Home

>

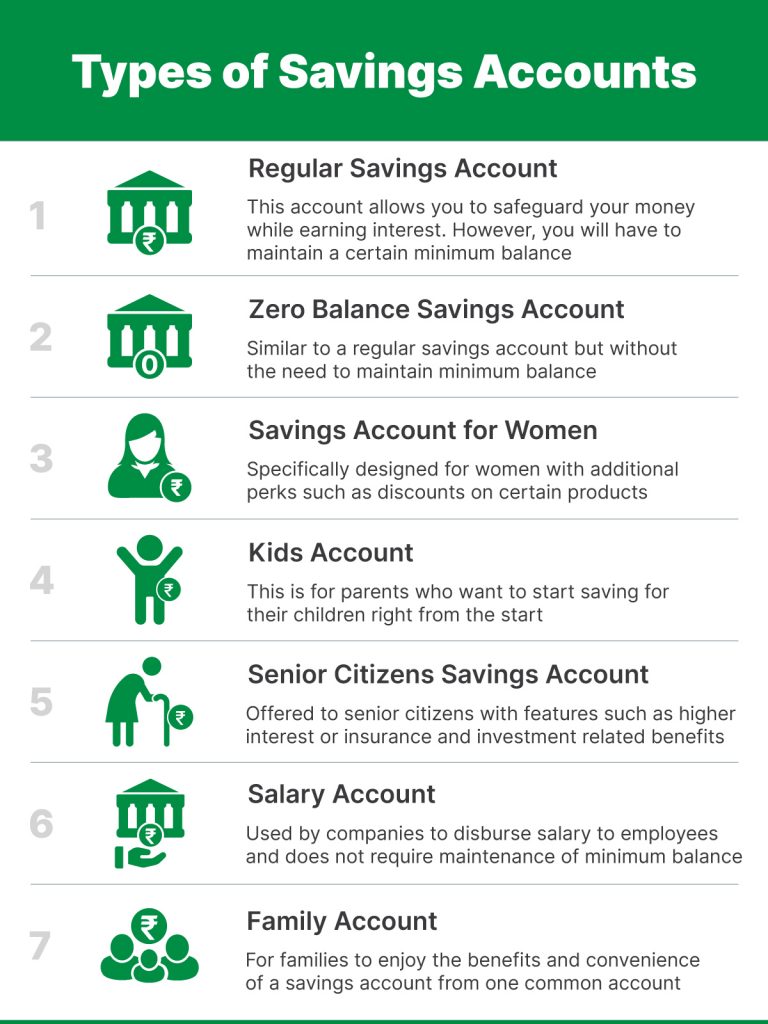

Types of Savings Accounts

There are many types of bank accounts that you can open, savings accounts being the most prominent and common ones. But do you know which type of savings account will best suit your needs?

The main purpose of a savings bank account is to save funds, as the name suggests. These bank accounts are used to manage daily finances by individuals who may or may not be salaried.

The bank even gives interest to the account holder on the funds parked in their savings bank accounts. The eligibility criteria for opening and the interest rates may vary on the type of savings bank account you have.

To cater to a diverse population, banks have come up with different types of savings accounts. They are not very different from a general savings bank account, but things like minimum balance requirements, interest rates, withdrawal limits, or eligibility criteria may vary between them.

Here are the various types of savings bank accounts that you might find in the most prominent banks in India -

This is the most common type of savings bank account. You can open this type of bank account, both by visiting the branch or instantly using the bank’s website. It is best suited for daily banking needs and managing your finances.

A regular savings bank account has a minimum balance requirement, and you will have to pay a penalty if you don't maintain it. You are also eligible to earn interest on the funds in your account, based on the rates decided by the bank.

A zero-balance savings account, as the name suggests, refers to a bank account where you don’t have to maintain a minimum balance. You can withdraw all your funds from this type of bank account and not have to pay a penalty.

You, however, get all other benefits like ATM/Debit cards, cheque books, etc. that are present in a regular savings bank account.

You can choose to open a Privilege Savings Bank Account if you have major transactions and adhering to regular withdrawal limits will impact your financial needs.

Such bank accounts have exclusive benefits like bank locker facilities at discounted rates, unlimited cash withdrawals, a dedicated banker to sort out queries and requirements, etc.

Some banks allow you to open a Family Savings Bank Account that allows all the members of a family to address their individual banking needs from one savings bank account.

Members of the family can enjoy benefits like lower minimum balance requirements, extra privileges, Wealth Management, Private Banking, and much more.

Persons under the age of 18 cannot open a bank account for themselves, which is why banks have come up with Kids’ Savings Bank Accounts.

Parents can open this type of account for their kids and put away funds for them. The funds can be for the child’s wedding, education, or just future savings.

Parents can choose to let kids access their money through Debit cards or ATM cards, which can build money management skills in them. They can teach the kids the process of banking, saving, and spending money responsibly.

As the name suggests, this type of savings bank account is customized for women account holders. They often come with added benefits like discounts, lower minimum balance requirements, offers on skill-building courses, etc.

Women can also enjoy loans on lower interest rates, and other privileged banking services that can help them become self-sufficient.

This type of savings bank accounts can be opened by persons over the age of 60. Just like Women’s Savings Bank Accounts, Senior Citizen Bank Accounts also come with various benefits customized to their requirements.

Health, investment, and insurance benefits are often included, along with higher rates on fixed deposits. Some banks also give special Debit Card access to account holders.

Often referred to as Salary Accounts, this is also a type of Savings Accounts. They are opened by large organizations or corporations in banks where they have their banking operations. This allows easy disbursal of salary and other benefits.

These bank accounts are generally zero-balance accounts, and account holders can withdraw their total salary without having to pay a penalty. At the same time, a Salary Account can also be used as a Regular Savings Account for their daily needs.

NRI Savings Bank Accounts are special accounts for Non-Resident Indians (NRI). There are three types of NRI accounts and you can choose the one that fits your needs -

NRE or Non-Resident External Accounts

NRO or Non-Resident Ordinary Accounts

FCNR or Foreign Currency Non-Resident Accounts

To cater to various customers and their needs, banks have come up with different types of bank accounts. In general, there are nine types of savings bank accounts.

You can discuss with the bank officials or check the bank’s website to decide

Savings Account Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?