Freedom From Debt: Liberate Yourself From Financial Burdens This Republic Day

While the country celebrates 75 years of being a republic, remember it’s not just about patriotic fervor and flag hoisting. True liberation in this economy is freeing yourself from the shackles of debt and gaining control over your finances.

Imagine life without the constant weight of debt on your shoulders. No more pestering calls from the lenders, no more budgeting every rupee that comes in, and no more compromising on your needs or desires due to financial shackles. Isn’t that what dreams are made of?

This Republic Day, as our pride soars high, let’s reclaim our financial freedom by bidding goodbye to debt! But before we decide on the course of action, let us understand debt.

What Are The Types Of Debt In India?

In India, various types of debt exist, catering to the needs of individuals, businesses, and the government. Here’s a look at the types of debt an individual might come across:

Secured Loans

Secure loans require collateral, like property, vehicles, or other assets, as security. If the borrower defaults on the loan, the lender can seize the collateral to retrieve the money owed. Examples include:

- Home Loans: Used to purchase residential property

- Car Loans: To finance the purchase of a car or two-wheeler

- Gold Loans: Offering gold jewelry as security for instant cash

Unsecured Loans

In unsecured loans, no collateral is required. Hence, the interest rates are generally higher as these loans pose an increased risk for the lender. Examples of unsecured loans are :

- Personal Loans: Multipurpose loans for various needs like weddings, medical expenses, or travel

- Education Loans: Used to finance higher education

- Credit Card: Revolving credit with high-interest rates

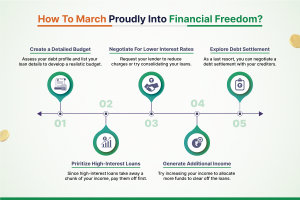

How To March Proudly Into Financial Freedom?

Debt wriggles its way into our lives through impulsive purchases, tempting loan offers, and unprecedented emergencies that can’t be avoided. Regardless of the reason, debt is a slippery slope if not trodden carefully.

Here are a few true and tested money management ways to break yourself free from the chains of debt.

1. Face Your Reality

You are debt-ridden. There are no two ways about it. In such a situation, it is wise to assess your enemy and draw a battle plan. Start by listing all your debts, including the amount owed, interest rates, and minimum payments.

Set your priorities straight. Tackle high-interest debts first, like credit cards, and slowly focus on other loans as well.

2. Craft a Clear Plan

Until you are completely free from debt, every rupee counts. Create a detailed budget that is apt for your income, loans, and expenses. Track your spending.

It is needless to live an extravagant life when you can’t afford it. Unsubscribe from a few digital platforms, cook for yourself instead of dining out and rethink purchases at all times.

3. Boost Your Income

The more you earn, the faster you can pay off your debt. Create a money-making side hustle through freelancing or turning your passion into a business.

You can also negotiate a raise at your job by showcasing your value, and confidently asking for what you deserve.

4. Seek Professional Help

Talk to a financial advisor. They can develop a personalized plan and offer expert guidance.

Additionally, consider debt consolidation. One loan with a lower interest rate can simplify repayment.

5. Stay Motivated

Track your progress. Celebrate milestones, no matter how small. When it seems difficult, visualize your debt-free future!

Also, don’t forget to reward yourself. Treat yourself to reach goals, but stay within budget. Financial freedom is its reward, but it doesn’t hurt to celebrate a little!

Dumb Ways To Deal With Debt

While tackling debt, there are several “don’ts” one must follow. Here is everything you should NOT do to emerge debt-free.

- Ignoring the problem

- Borrowing more without a plan

- Taking cash advances on credit card

- Paying other credit bills using a credit card

- Paying off only the minimum balance

- Cutting necessary expenses, and lastly,

- Relying on luck!

Debt is not going to disappear just because you forget about it. Reduce your debt by paying off small debts first and addressing the next smaller debt(Debt Snowball method). Borrowing from friends and family, thinking it isn’t legal debt is simply foolishness. At the end of the day, you still owe money.

Use your credit card sparingly and pay off the credit card bills in full to avoid exuberant charges. Most importantly, only you can clear your own debt. Hence, it is important to maintain discipline to overcome debt.

In a Nutshell,

Debt isn’t the enemy. It is our financial habits and our impulses that dictate the amount of debt we accumulate. As the heroes of our freedom struggle marched toward liberation through small yet consistent efforts, let us also tackle foes of our own with smart yet steady measures. It is never too late to change our habits and set a course for a debt-free destiny.