Complete Your PAN-Aadhaar Link – A Step-by-Step Guide

The deadline to complete your PAN-Aadhaar link is 30 June 2023. Linking your PAN and Aadhaar is mandatory. You can complete this process easily by paying a fee of Rs.1,000.

If you have still not linked your PAN and Aadhaar cards, follow the steps given below to complete the process.

How to Link PAN Card with Aadhaar Card

This process can be completed in 2 main steps –

- Pay the applicable fee either on the e-Filing Portal or through Protean (NSDL) portal

- Submit a request to link PAN and Aadhaar

Step 1: Pay the Applicable Fee

If your bank is authorized for e-Pay Tax, you can follow the steps given below –

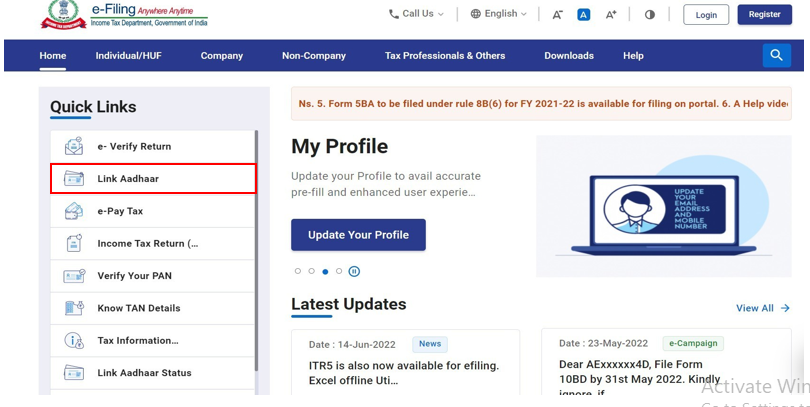

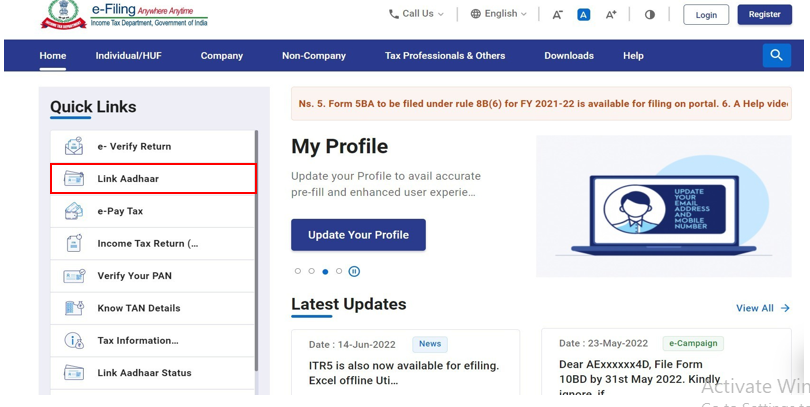

- Visit the e-Filing Portal Home page and select ‘Link Aadhaar’ in the ‘Quick Links’ section on the left hand side. You can also login and select ‘Link Aadhaar’ in the profile section.

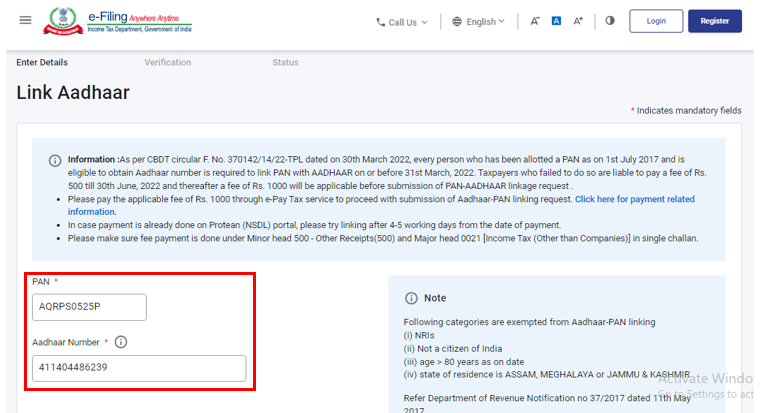

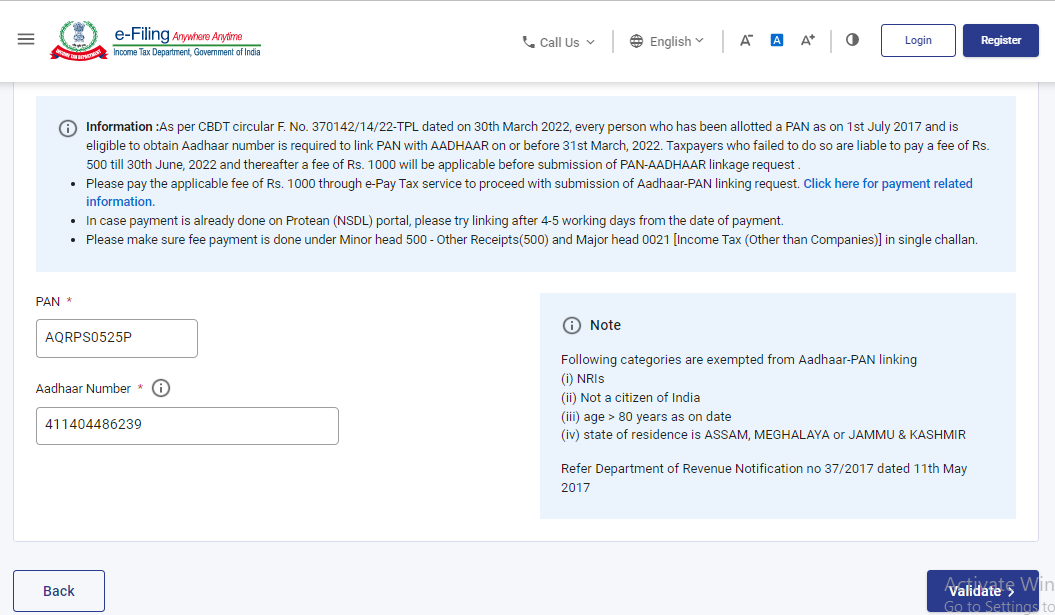

2. Enter your PAN and Aadhaar number

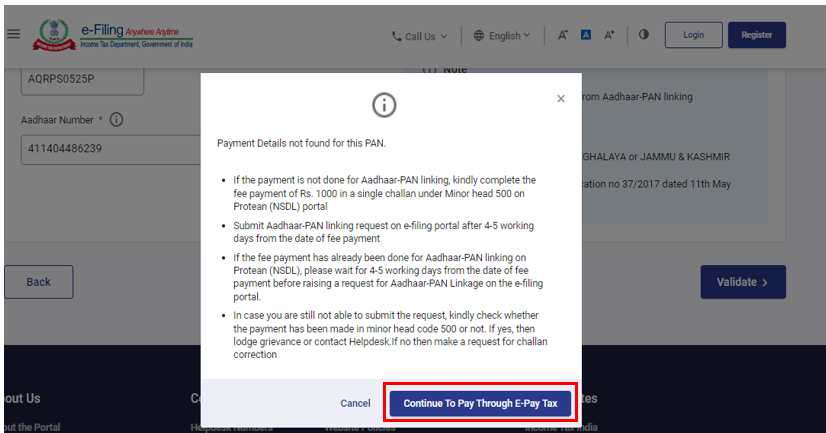

3. A pop-up window will appear. Click on ‘Continue to Pay through E-Pay Tax’

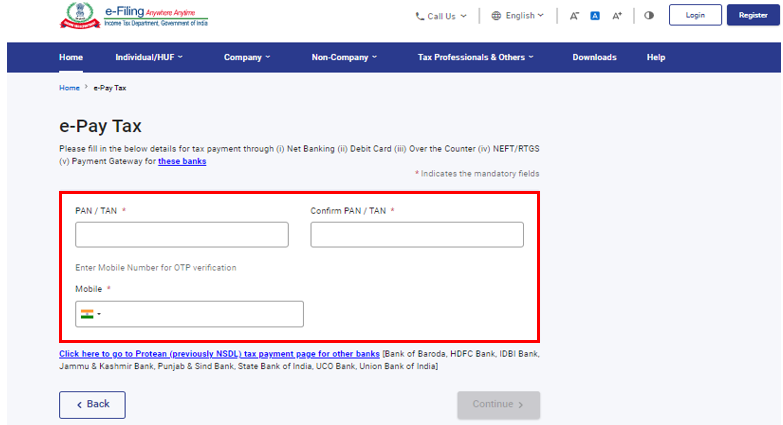

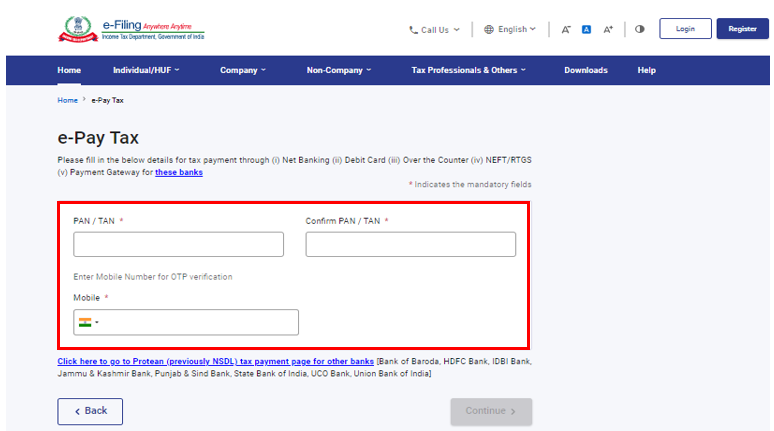

4.Then, enter your PAN number, confirm it, and enter your mobile number to get an OTP

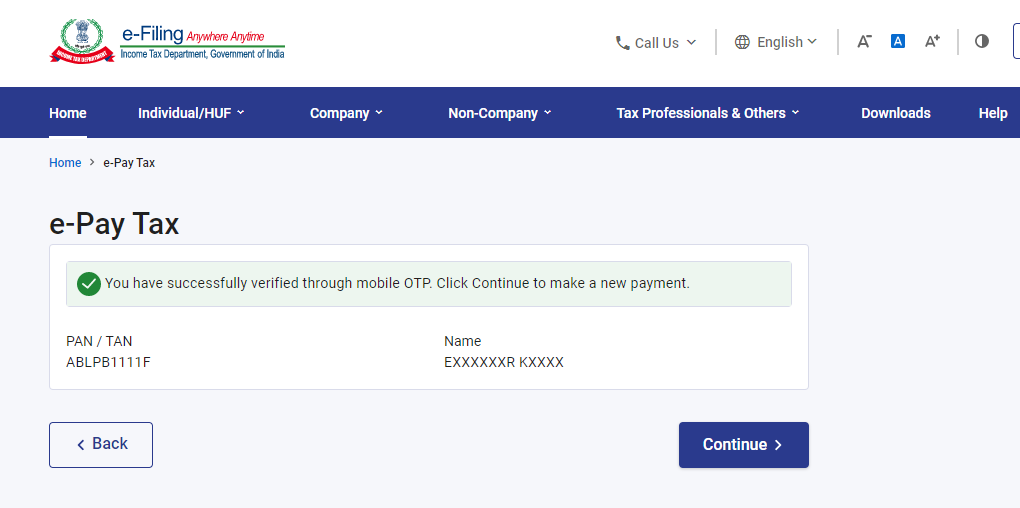

5. Verify your OTP. You will then be redirected to the e-Pay Tax section. Click on ‘Continue’

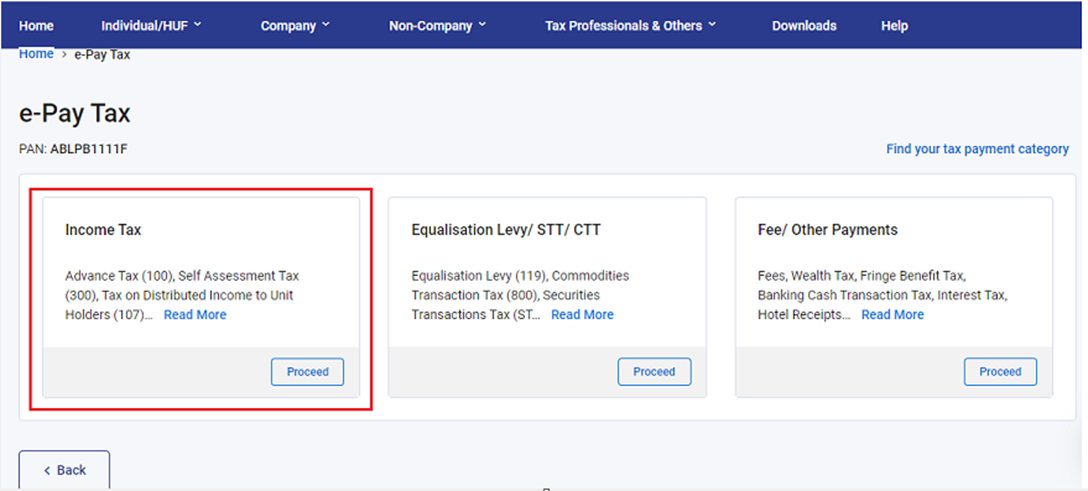

6. You will find a section titled ‘Income Tax’, click on ‘Proceed’

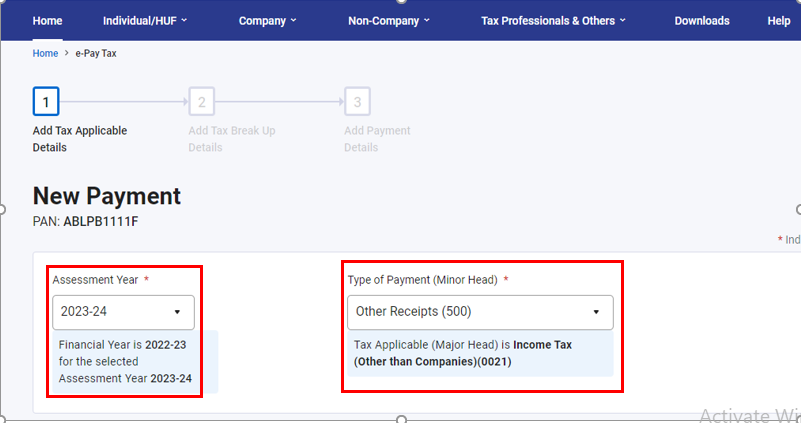

7. Choose ‘2023-24’ as the Assessment Year and ‘Other Receipts 500’ as the ‘Type of Payment’. Click on ‘Continue’

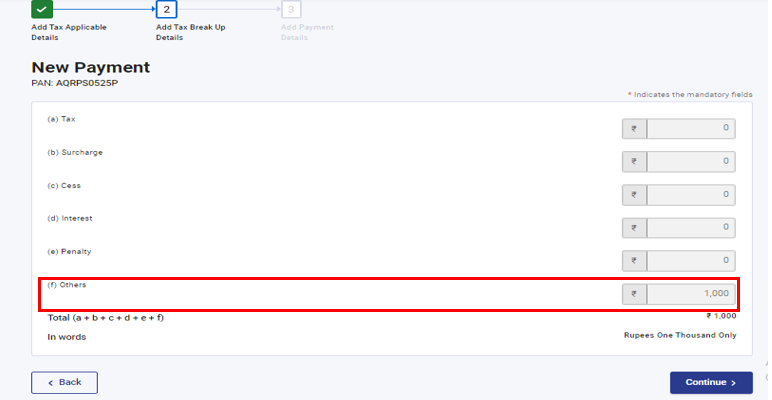

8. The amount you are supposed to pay (Rs. 1,000) will be pre-filled against the option ‘Others’. Click on ‘Continue’

A challan will be generated after which you will be redirected to the payment page. Select a mode of payment convenient to you and complete the same.

Please note that you will be able to use the above payment method only if you have an account in the following banks –

Axis Bank, Bank of Maharashtra, Karur Vysya Bank, Canara Bank, Central Bank of India, Federal Bank, ICICI Bank, Kotak Mahindra Bank, IDBI Bank, Indian Bank, Bank of India, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank Punjab National Bank, City Union Bank, UCO Bank Union Bank of India.

In case you have to pay via the Protean (NSDL) Portal, you can follow the steps given below –

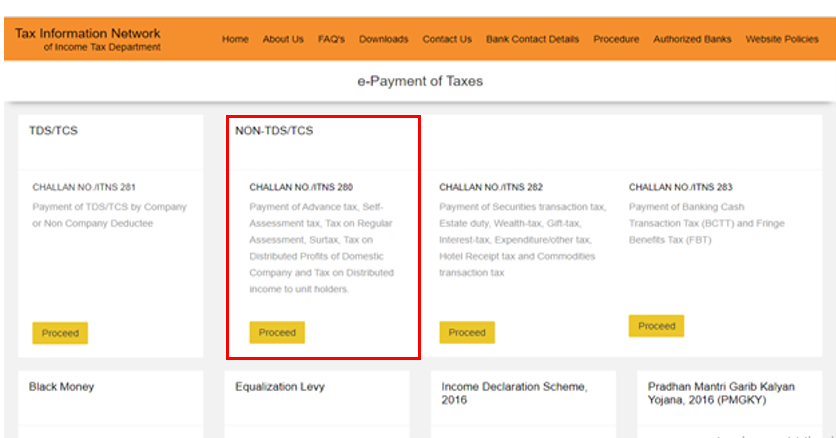

- Follow steps (1) to (3) given above. In the e-Pay Tax page, click on the blue hyperlink at the bottom of the page that says ‘Click here to go to Protean (Previously NSDL) tax payment page for other banks’

2. You will be redirected to the relevant page. Under the ‘Non-TDS/TCS Challan No./ITNS 280’ section, select ‘Proceed’

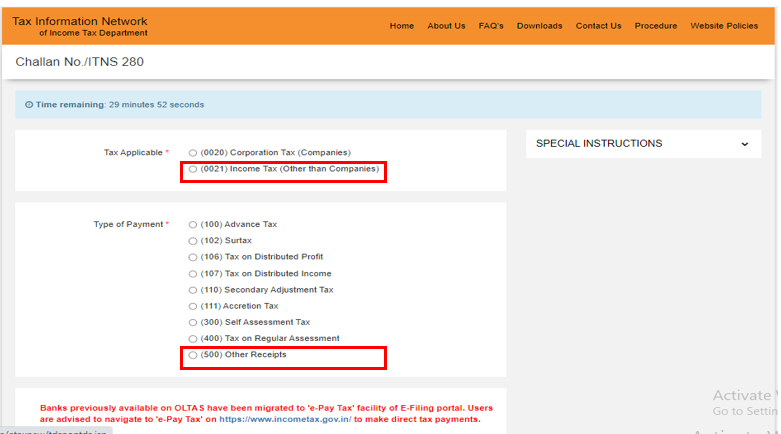

3. Opt for ‘Tax applicable’ as (0021) Income Tax (Other than Companies)’ and ‘Type of Payment’ as ‘(500) Other Receipts’

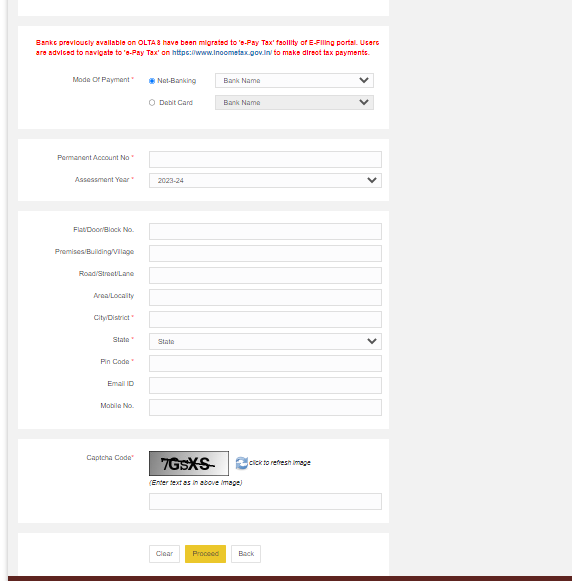

4. Choose ‘2023-24’ as the Assessment Year and provide other details as required. Then, click on ‘Proceed’. You will then receive further instructions regarding your payment.

Once the payment is made, follow the steps given below to complete PAN-Aadhaar link.

Step 2: Submit the PAN-Aadhaar link Request

- Visit the e-Filing Portal Home page and click on ‘Link Aadhaar’ in the ‘Quick Links’ section on the left

2. Enter your PAN number and Aadhaar number and select ‘Validate’

Note: If you have made your payment through the Protean portal, you may have to wait for 4-5 working days for the payment to be processed. You can submit the link request after.

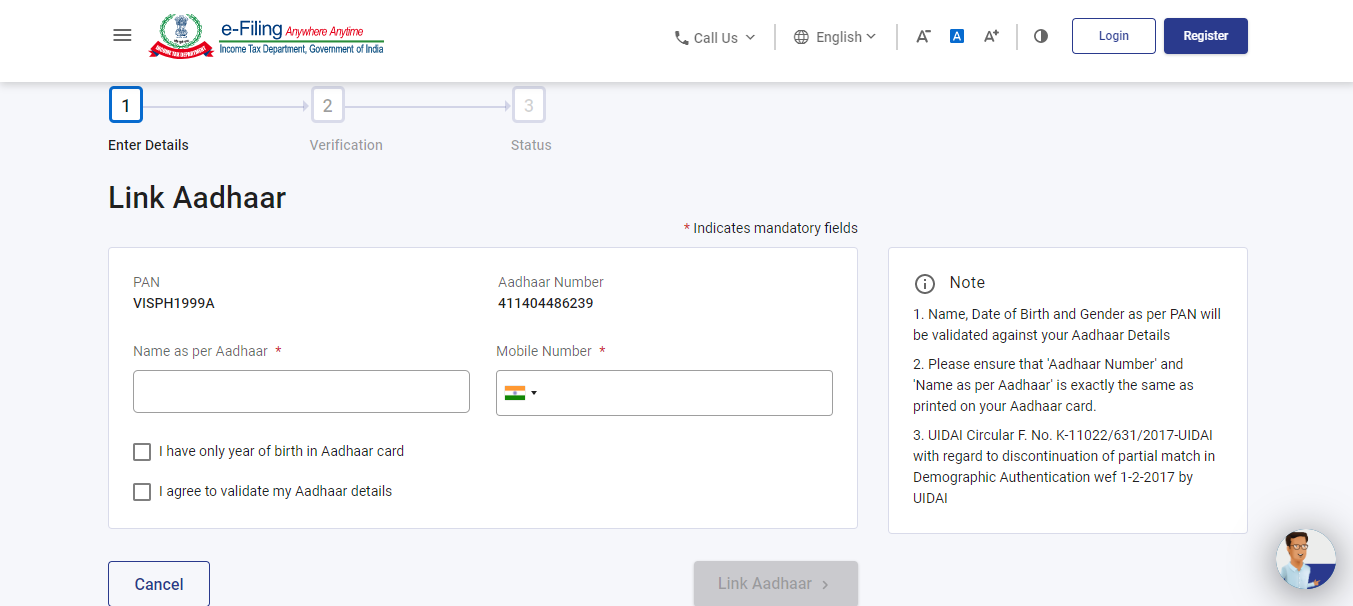

3. Enter the required information and select ‘Link Aadhaar’

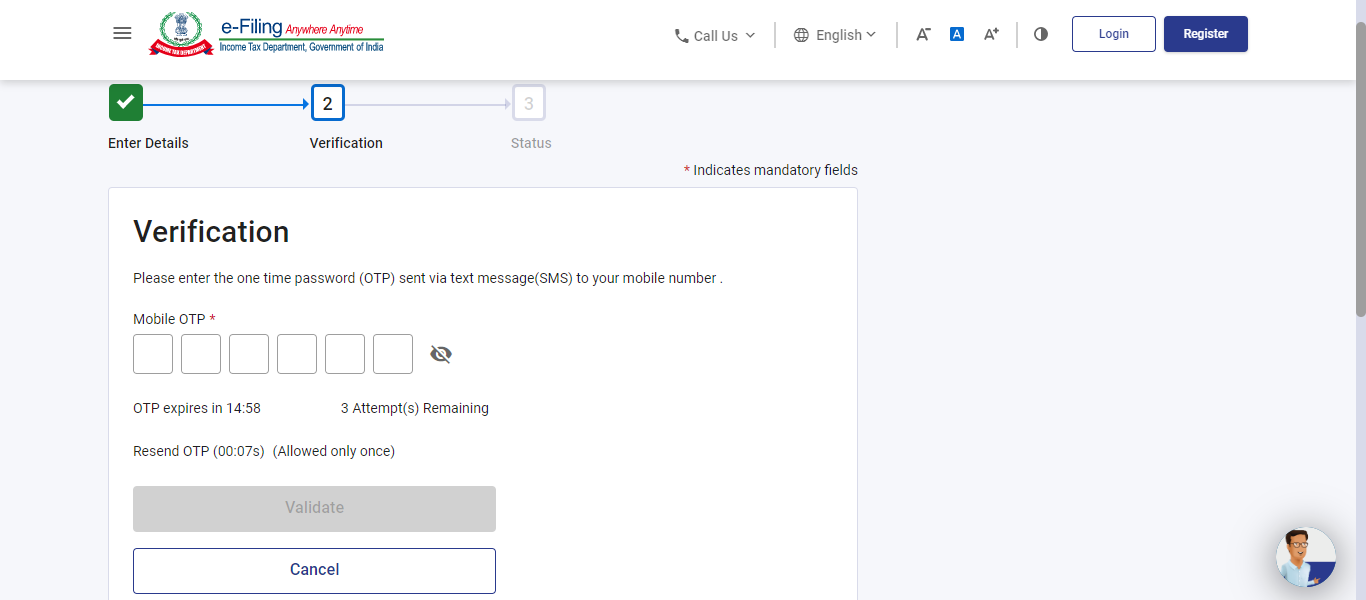

4. You will receive a 6 -digit OTP on your registered mobile number. Enter this and click on ‘Validate’

Your request will be successfully submitted. You can check the status of your request after some time.

The above steps can also be completed by logging into your account and selecting ‘Link Aadhaar’ in the dashboard.

Who is Exempt from Linking PAN and Aadhaar Card?

The following individuals are exempt from having to link their PAN and Aadhaar cards –

- Non-Resident Indians (as per Income Tax Act of 1961)

- Residents of Meghalaya, Jammu & Kashmir, Assam

- Who are 80 years of age or older as on 2022

- Not a citizen of India

In Conclusion

Linking your PAN card and Aadhaar card is a mandatory process. While the steps are simple enough, a fee will have to be paid. If this process is not completed before 30 June, 2023, your PAN will be inoperable. Follow the steps given above to complete this process at the earliest.