Myths Related to Loans

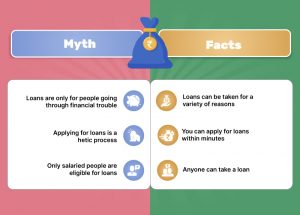

Having certain misconceptions related to loans is not uncommon. We hear them from people and believe in them without looking into the true story.

Let us take time to read about some common myths related to loans and bust them! From now on, you won’t have to be scared of loans as you will know fact from fiction.

Here are some common myths and myth-busters related to taking loans.

Myth 1: Loans are Only Meant for People Going through Financial Trouble

Most of us believe that loans are taken only during financial trouble. But that is not all.

Loans can be taken for a variety of reasons to help you fulfill your dreams and goals. You can apply for a loan to fund your higher education, a luxury vacation, weddings, buying a house, etc.

You might also take loans to invest in your business, whether it is starting a new one or expanding an existing one.

Personal loans are a type of loan that have no limitations to what the funds can be used for. It can be used for businesses, buying a property, or redecorating your dream home. In fact, loans are a great way to cater to your needs without depleting your savings.

Myth 2: Applying for Loans is a Complicated and Time-Consuming Process

If you are new to loans, you might be worried about the cumbersome application process. However, the need for multiple documents, long application forms, and time-consuming approvals are things of the past.

Nowadays, banks, NBFCs, and online lenders have streamlined the process and made it hassle-free for you. You can apply for a loan and get the funds in your bank account within 24 hours. Even the documentation process is easier with just two or three documents being enough.

moneyview instant personal loan applications are 100% online and need only basic documents like your PAN card, Aadhaar card, and bank statement. You can get loans from Rs.5,000 to Rs.10 Lakh within 24 hours, in most cases.

Myth 3: Only Salaried People are Eligible for loans

One of the biggest myths when it comes to loans is that only people with a salary are eligible for one. However, this is far from the truth. Anyone can take a loan, regardless of their employment status.

While getting a loan is easier for people who have a steady flow of income from a credible source, even self-employed individuals can borrow with the strength of their credit score and income.

Once you can prove that you have the capability to repay the loan through regular EMIs, getting a loan is possible even if you are self-employed.

Myth 4: You Can’t Take a Personal Loan With an Existing Loan

Banks do consider your existing liabilities, including any ongoing EMIs, before sanctioning your loan. However, this does not mean that you have to repay a loan completely before applying for a new one.

Lenders use the same parameters to approve your second loan as your first. They pay more attention to your debt-to-income ratio than the number of ongoing loans. Even when you have an existing loan, if your income allows you to repay another loan, it will be easy to get another.

Myth 5: A Perfect Credit Score is Needed for a Loan

The CIBIL score is India’s most commonly used credit score, and a score of 750 and above is considered good enough for most loans. The chances of getting a loan on better terms and conditions increase with a higher credit score. You can get a higher loan amount at lower interest rates and a longer tenure.

That doesn’t mean it is impossible to get a loan with a low CIBIL score. You can prove your creditworthiness through other means and can get a loan even if you don’t have a perfect credit score. Factors like your income, repayment capacity, age, etc. can help you if you don’t have a high credit score.

Check your credit score before applying for a loan so you know where you stand. moneyview uses a unique model to check your eligibility and provides personal loans with a CIBIL or Experian score of just 650 and above.

Myth 6: Personal Loans Hurt Your Credit Score

When you apply for any kind of loan, the lender checks your credit score and report, which is known as a hard pull. This may temporarily affect your credit score negatively.

You can easily outweigh this by making timely payments toward loan repayment. That way you will be able to build your credit score further. Thus, personal loans can help you build your credit score from scratch if you are disciplined about EMI payments.

If you are new to credit, personal loans are your best bet to improve your credit score. Once your credit score is better, you will be able to apply for bigger loans at more favorable terms.

Summing up

Holding on to myths can affect your financial health. Instead, make informed decisions and don’t be scared of taking loans. Loans can help you practice healthy financial habits if taken after meticulous planning.

Use an EMI calculator to understand how much EMI you would have to pay every month. Don’t miss out on EMIs and try to not settle your debt.

Instant personal loans from moneyview are a great option if you want to give wings to your dreams and aspirations. Visit our website or download the moneyview app to learn more about the eligibility criteria, documents required, and application process.

Now you can also track your credit score for free on the moneyview website in just 2 minutes!