Have you changed your mobile number recently and are wondering how to change mobile number in CIBIL? Read ahead for a step-by-step process to complete this process from your home.

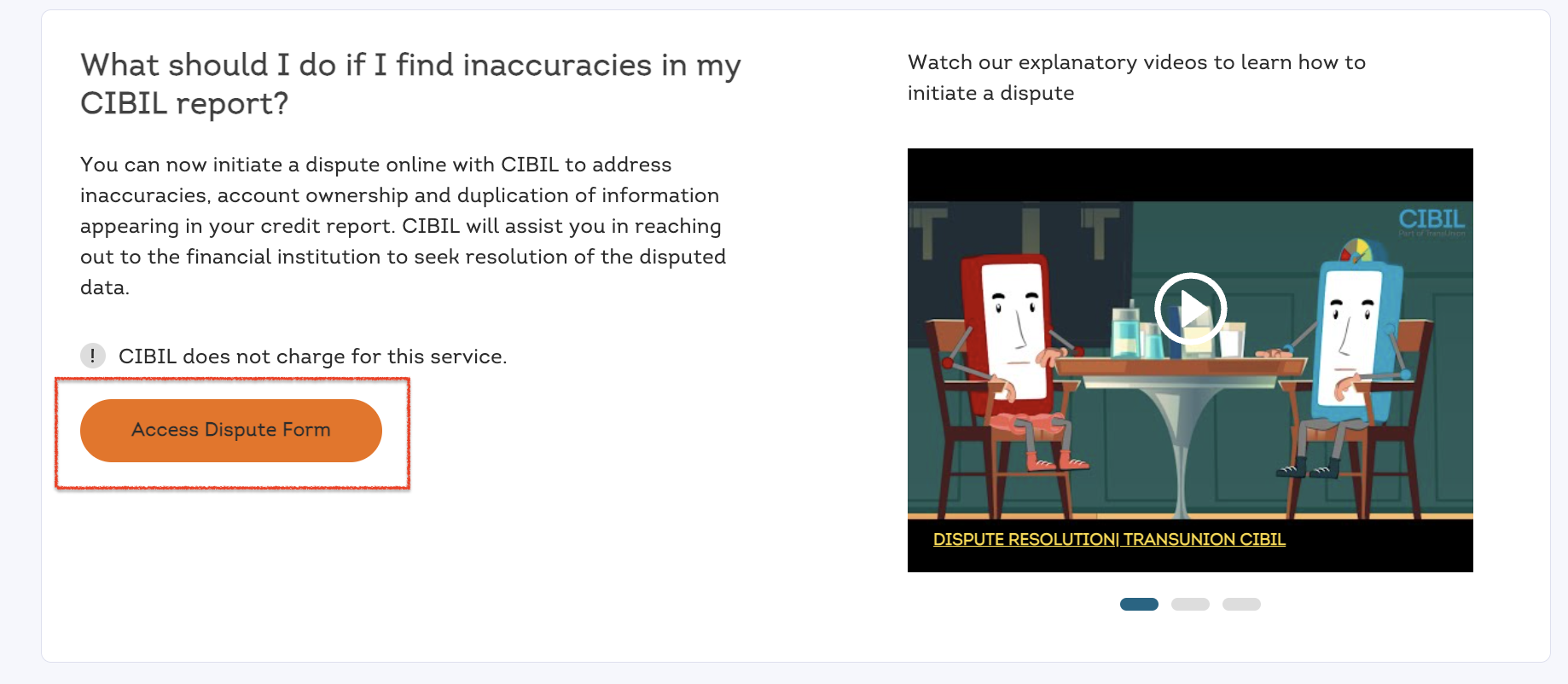

TransUnion CIBIL allows you to raise a dispute in case you spot any errors, or want to change any information on your credit report. You can get your details edited, but it needs to be verified by CIBIL first.

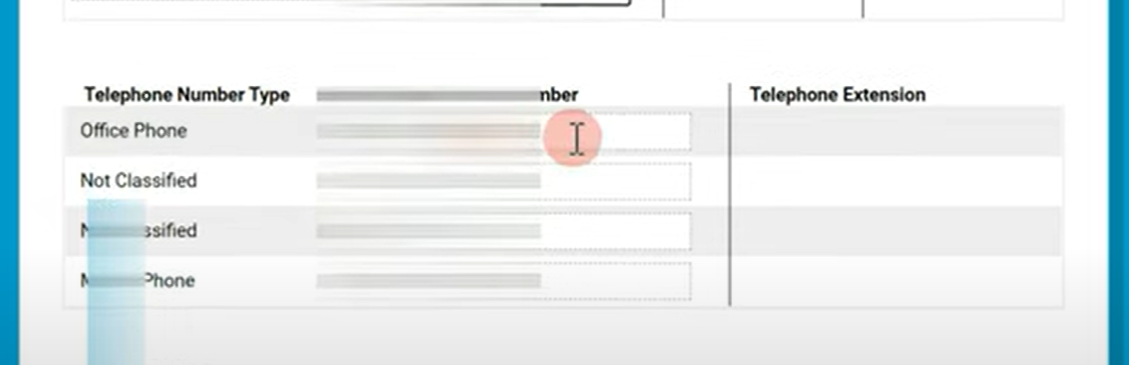

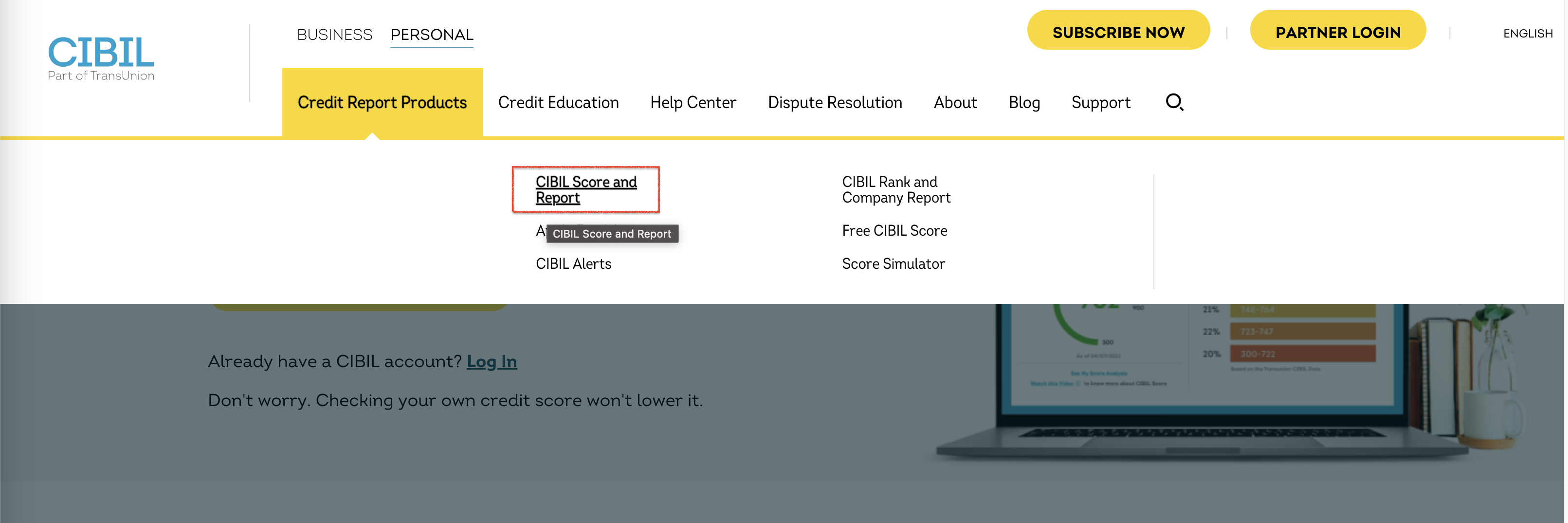

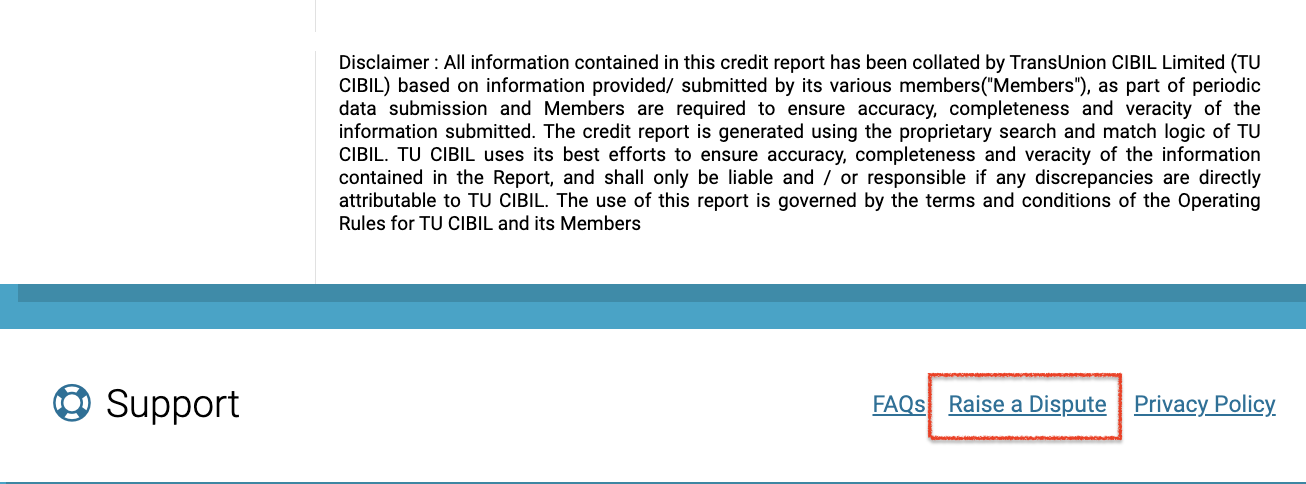

You can follow these steps to update your mobile number in CIBIL.

Your updated mobile number will be reflected on your CIBIL report within 30-45 days after verification.

There are no charges for changing any information or raising a dispute on the CIBIL website. It is completely free of cost.

But, a dispute can take anywhere between 30-45 days to be resolved. If you haven’t taken any subscription, you will not be able to view the updated information on your CIBIL report. You will just see the information as it was when you first logged in.

Thus you may consider taking a subscription if you have errors in your report that need to be rectified. Subscriptions for 1 month, 6 months, and 12 months cost Rs.550, Rs.800, and Rs.1,200, respectively. This gives you updated information for the duration that you have subscribed.

Your CIBIL report is much more than your CIBIL score. When lenders approve your loan, they go through each and every aspect of your credit report. Your report has the following types of information -

All of these together help the banks or lenders gauge your creditworthiness. They can get an overview of your financial behavior by studying your report. Outdated information may prove to be a roadblock while procuring a loan.

This is why keeping your CIBIL error-free and updated is very important.

Know Your Credit Health Instantly

TransUnion CIBIL is the most commonly used credit score in India. Almost all banks check your CIBIL score first, and then any other score. To build trust, your credit report should be true to the best of your knowledge.

It is essential that you monitor your CIBIL score and report closely. Raise disputes and update information as and when required to maintain a good credit report.

CIBIL Score Check and Boost Guide

Credit Score Basics and Full Forms

Credit Tracker Related Other Articles

Credit Card Insights

Fixed Deposit Insights and Guides

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?