How is Your Personal Loan EMI Calculated

All your loans are repaid through EMIs or Equated Monthly Installments. These are periodic loan repayments that are made to the lender over a certain term.

But have you ever wondered how this amount is calculated? Let us take a look.

How is EMI Calculated

There are two formulae that you can use to find out your EMI amount and this will depend on the type of interest calculation chosen.

-

Reducing Balance Interest Rate

In this method, the interest amount accrued will depend on the amount of principal that is yet to be paid and the interest component in the EMI will reduce with each payment.

The EMI calculation formula in this case will be –

P x R x (1+R)^N / [(1+R)^N-1]

Where P is the principal amount, R is the rate of interest imposed, N is the tenure in number of months

If you have taken a loan of Rs. 10,000 at 16% p.a. for a term of 6 months, the EMI to be paid using this calculation will be – Rs. 1,745

Note: The rate of interest (R) is calculated monthly

The tabular representation of your EMI or the Amortization Schedule in this case will be –

| Month | Interest | Principal | Closing Balance |

| 1 | ₹ 133 | ₹ 1,611 | ₹ 8,388 |

| 2 | ₹ 112 | ₹ 1,633 | ₹ 6,755 |

| 3 | ₹ 90 | ₹ 1,654 | ₹ 5,100 |

| 4 | ₹ 68 | ₹ 1,676 | ₹ 3,423 |

| 5 | ₹ 46 | ₹ 1,699 | ₹ 1,723 |

| 6 | ₹ 23 | ₹ 1,722 | ₹0.00 |

-

Fixed Interest Rate

This is where the interest rate remains the same throughout the loan repayment tenure and is charged on the total amount borrowed. If you have chosen this type of an interest calculation then the formula will be –

EMI = Principal + Interest/(Repayment Term in Months)

And continuing with the previous example, the EMI in this case will be Rs 1,800 which is slightly higher than the previous option.

Easy Way to Find Out your EMI without Calculation

If these formulas seem complicated, we have a better option for you which is –

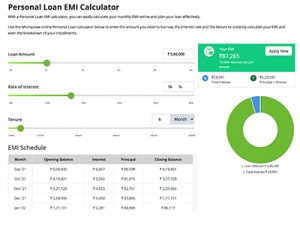

To Use an EMI Calculator

You can use an EMI Calculator to do the work for you. All you need to do is provide the principal amount, interest rate being charged, and the repayment term and the voila! The calculator does all the work for you.

You must also note that your EMI will be impacted if you opt to prepay or foreclose your loan. Additionally, if there are changes in your repayment term or your interest rate, the EMI amount will vary.

Factors That Impact EMI

Here some of the most important factors that affect your EMI –

-

Loan Amount

The amount you avail as a loan will have a bearing on the EMI. Lower the loan amount, lower is the EMI to be paid.

-

Repayment Term

Your repayment term will inversely affect your EMI, i.e., shorter the repayment term, higher will be the EMI. However, while you may want to opt for a longer repayment term, the interest paid over time will definitely be higher.

Therefore, if you can afford to, opt for a shorter repayment period to save more in the long run.

-

Rate of Interest

As a borrower, you will definitely be looking for a loan that comes with low interest rates as this means that the amount you pay as EMI will be on the lower end and having a high credit score can help with this.

In Conclusion

If you want to avail a loan, understanding how your EMI is calculated can help you set a budget and plan your finances. Check with the lender to see if the interest rate calculation is done through a fixed or reducing balance method and plan accordingly.

If you are looking for a personal loan that is easy to avail and is disbursed within 24 hours of approval, Money View loans is the way to go! Visit the website or download the app and start applying