Union Budget 2020 – A Detailed Analysis

The Union Budget 2020 was a Budget of hopes, which fructified into the Budget of dreams and aspirations. However, in the absence of any short-term relief measures to boost consumption demand, it was a dampener for the markets. Many expectations were not met, including revamping the LTCG (Long Term Capital Gains) Tax regime, sector-specific relief measures etc.

This was also reflected in the reaction of the Stock markets, which corrected around 2.5% on Budget Day. Apart from several structural and fundamental reforms and increased allocation to key budgetary schemes, the Budget fine print had several critical changes in the tax proposals which would impact the common taxpayers.

Let us discuss Analysis of Budget 2020 in detail below:

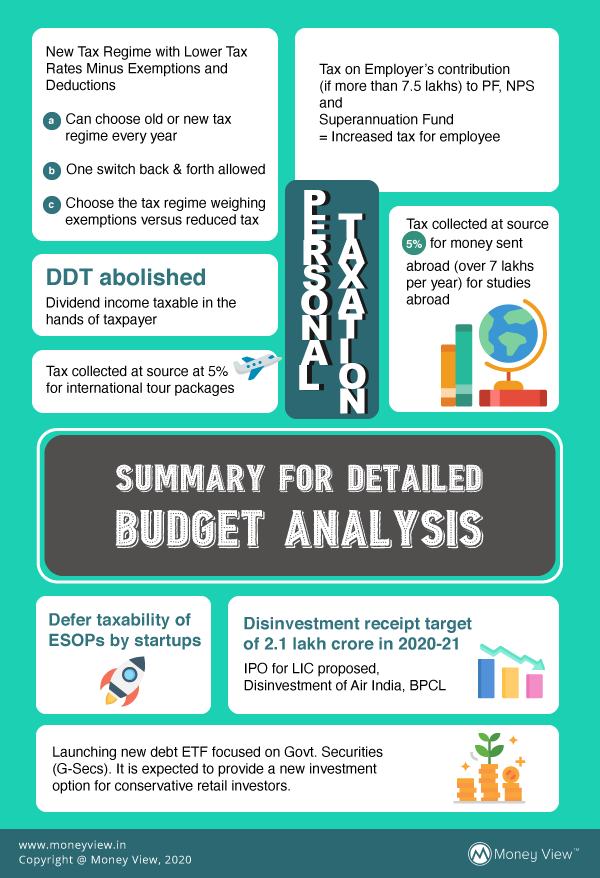

1. Changes in Personal Taxation

Largely promoted as a major tax relief by the Govt., an optional tax rate structure has been introduced by the Govt., wherein the taxpayers are eligible for reduced tax rates but only after foregoing key exemption/ deductions available under the Income Tax Act. Here is the snapshot of the comparative review of the tax rate structure as proposed:

| Income tax slabs | Existing Tax Rates | Proposed Rates under the optional new regime |

| Upto Rs. 2,50,000 | Nil | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,001 to Rs. 7,50,000 | 20% | 10% |

| Rs. 7,50,001 to Rs. 10,00,000 | 20% | 15% |

| Rs. 10,00,001 to Rs. 12,50,000 | 30% | 20% |

| Rs. 12,50,001 to Rs. 15,00,000 | 30% | 25% |

| More than Rs. 15,00,001 | 30% | 30% |

While the new slabs may excite taxpayers anticipating reduced tax outflow, taxpayers need to forego several key exemptions/ deductions, such as below:

- Standard Deduction of Rs. 50,000 available to all salaried taxpayers

- Exemption in respect of House Rent Allowance (HRA)

- Exemption in respect of Leave Travel Allowance (LTA)

- Deduction towards Entertainment Allowance/ Professional Tax

- Deduction in respect of Interest on Housing Loan for self-occupied house

- Deduction of Rs. 1.50 lakh under Section 80C

- Deduction towards voluntary NPS contribution under Section 80CCD(1B)

- Deduction towards medical insurance premium under Section 80D

- Deduction towards donations under Section 80G

- Deduction towards royalty income under Section 80QQB/80RRB

Please note that the list above in respect of tax benefits to be foregone to avail reduced tax rates is an illustrative list, and the actual list includes even more tax benefits, which are required to be foregone. Further, it has been clarified by the Govt. that taxpayers with non-business income can make a choice every year to be taxed under old or new tax rate structures.

On the other hand, if the taxpayer has a business income, they can shift to the new tax regime only once. Once chosen, the new tax regime will be applicable in perpetuity unless the taxpayer chooses to get back to the old tax regime once. This decision to shift back to the old regime can also be taken only once.

Given the plethora of the tax benefits to be foregone, the new tax regime may be suitable only for those taxpayers who could not plan their taxes earlier, or who were doing forced savings for the sake of tax benefits. If you are one of those taxpayers who planned their taxes and utilised the tax benefits available, you are likely to pay more tax under the new tax regime.

Here is a small comparative table for taxpayers at different income points and the break even point for tax benefits for them, so that they can make an informed decision about making a choice between old and new tax rates:

| Income Level | Tax payable as per Old Rates

(assuming no deductions) |

Tax payable as per New Rates | Additional Benefits which can be foregone without tax loss |

| Rs. 5,00,000 | Nil | Nil | Not Applicable |

| Rs. 7,00,000 | Rs. 54,600 | Rs. 33,800 | Rs. 1,00,000 |

| Rs. 9,00,000 | Rs. 96,200 | Rs. 62,400 | Rs. 1,62,500 |

| Rs. 11,00,000 | Rs. 1,48,200 | Rs. 98,800 | Rs. 1,87,500 |

| Rs. 13,00,000 | Rs. 2,10,600 | Rs. 1,43,000 | Rs. 2,16,667 |

| Rs. 15,00,000 | Rs. 2,73,000 | Rs. 1,95,000 | Rs. 2,50,000 |

| Rs. 17,00,000 | Rs. 3,35,400 | Rs. 2,57,400 | Rs. 2,50,000 |

The above table can be a ready reference for the taxpayers with different income levels, and anyone who is availing tax benefits more than those mentioned in the table above will be better off continuing under the present tax rate structure.

2. Disinvestment Targets

The Govt. is targeting disinvestment receipts of Rs. 2.10 lakh crores during the next year 2020-21, which may also cover the present disinvestment targets in the pipeline including BPCL, Air India etc. and further, IPOs of flagship institutions of the Govt. including Life Insurance Corporation of India (LIC) may also see the light of the day.

3. Abolition of Dividend Distribution Tax (DDT)

As per the present tax laws, dividend income received by the investors remains exempt in their hands, while the Companies are required to pay Dividend Distribution Tax (DDT) on such dividends distributed to the shareholders unitholders. This tax rate was around 21% for the companies and such DDT reduced the overall available surplus with the Companies.

The Govt. has now proposed to abolish the Dividend Distribution Tax (DDT) and instead, tax such dividends in the hands of the shareholders/ unitholders. With expectations of higher dividend payouts now due to no DDT implications now, shareholders in lower-income groups are expected to be the beneficiaries of this proposal, while the same is negative for investors in the higher tax brackets.

4. Tax Deduction on Dividends by Companies and Mutual Funds

To plug the leakage on account of non-declaration of dividend income by taxpayers, the Govt. has also proposed to introduce the TDS (Tax Deduction at Source) provisions for such dividend income.

Now, the Company and Mutual Funds will be required to deduct tax @ 10% before paying any dividend income to the shareholders, provided that such dividend exceeds Rs. 5,000 in a year. The respective provisions are provided under Section 194 and 194K of the Income Tax Act 1961, respectively.

5. Taxation of Employer’s Contribution to PF, NPS and Superannuation Fund

As per the proposed provisions, if the employer’s contribution towards Provident Fund (PF), National Pension Scheme (NPS), and Superannuation Fund in a year exceed Rs. 7.50 lakh, such excess amount shall be considered as perquisite in the hands of the employee. This will be added to the income of the employee and taxed at the rates as applicable to them.

Further, presently the interest income from the PF account was exempt to the extent of 9.5% per annum and returns from NPS and Superannuation Fund were also not taxed at the accrual stage. While such exemptions continue, the Govt. has proposed to tax the returns from the corpus of such retirement funds to the extent such returns are from the employer contributions that have been considered as income.

However, the manner in which such returns will be calculated will be specified in the rules to be notified later. Accordingly, structuring the pay packages to have higher employer contributions to retirement funds will be less tax-efficient now.

6. Deferment of Tax Liability on ESOPs issued by Startups

As per the present income tax laws, the ESOPs (Employee Stock Option Plans) granted by the Companies to their employees are taxed at the time of exercise of such an option by the employee. The difference between the fair price and the exercise price of such option is considered as perquisite.

However, most of the employees stayed invested in such shares, in line with the intent of ESOPs to let the employees participate in the long term growth of the Companies. This often caused cash flow problems for the employees. To bring relief to such employees, Govt. has now proposed to defer the taxability of ESOPs to a later stage.

According to the new tax rules, the employees will be required to pay tax on such ESOPs in the year it falls due, which will be calculated as the earliest of the three dates below:

- 5 years from the end of the year in which ESOPs were allotted to the employee

- Date of sale of such ESOPs by the employee

- Date of the Employee ceasing to be employee of that company

TDS provisions have also been proposed to be amended to this effect. However, it must be noted that this tax relief will be applicable only to the ESOPs issued by eligible startups, and not all companies.

7. TCS on Remittances abroad under Liberalised Remittance Scheme (LRS) of RBI

TCS (Tax Collection at Source) provisions collect information about expenses of taxpayers, as tax is collected by the entity that receives any payment from the taxpayer. Such tax collection is also available to the taxpayer as an income tax credit which can be adjusted in the overall tax liability. TCS applicability does not cause any additional tax outflow for the taxpayer, but only prepones the tax payments.

Further, it enables the flow of such expenses/payments made by the taxpayer to the Income Tax Department. The Govt. has proposed TCS at the rate of 5% on remittances abroad under the Liberalised Remittance Scheme (LRS) of RBI, if the amount of such remittance is Rs. 7 lakhs or more. Such remittances may include sending money to children, paying tuition fees for child’s education in a foreign university, etc.

8. TCS on Payments towards International Tour Packages

The Govt. has also proposed TCS provisions on payments made by the taxpayers towards international tour packages. As such, a seller of an international tour package will collect TCS at 5% on this amount.

This information collection by the Income Tax Department through TCS provisions is expected to help them to plug potential tax leakages, as the taxpayers tend to be more cautious about the information already available with the Income Tax Department.

9. Increase in Deposit Insurance Coverage Ratio

The recent collapse of a large cooperative bank has made the depositors in these entities worried. This also led to debate on the insurance coverage of such deposits provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), the limit of which had been long-standing as Rs. 1 lakh since 1993.

To cushion conservative investors and help them feel a little more comfortable in saving their money in savings accounts and fixed deposits banks, the Govt. has permitted DICGC to enhance deposit insurance coverage from Rs. 1 lakh to Rs. 5 lakh. DICGC has subsequently issued its orders to this effect to enhance the insurance coverage w.e.f. 4th February 2020.

10. Launch of G-Sec Oriented Debt Fund

With the success of India’s first Corporate Debt ETF, Bharat Bond ETF launched in Dec. 2019, the Govt. is planning for a new debt ETF focused on Govt. Securities (G-Secs). It is expected to provide a new investment option for conservative retail investors.

11. Increase in Safe Harbour Limit of Properties under Section 43CA/ Section 50C/ Section 56

As per the current tax laws, if the transaction value of residential/commercial property was less than the stamp duty value, the stamp duty value was considered as the deemed transaction value for such transactions under different tax provisions like Section 43CA/ Section 50C/ Section 56. These sections are applicable for calculating income under Business and Profession, Income from Capital Gains and Income from Other Sources in the form of a gift.

However, to provide relief to genuine transactions within a short range of such stamp duty value, the tax laws also provided that if the difference between the transaction value and stamp duty value was less than 5%, such difference is acceptable. This 5% difference, often referred to as Safe Harbour Limit, is now proposed to be enhanced to 10% under the Finance Bill 2020.

12. Annual Financial Statement

Presently, the Income Tax Department provides information concerning the TDS, TCS, tax refund and other specified high-value transactions under Form 26AS (Tax Credit Statement). Such a statement could be downloaded from the Income Tax E-Filing website directly and was also accessible through the net banking portals of specified banks.

As a tax-friendly measure for taxpayers, the Govt. is proposing to replace Form 26AS with another comprehensive statement in the form of an Annual Financial Statement. This Statement is expected to reflect all the financial information available with the Income Tax Dept.

This information includes financial transactions, capital market transactions in shares, mutual funds, tax deduction details, and specified high-value transactions, etc. The Govt. has also shown an inclination to provide pre-filled ITR forms to the taxpayers to ease their compliance burden.

With fewer hits and more misses for the taxpayers, they may be feeling disappointed. However, with several structural reforms in sight, the only hope for future relief is the revival of the economic growth pace which will provide more headroom and fiscal cushion to the Govt. to provide more tax benefits.