Home

>

CA Salary in India

How much does a Chartered Accountant make in India? This is one of the most often asked questions among CA students. In India, the average income for a CA is quite good.

There is no doubt that a CA salary in India per month is a nice salary but earning that much money demands a lot of attention and hard work to pass all of the Chartered Accountants in India examinations.

The CA salary in India 2021 is differentiated by several things. The continued need and growth of India's finance sector has increased the demand for Chartered Accountant employment.

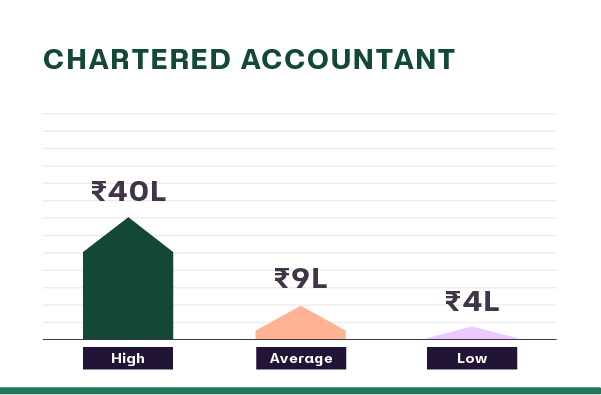

The average annual salary of a CA in India ranges from 6-7 lakh rupees to 40 lakh rupees. The Big 4 firms, as well as organizations in the industrial sector, pay the majority of the top salaries for CAs in India.

If we talk about Chartered Accountant Salary Outside India, the annual compensation ranges from 27 to 60 lakh rupees.

Although there may be variances in CA income in different nations, it is dependent on the level of life and human resource value of each country. According to the ICAI study, the following are the chartered accountant salary discrepancies among major countries.

| Country | Fresher CA | Accomplished CA | Highest CA Salary |

|---|---|---|---|

|

Dubai |

AED 100k |

AED 123k |

AED 615k |

|

Australia |

AU$ 74k |

AU$64k |

AU$113k |

|

UK |

£28.4k |

£32.1k |

£62k |

|

India |

₹698.2k |

₹744.3k |

₹2m |

|

USA |

$51k |

$78.7k |

$267k |

Obtain a High Score in the CA Exams - If you score well in the CA Exam, your chances of landing a high-paying job increase automatically. That is to say, if you achieve a high rank in the CA Exams and are hired by a top corporation, your starting income as a CA will easily be in the range of $20-25 million per year. However, if you have other abilities in addition to a rank, you may be eligible for compensation increases.

Possess Knowledge - Knowledge is the key to unlocking any door. If your notions are clear and you understand your subjects, your chances of being selected for the higher packages are always strong. High packages do not imply a high starting wage for a new employee. However, if you work for a multinational corporation or a top organization, your prospects of progressing in a few years improve.

Attempts are made in fewer numbers - Unless you have a great reference, the number of efforts matters in landing a great job. Only if you pass in two or three attempts will you be shortlisted for significant firms like KPMG, Deloitte, EY, PWC, or other Top CA Firms. Only if you are shortlisted first will you be allowed to demonstrate your abilities in an interview. PSUs, on the other hand, shortlist candidates regardless of the number of attempts. So, if you want to work for BIG 4 or other top accounting firms, strive to pass your CA Final on the first try. It will also boost your overall package.

Excellent results on your final exam - The grades you acquire at each level are important, but the most important marks in gaining a decent job with a higher salary are the ones you get in CA Final. Because you won't be able to pass CA Final unless you know what you're doing. CA Final is an advanced level of CA Foundation (CPT), CA Intermediate (IPCC), and CA Foundation (CPT). Whatever you learned in CPT, IPCC, or Practical Training will help you pass the Final. And, as I previously stated, PSUs select candidates after a certain number of attempts, thus your selection and package will be based on the marks you received after a certain number of attempts.

Excellent Practical Training Experience - Many students enroll in dummy Articleships to pass their CA Final on the first try. However, what they lack in doing so is the experience that they could have gained through practical training. If you believe that your concepts are clear and that you will easily pass the interview, let me warn you that the interviewer in front of you will be an experienced individual. He will need no more than 10 minutes to assess your practical training experience. You may be shortlisted for the interview based on your grades, but then your experience will be highlighted during the interview. Students can also apply for training in some of India's largest accounting firms, where they will be paid a stipend of around Rs 20,000. These companies also pay their employees the highest wages.

BIG 4 (EY, Deloitte, PWC, and KPMG) - Without a doubt, BIG 4 is one of the leading firms in India that hires the highest number of CA freshers on every attempt. You will gain valuable experience working with these companies. Salary and other initiatives are also exorbitant. Although it is every CA student's dream to work for BIG 4, this is not always possible. The salary offered by CA firms in the BIG 4 varies depending on the job profile. The Audit Section hires the majority of CA Freshers. It handles a large volume of accounting work from all over India. On average, freshers working in a BIG 4 CA Firm are paid between 12 and 210 Lakhs per annum.

PSU’s - As previously stated, PSU shortlists candidates even after multiple attempts, but the criteria for their shortlisting is marks. Some PSUs, such as ONGC, HPCL, BSNL, and others. In comparison to CA firms, they provide a competitive salary package. Their price range is usually between 6 and 15 lacs. After being shortlisted, your selection will always be based on your performance in the interview.

Companies that provide information technology - Companies such as Infosys, Wipro, and Microsoft hire a large number of CA candidates. They have a fully-fledged audit team. CA IT company salaries typically range between 7 and 10 lac rupees per year.

Banks - A number of CA candidates are descended from Banks Banks. They have a variety of job opportunities for new Chartered Accountants. Banks such as ICICI, HDFC, and others typically offer salaries ranging from 5 to 10 lacs.

CA Firms in India - Many Indian accounting firms hire CA candidates to handle office work. By increasing the number of CAs, they also gain the benefit of appointing Chartered Accountants as the number of audits increases. Top accounting firms in India include Haribhakti & Co., Singhi & CoChaturvedi & Shah, and others.

CA salary for freshers in India is determined by their abilities and knowledge. Freshmen who pass the exam based on the following criteria will be compensated accordingly;

| CA Final Passed In Several Attempts | Passed in Single Attempt | CA Final Toppers |

|---|---|---|

|

INR 6-9 Lakhs |

INR 11-110 Lakhs |

INR 16 – 210 Lakhs |

There are numerous positions in the country that require a Chartered Accountant to have knowledge of more than just accounts and taxes. Several people in the country with a good education profile apply for the higher position of the Job. CFOs, Account Executives, Finance Controllers, and Finance Managers earn good salaries, with annual packages of Rs. 20 lakhs. The following is a list of the highest annual CA salaries in India based on the job profile in 2021.

| Jobs profile | CA Salary per annum (Avg) |

|---|---|

|

Account executive |

20 Lakhs |

|

Finance controller |

14-16 Lakhs |

|

Accountant |

14 Lakhs |

|

Finance Manager |

10-12 Lakhs |

|

Financial analyst |

06-07 Lakhs |

|

Assistant Account Manager |

010 Lakhs |

|

Senior Account Executive |

04 Lakhs |

|

Business Analyst |

4-7 Lakhs |

|

Account Assistant |

3-10 Lakhs |

To Know More About Similar jobs in India.

Chartered Accountants who want to start their practice generally have two options. They either join their family practice if anyone in their family is pursuing practice, such as parents, siblings, spouse, etc., or they go for a job for 4 – 5 years to gather funds to invest and also find several clients, gain experience during this period, and then they start their practice, which will take around 2 years to set up.

If you can do something, start your practice before being hired by someone else. It will put your true intelligence to the test. If you do not want to take such a risk or prefer a fixed monthly payment, consider using a service.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?