) then 12% of 30,000 which is Rs. 3,600 each will be contributed by the employee and employer adding up to Rs. 7,200 overall.

However, while the entire 12% of the employee’s contribution will go to EPF, the employer’s contribution will be divided which is as follows –

- 3.67% of the employer’s contribution will go to EPF

- 8.33% of Rs. 15,000 goes to EPS (the EPS contribution is calculated on a basic pay of Rs. 15,000 as per government rules)

- If the employee’s salary is higher than Rs. 15,000, 8.33% of the remainder salary which in this case is (Rs. 30,000 – Rs. 15,000) Rs. 15,000 will be contributed towards EPF

| Particular | Percentage | Amount |

| Employee’s Contribution | 12% | 3,600 |

| Employer’s Contribution to EPF | 3.67% | 1,101 |

| Employer’s Contribution to EPS | 8.33% (of Rs. 15,000) | 1,250 |

| Employer’s Remaining Contribution to EPS | 8.33% (of the remainder Rs. 15,000) | 1,250 |

Therefore, in this case, 24% of Rs. 30,000 which is Rs. 7,200 will be contributed towards the employee’s EPF out of which Rs. 5,950 will be towards EPF and Rs. 1,250 will go to EPF.

Additionally, employers will also have to contribute an extra 1% – 1.36% towards EDLI and other administrative charges.

EPF Eligibility Criteria

As an employee, if your salary is Rs. 15,000 or less, you will have to mandatorily be a part of the EPF program. However, if your salary is above Rs. 15,000, you can opt out of the scheme at the start of your career by filling Form 11. But this is not possible once you have enrolled in the scheme unless you change your job and your new employer is not registered under the EPF Act.

Every company that has 20 or more employees will have to compulsorily be a part of the EPF program and organizations that have less than 20 employees can register themselves voluntarily.

How to Withdraw the EPF Amount

The entire EPF corpus can be withdrawn only in the following circumstances –

- Once the employee retires at 58 years

- If he/she is unemployed for over 2 months

- Upon premature death of the member after which the entire corpus is given to the nominee

Partial withdrawal is possible in certain circumstances such as –

- For medical reasons where in one can withdraw 6 times the monthly salary or the accumulated corpus, whichever is lower

- For a wedding wherein 50% of the total corpus along with interest can be withdrawn. However, the employee must have completed at least 7 years of service

- Special circumstances such as the ongoing COVID-19 pandemic wherein the government has allowed members to withdraw a non-refundable COVID-19 advance twice

Benefits of EPF

There are a number of benefits available for employees who are a part of this scheme –

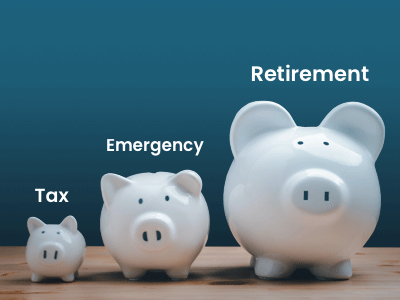

- Tax Benefits

EPF enjoys EEE or exempt-exempt-exempt status. As an employee, you can claim the amount of PF deduction under Section 80C

- Additionally, the interest amount credited is also tax free as long as you are employed

- The corpus in the account is tax free unless there has been no contribution for a minimum of 5 years and a withdrawal was made in this case

- Comfortable Retirement Corpus

EPF ensures a retirement corpus for you and can provide financial support in your sunset years.

- Emergency Fund

Your EPF can also serve as an emergency fund in uncertain circumstances. While you may not be able to withdraw the full amount, even a small percentage of the corpus will be beneficial in financial emergencies

Latest Developments Regarding EPF

- From 1 June 2021, if your PF account is not linked to your Aadhaar or if your UAN is not Aadhaar verified, you will not be able to get your employer’s share

- In light of the second wave of COVID-19, the EPFO has allowed members to withdraw a second non-refundable COVID-19 advance

- A maximum non-refundable withdrawal of dearness allowances and basic wages for 3 months or up to 75% of the amount in the member’s credit, whichever is less, can be withdrawn.

In Conclusion

An EPF account is just one of many perks offered to salaried employees. A retirement account that doubles as a savings scheme, EPF offers excellent interest rates while offering tax benefits too. The risk associated with this financial plan is also extremely low making it suitable for everybody.

Apart from this you can also avail an EPF advance or partially withdraw the EPF corpus in case of emergencies. However, there are a few limitations and conditions that need to be fulfilled such as minimum years of work experience and are only available for specific reasons. Therefore, an easier option to explore during times of financial need is to avail a personal loan at competitive rates and 24 hours disbursal from Money View. Visit the website or download the app to apply today.

Did you enjoy this blog? Let us know in the comments below how beneficial EPF has been to you and if you would like to know more about this government-backed financial scheme.

I don’t know think about.

Thankyou.

So needful information given this blog.