Sankranti & The Importance Of Homegrown Financial Lessons

The festival of Makar Sankranti has many names: Pongal, Lohri, Makara Chaula, Uttarayan, and more. Irrespective of the name, the festival is celebrated across India with great fervor. It is a day dedicated to worshipping the Sun god, honoring cattle, and celebrating the harvest. It is observed with bonfires, elaborate feasts, and kite flying.

Did you know that certain lessons from Makar Sankranti hold valuable significance to the modern investor?

In this blog, we will explore how the days of Sankranti resonate with our modern life and the lessons of investment we can learn from them.

Sankranthi & Its Financial Wisdom To Modern Life

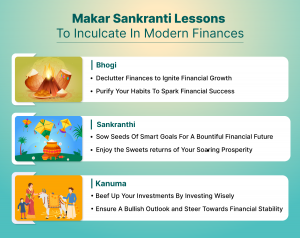

Makar Sankranti is celebrated for three days: Bhogi, Sankranti, & Kanuma. Each day represents a different financial lesson that can be applied to modern investing.

Bhogi teaches us the importance of getting rid of old possessions, Sankranti teaches us the importance of investing in the right assets, and Kanuma teaches us the importance of sharing what we have with others.

Bhogi: Letting Go Of Financial Clutter

The morning of Bhogi welcomes you with the warmth of Bonfires cutting through the chilly January air. Old and young alike burn unwanted items to rid themselves of irrelevant things they have gathered over the past year.

The joyous occasion of Bhogi carries a deeper meaning: Letting go of the unessential.

As Bhogi celebrates the end of the cold, harsh winter, we must shift our focus from past burdens to create space for future opportunities. Similarly, you must evaluate your assets and cleanse your portfolio of investments that are not serving you.

Sankranti: Fostering Prosperity

The harvest festival signifies the ending of the harsh winter and marks the transition of the Sun to the zodiac sign Capricorn.

It additionally celebrates reaping the benefits of seeds sown the previous year. Farmers assess the condition of their lands during the winter and plant crops that can withstand severe weather conditions.

While making a financial decision, you must remember to estimate the highs and lows of it before jumping feet first. Your conscious consideration and the right money management plan can help you grow your wealth and set you up for your desired future.

Kanuma: Financial Sustainability & Ethical Practices

In agriculture, cattle are considered symbols of wealth and prosperity and are worshiped during this last day of harvest.

Kanuma is the day to offer thanks to the loyal cattle, share meals and gifts with your near and dear, and enjoy the time of plenty. It is important to give gifts that truly matter to your community.

The festival highlights mindful consumption, storing surplus for a rainy day, and promoting sustainable economic growth and well-being of the individual as well as the community through shared values and responsible resource management. It reinforces the importance of investing in skills and knowledge for a secure financial future.

Lessons in Sowing & Reaping Finances

The concept of “sowing and reaping” isn’t just a metaphor for agriculture. It’s a principle that applies to our financial lives as well. Just as we nurture seeds to grow into bountiful harvests, our financial decisions today determine the fruits we reap tomorrow.

Let’s look at a few important lessons in sowing and reaping finances for a safe and prosperous future.

1. Plant the Seeds of Saving

Saving should be treated similarly to planting seeds. Every rupee you save now is a seed for future financial stability. Always have an emergency savings account and avoid dipping into it unnecessarily.

Set SMART financial goals and don’t be discouraged if you can’t save a lot of money right away. Make the right investments and watch as your interest compounds over time, giving you significant returns.

2. Cultivate Smart Spending

Budgeting is similar to tilling the soil to plant your financial seeds. Plan your expenses, track your income, and categorize your spending depending on essential and non-essential.

Additionally, avoid unnecessary debt. Use credit cards responsibly and prioritize paying off high-interest debts first.

3. Invest in Growth

Consider investments as seeds sown for success in the future. Diversify your portfolio and invest in stocks, bonds, and mutual funds for long-term growth. For investing guidance to reach your personal financial goals, seek a financial advisor.

4. Nurture Financial Knowledge

Stay updated on money management concepts such as debt management, investing, and budgeting. Read books, go to workshops, and get advice from trustworthy people. Being well-informed allows you to base your financial decisions on logic and data rather than impulses.

5. Reap Your Rewards

Keep in mind that success rarely happens overnight. Have patience, maintain financial self-discipline, and have faith in compound interest.

Additionally, it is important to constantly check your credit score to ensure your borrower profile is acceptable to lenders if the need for borrowing ever arises. Keep track of your credit score using moneyview’s Credit Tracker

Conclusion

The centuries-old festival of Sankranti teaches us valuable lessons that can be integrated into our modern-day financial planning. While Bhogi encourages us to let go of past anxieties, Sankranti makes way for possibilities and hope for the future. The day, Kanuma guides us to stay responsible and practice sustainable methods to build a secure future. The festival of harvest ushers in new beginnings and encourages us to foster financial well-being.