Financial Wisdom: New Year Resolutions for Every Stage of Life

How long is your list of resolutions? They must include goals related to health, hobbies, life, etc. But does it include your finances? No? Then this blog is for you!

No matter what your age, we have four New Year financial resolutions that you can follow through. So, read ahead and put your best financial foot forward on the first working day of 2024!

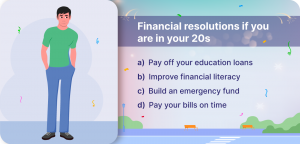

Financial Resolutions if You are in Your 20s –

Chances are that you will still be in college at the beginning of your 20s. And if you pursue higher education, you will be employed by your mid-20s. You should take it easy and enjoy your new freedom.

But you still have some financial responsibilities, and the earlier you start taking money seriously, the better it is for you. The first thing you should focus on is paying off your education loans.

You must also read books, articles, and blogs to learn more about managing finances. Take time to acquaint yourself with investments, and improve your financial literacy.

Consider building an emergency fund, which can be useful when facing an unexpected financial low. It should be built in such a way that you can comfortably survive without any income for 3 to 6 months.

Start inculcating good financial habits like paying your bills on time. This includes your utility bills and credit card bills. Following these will give you the foundation you need to build your finances for the future.

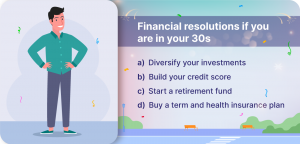

Financial Resolutions if You are in Your 30s –

Your 30s are when you have a serious career and are making good money. Try not to spend all your money on unnecessary things, and start investing. Diversify your investments by investing in long-term and short-term plans. Get in touch with a financial advisor to understand the intricacies of investments better.

Consider getting a credit card and taking small loans to build your credit score. Your 30s is a good time to start a retirement fund. It should be something that has fewer risks involved so that your money is safe.

You must also get a term and health insurance plan. Term insurance provides life coverage for a specific time. On the other hand, health insurance can help you cover your medical expenses, such as hospitalization and surgeries, if any.

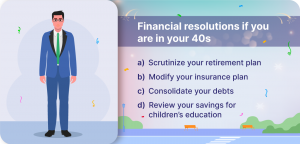

Financial Resolutions if You are in Your 40s –

In most cases, your 40s are a time when you find yourself settled in a family life, and might have children. At this stage in your life, your finances need to cover your new family. You must take a close look at your retirement plan, and tailor it based on your new lifestyle.

At this age, you might develop some health issues, and it is a good time to modify your insurance plan accordingly. If you have any ongoing loans, consider paying them off to be debt-free.

Your children will need funds for education so they can fulfill their dreams. Take those costs into consideration and review your savings. This decade must be all about saving, saving, and saving!

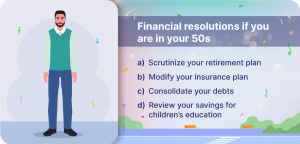

Financial Resolutions if You are in Your 50s –

The 50s are a time when you must be actively planning your retirement. This is a good time to once and for all, pay off your existing loans. You don’t want to enter your 60s with old loans pulling you back.

You probably are a homeowner and your children’s education is sorted. But that doesn’t mean you can ignore your credit score. You never know when you might need to take a loan, so keep using your credit cards and paying the bills on time in full.

Only take new loans if you have no other choice. You must also live by a strict budget, and not spend on non-essentials.

Financial Resolutions if You are in Your 60s –

In your 60s, you are probably already retired and if you have managed your finances all your life, you can sit back and relax at this stage. You can utilize this time to monitor and maintain your health emergency fund, as you or your spouse are more likely to have health emergencies at this age.

Keep a close eye on your investments yourself, or hire an expert financial advisor to do it for you. You must also not ignore creating a will so that your dependents are taken care of after you.

Conclusion

Managing your finances efficiently requires lifelong work. However, it is not as difficult as it looks. The basics for every age, are creating a budget, sticking to it, and cutting your expenses.

Don’t shy away from seeking professional help if you cannot manage investments by yourself. They can give you expert advice and won’t charge too much either. Done properly, you will make more money from your investments than you will spend on the professional!

If you have not saved up anything in the earlier decades of your life, and are starting late, don’t fret. Better late than never. You can start saving more to catch up on the lost time and still have a comfortable retirement.

Being financially stable requires some planning and discipline. Putting your savings on auto-pay is a great way to do it. With the right attitude, you can plan a financially stable life. Good luck!

Happy New Year, and may you have a financially sound 2024!