What is Bitcoin? Everything You Need to Know

Bitcoin has been the talk of the town as the value of a single bitcoin has rallied from $800 in January 2017 to $ 18,348 in December 2017, thereby giving 2294% returns in less than 12 months.

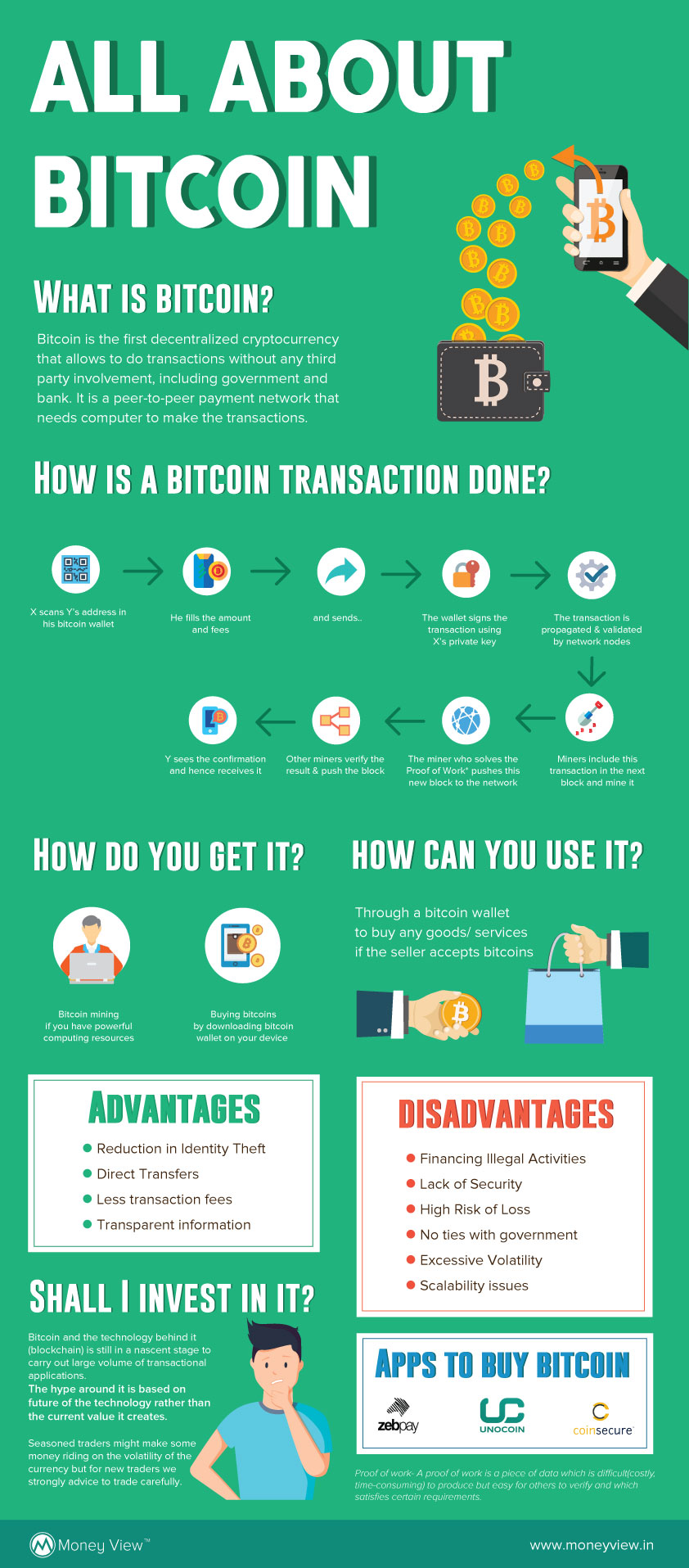

What is Bitcoin?

Bitcoin is the first decentralized cryptocurrency/ digital currency that allows doing transactions without any third-party involvement including governments and central banks. It is a peer-to-peer payment network that needs a computer to do the transactions, unlike physical currency wherein physical currency notes like Rs. 500/ 2000 etc. are required to perform financial transactions.

Development of Bitcoin

The development of the cryptocurrency, Bitcoin, is attributed to an unknown person/ group who worked under the pseudonym, Satoshi Nakamoto. In October 2008, Nakamoto published a paper describing the bitcoin digital currency which was titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. Subsequently, Nakamoto released the first Bitcoin software that launched the network and the first units of the bitcoin cryptocurrency, called bitcoins in January 2009. As such, Bitcoin is just an eight-year-old currency but currently, the highest valued.

How are Bitcoin transactions Made?

Just like the transactions made through electronic wallets, bitcoin transactions are made in digital bitcoin wallets, but within highly secure and encrypted form. Here are the steps in brief:

- A scans B’s address in his bitcoin wallet.

- A then inputs the amount to be sent along with associated fees.

- He sends the same to a system for further processing.

- The wallet then signs the transaction using A’s private key/ password.

- The transaction is then validated through the server within the network.

- The bitcoin flows within the system and the miners include the transaction in the next batch and mine it.

- The miner who solves the Proof of Work pushes the new block to the network.

- Other miners verify the result and push the block.

- B sees the confirmation in his bitcoin wallet after receipt.

How do you get the Bitcoin?

Since the bitcoin technology is a highly sophisticated technology, you can mine the same if you have powerful computing resources. Alternatively, you can buy the bitcoins through various third-party digital wallets like ZebPay, Unocoin, coinsecure etc. Further, the exchange of bitcoins can also happen between two independent persons, i.e. one who is willing to buy and the other person who is willing to sell without any involvement of third party software etc.

How can you use the Bitcoin?

Just like physical currency, bitcoins can also be used through a bitcoin wallet to buy any goods/services. However, since there is no backing of central bank or government, the acceptance of bitcoin as a transactional currency is subject to seller’s willingness. While a large number of sellers have been accepting it, the high volatility in the bitcoin value has been a cause of concern for people accepting it. However, several large corporates including Microsoft, Expedia etc. have been accepting bitcoins for some time now. Just quite recently, KFC Canada also launched a new Bitcoin Bucket that can only be purchased using digital currency.

Advantages of Bitcoin

Following advantages emerge by transacting in digital currency like Bitcoin:

- Reduction in Identity Theft – Since bitcoins are not attached to your public identity, the transactions performed don’t pass on your identity details to the merchants or across the networks. As such, identity theft is reduced and in fact, may be eliminated altogether through bitcoin use.

- Direct Transfers – The blockchain technology, that surrounds and powers the bitcoins, is built in such a way that restricts chargebacks. As such, reversals/ chargebacks are not possible for bitcoin payment transactions.

- Less Transaction Fees – Getting all the processes through digital techniques, there are lower transaction charges for processing transactions through bitcoins. With bitcoin, the fees you pay determine the speed at which you receive your money. Even when you pay no fee, you can receive bitcoin transactions, albeit with longer processing time.

- Transparent Information – Bitcoin and the underlying blockchain technology offer a completely transparent ecosystem wherein you can store your bitcoins digitally without fear of theft, with the transaction charges as you may so desire.

Disadvantages of Bitcoin

Just like a coin has two sides, the use of digital currency also comes with its own set of disadvantages, some of which are being listed below:

- Financing Illegal Activities – Bitcoin is a peer-to-peer payment method without any regulatory forbearance and identification structure. As such, its use for financing illegal activities can’t be ruled out, especially when the users get identified by usernames.

- Lack of security – Bitcoins are stored in a “digital wallet,” which can be hosted on a cloud or on a user’s computer. There have been instances wherein the servers on the cloud have been hacked along with siphoning off of bitcoins from the servers. Similarly, data on user’s computer is susceptible to deletion accidentally or through corruption in the system of computer viruses etc.

- High Risk of Loss – Not only the volatility in the bitcoin value, the processing within the bitcoin network takes up a lot of time. As such, the transaction confirmation takes more than an hour or so and hence, the use of bitcoin as transactional currency has found a lot of resistance. This is because the merchants face a high risk of loss in case the transaction fails to reach the intended destination.

- No ties with Government – Bitcoin is not backed by any government or central bank and thus, faces a high risk of adverse regulatory action across the territories. This can further add to the destruction of bitcoin value.

- Excessive Volatility – Bitcoin has been showcasing extreme volatilities and after touching highs of $18,348 per bitcoin in December 2017, it retraced to almost 50% of the highs to $9,500 in January 2018. As such, its worth as a currency, which stores a definite value, has been found to be limited, and instead more of speculative nature.

- Scalability Issues – Bitcoin, by its very technological structure has a limited and finite supply. There can be only 21 million bitcoins that can be mined in total. As such, once the entire supply of bitcoin gets absorbed, scaling it up further might not be possible.

Should you Invest in it?

Bitcoin and the technology behind it (blockchain) is still in a nascent stage to carry out a large volume of transactional applications. The hype around it is based on the future of technology rather than the current value it creates. Further, countries across the Globe have started looking into the regulatory issues surrounding the currency and hence, the bitcoin value is expected to stay volatile in the coming times as well.

Seasoned traders might make some money riding on the volatility but for new traders, it is strongly advised to trade carefully or avoid it entirely.