Credit Score and Financial Planning: A Holistic Approach

Are you hearing about the ‘credit score’ for the first time? What is this three-digit score that is so important for your financial health? This guide to credit health will tell you everything you need to know about it!

The credit score is a 3-digit score ranging from 300 to 900. It is a score that rates your creditworthiness and a higher score translates to better financial health. Every lender checks your credit score before approving your loan.

There are a few popular bureaus whose credit scores have more weightage. The CIBIL score, Experian score, CRIF HighMark credit score, etc. are noteworthy. Out of these, the CIBIL score is the most commonly used credit score in India.

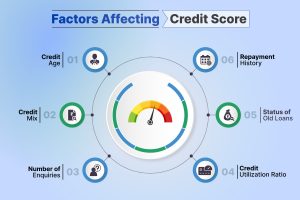

What Affects Credit Score?

The credit tracking bureaus take certain factors into account before calculating your credit score. What are those factors?

-

Credit Age

Your credit age is the total number of active credit history that you have. Lenders are more likely to trust you if you have a longer credit history.

-

Number of Enquiries

Lenders check your credit score whenever you apply for a credit product. Known as a hard pull, it appears on your credit report under the ‘inquiry’ section.

Your credit score is negatively affected by too many hard credit inquiries on your credit report.

-

Credit Mix

A credit mix refers to the variety of credit products that you have. A good mix of credit cards, secured, and unsecured loans will positively impact your credit score.

-

Repayment History

A repayment history shows how you have paid your EMIs and credit card bills. Regular payments improve your credit score.

-

Credit Utilization Ratio (CUR)

Your credit utilization ratio refers to the percentage of credit you have utilized to the credit available to you. You should ideally maintain a CUR below 30%.

-

Status of Old Loans

Any old loans that have the status of ‘settled’ or are not closed may hurt your CIBIL score.

How to Check My Credit Score?

There is good news when it comes to checking your credit score! You can now check your credit score for free on the moneyview website in just 2 minutes.

STEP-1: Go to the moneyview credit tracker page, enter your mobile number, and click on ‘Get Score and More’.

STEP-3: Enter the 5-digit OTP you get on your mobile number and voila!

You will be able to see your credit score, tips to improve your score, your active loan accounts, and much more!

Good Credit Score = Good Financial Health

Even though a good credit score is helpful only while applying for loans, it plays an important role in your overall financial health. If you focus on the factors that credit score depends on, you will have automatically followed good financial behaviour.

For example, paying your bills promptly would make sure that they don’t accumulate and become a burden for you later. Also, keeping your credit utilization ratio lower will make sure you have enough for savings, instead of spending too much on EMIs.

Additionally, when you have a favourable credit score, taking loans becomes cheaper for you. Banks will offer loans to you at lower interest rates, which will mean you will end up saving some bucks! Remember, every penny saved is a penny earned.

You can utilize that money for savings, investments, retirement funds, and much more. Thus, you can have better financial health just by maintaining a good credit score.

So, what are you waiting for? Check your credit score on the moneyview website now!