Filing your Income Tax Return is very important and must be done every year. If you are curious to know more or are searching for ‘income tax ITR filing’, read on.

ITR or Income Tax Return is a way to provide information about your income and taxes to the Income Tax Department. Everyone is liable to pay taxes according to their income. In case you have paid excess tax, you will be able to get a refund from the Income Tax Department.

It is also essential for you to file your ITR within the income tax return due date.

You can now file your ITR through both online and the offline methods.

Let’s take a look at the online method first -

You need to link your PAN card to your ITR to be able to successfully file your returns. Then, you can easily follow these steps -

STEP 1- Visit the Income Tax e-Filing portal, and log in using your credentials.

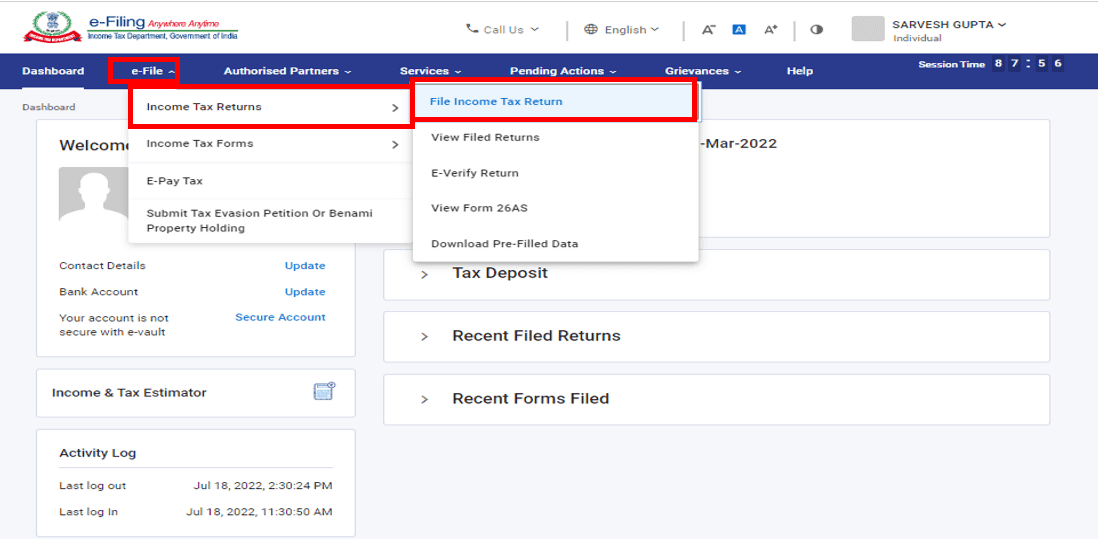

STEP 2- Go to ‘e-File’ → ‘Income Tax Return’ → ‘File Income Tax Return’.

STEP 3- On the Income Tax Return page, select the assessment year, and mode of filing as ‘Online’. Click on ‘Continue’.

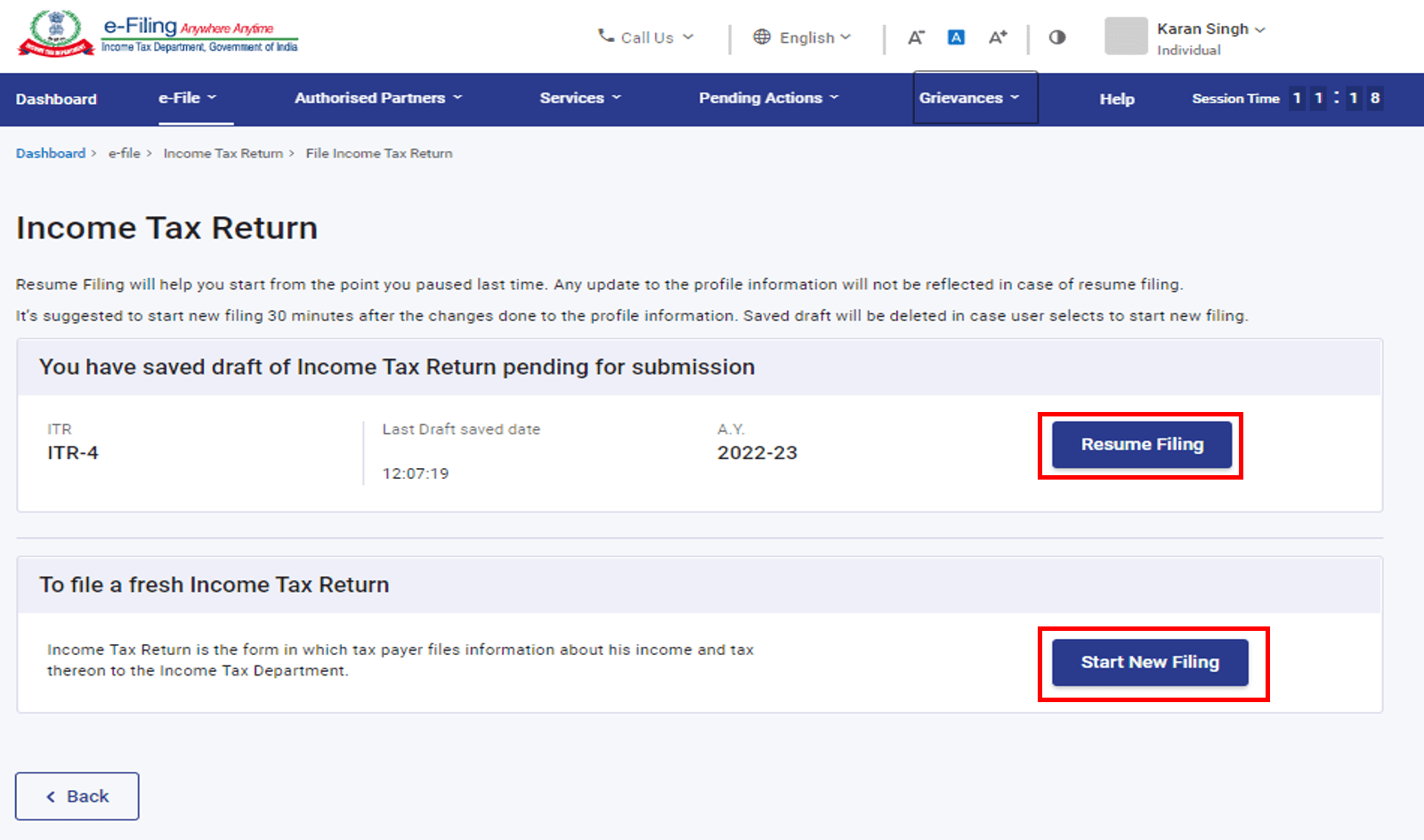

STEP 4- If you have already filled in your ITR, and want to submit it, click on ‘Resume Filing’.

But if you are starting afresh, click on ‘Start New Filing’.

STEP 5- Select the status that is applicable to you and click on ‘Continue’.

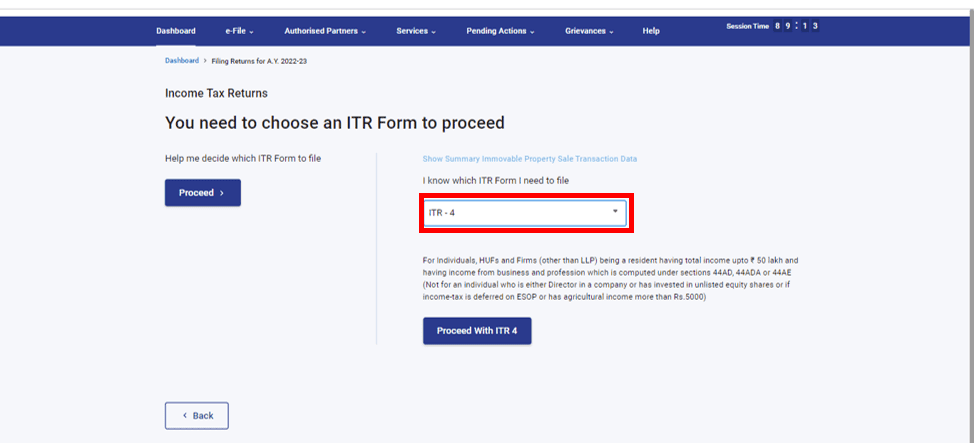

STEP 6- Now you need to select which kind of ITR you need to file. If you are unsure, you can choose the wizard based return filing by clicking on ‘Proceed’. If you know which to choose, you can manually select it.

STEP 7- Read the guidelines mentioned and take a note of the documents you will require. Then, click on ‘Let’s Get Started’.

STEP 8- Go through your submitted data, and edit it wherever necessary. Keep clicking on ‘Confirm’ after each section.

STEP 9- Finally, when you are done with all the sections, click on ‘Proceed’.

STEP 10- Enter your income and deduction details. Click on ‘Proceed’ again.

STEP 11- If there is some amount due, you will get the option to ‘Pay Now’ or ‘Pay Later’. If there is no due tax or you are supposed to get a return, click on ‘Preview Return’.

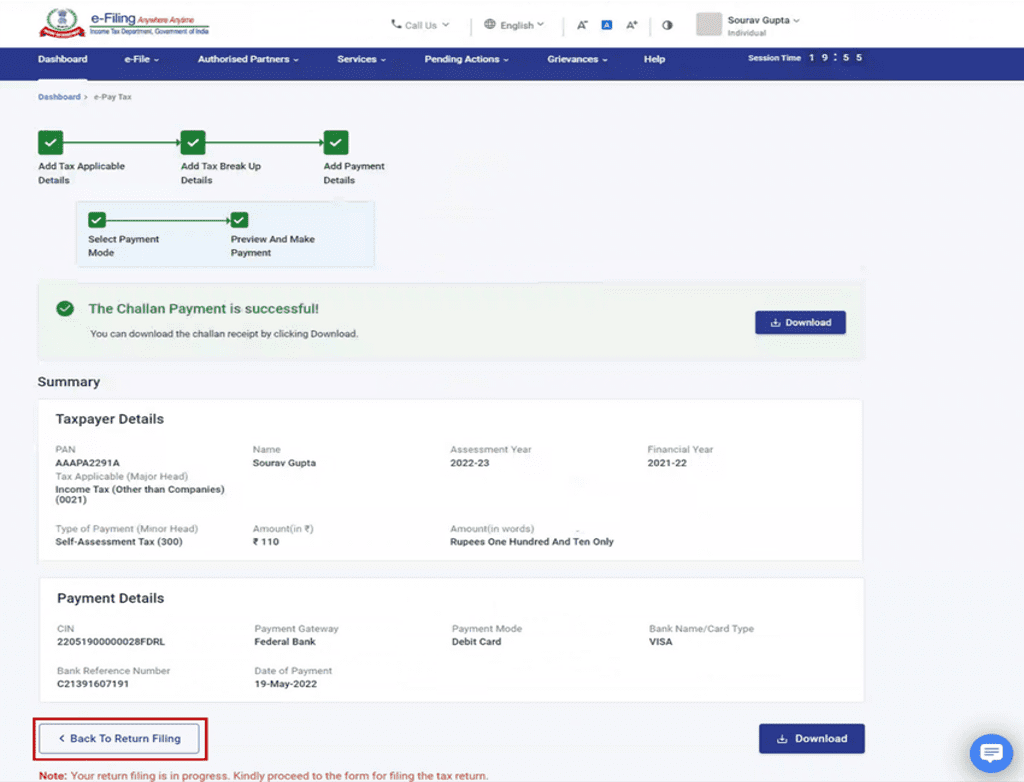

STEP 12- You will be redirected to the ‘Preview and Submit Your Return’ page, and once the payment is successful, you will see a message.

STEP 13- Then, click on ‘Back to Return Filing’ → ‘Preview Return’. Check your details, and click on ‘Proceed to Preview’.

STEP 14- After previewing your returns, click on ‘Proceed to Validation’. If there are any errors in your filing, they will be displayed and you will need to go back and rectify them. If there are no errors, click on ‘Proceed to Verification’.

STEP 15- On the ‘Complete your Verification’ page, select a verification method, and click on ‘Continue’.

STEP 16- If you want to view the uploaded ITR or check your income tax return status, you can visit the Income Tax e-Filing portal.

You can follow these steps to file your ITR through the offline method -

STEP 1- Visit the Income Tax e-Filing portal, and without logging in, download the relevant utility from ‘Home’ → ‘Downloads’. Install it on your computer to proceed further.

STEP 2- Alternatively, you can also login to the portal using your credentials and then go to

‘e-File’ → ‘Income Tax Returns’ → ‘File Income Tax Return’. Then, select the current AY and ‘Mode of Filing (Offline)’. Finally, click ‘Download’ under the ‘Offline Utility’ option.

STEP 3- Install and open the offline utility and click on ‘Continue’.

STEP 4- On the Income Tax Return page that opens up, you will see the following tabs-

Returns: You can start filing your new return by clicking on ‘File Returns’.

Draft Version Returns: If you want to continue filling a partially filled ITR, you can click on ‘Edit’ from the ‘Draft Version of Returns’ tab.

Pre-Filled Data: All the previously filled files that are downloaded from e-Filing will be present here. You can click on ‘File Returns’ to start filing your returns.

STEP 5- Now, go to the ‘Returns’ → ‘File Returns’.

From here, you have 3 ways to fill your returns in the offline method. Check them out-

Once you follow step 5, you will reach the Income Tax Returns page. Click on ‘Download Pre-filled Data’ → ‘Continue’.

Enter your PAN, select the Assessment year and click on ‘Proceed’.

You will get a message saying that the details saved against your PAN will be discarded if you continue with a new filing. Click on ‘Yes’.

You will be taken to the login page where you will be able to login from the Offline Utility itself.

When you login, you will see your downloaded data. Click on ‘File Return’.

Method-2: Import Pre-filled Data

Once you follow step 5, you will reach the Income Tax Returns page. Click on ‘Import Pre-filled Data’ → ‘Continue’.

Enter your PAN, select the Assessment year and click on ‘Proceed’.

You will get a message saying that the details saved against your PAN will be discarded if you continue with a new filing. Click on ‘Yes’.

Click on ‘Attach File’ and select the pre-filled data downloaded from the e-Filing portal.

Once uploaded, click on ‘Proceed’.

Once validated, you will see details of pre-filled data downloaded. Click on ‘File Return’. You will be redirected to the ITR form selection page.

Method-3: Import Draft ITR filled in online mode

Once you follow step 5, you will reach the Income Tax Returns page. Click ‘Import draft ITR filled in online mode’ → ‘Continue’.

Click on ‘Attach File’ and select the pre-filled data downloaded from the e-Filing portal. Once uploaded, click on ‘Proceed’.

You will get a message saying that the details saved against your PAN will be discarded if you continue with a new filing. Click on ‘Yes’.

You can choose any of these three, and then start following the steps mentioned below-

STEP 6- After downloading or importing your pre-filled data and clicking on ‘File Return’, select the status applicable to you, and click on ‘Continue’.

STEP 7- Now you need to select which kind of ITR you need to file. If you are unsure, you can choose the wizard based return filing by clicking on ‘Proceed’. If you know which to choose, select the one which is relevant and click on ‘Proceed with ITR’.

STEP 8- Read the guidelines mentioned and take a note of the documents you will require. Then, click on ‘Let’s Get Started’.

STEP 9- Select the reason for filing ITR and click on ‘Continue’. After confirming and filling all sections of the form, click on ‘Proceed’.

STEP 10- On the ‘Confirm Your Return Summary’ page, you will be able to see a summary of your tax computation based on your submitted details.

STEP 11- If there is some tax amount due, you will get the option to ‘Pay Now’ or ‘Pay Later’. If there is no due tax or you are supposed to get a return, click on ‘Preview Return’.

STEP 12- You will be redirected to the ‘Preview and Submit Your Return’ page, click on the declaration checkbox, enter the required details, and click on ‘Proceed to Preview’.

STEP 13- On the same page, click on ‘Proceed to Validation’. If there are any errors in your filing, they will be displayed and you will need to go back and rectify them. If there are no errors, click on ‘Proceed to Verification’.

STEP 14- You will be taken to the Login page through the utility. You will have to login using your e-Filing user credentials. Once you login, click on ‘Upload Return’ → ‘OK’.

STEP 15- On the ‘Complete your Verification’ page, select a verification method, and click on ‘Continue’.

STEP 16- If you click on ‘e-Verify Now’, you will be taken to the e-Verify page where you can e-Verify your return.

STEP 17- On successful e-Verification of the ITR, a success message is displayed along with a Transaction ID and Acknowledgement Number. You will also receive a confirmation message on the email ID and mobile number registered on the e-Filing portal.

The ITR Form has 6 sections that need to be filled in order to file your ITR. They are mentioned here -

Personal Information

Gross Total Income

Disclosures

Total Deductions

Taxes Paid

Total Tax Liability

If you are searching for ‘income tax itr filing due date’, you are at the right place. You can file your income tax returns 24/7, from anywhere. The due date will vary depending on which ITR is applicable to you, and you can find details on the e-Filing website.

Usually, for individual and non-audit cases, the due date to file an ITR is 31st July of the relevant assessment year. In case your is an audit case, the due date generally is 31st October of the respective assessment year.

If you have already searched for your ‘income tax return due date’ and filed it, you must be interested in checking your income tax return status. To check the status of your ITR, you just have to login to the e-Filing portal using your credentials.

Then you can simply click on the ‘Income Tax Return (ITR) Status’ option from the menu. Once you enter your acknowledgement number and mobile number, you will be able to see your status easily.

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

Filing your Income Tax returns is a voluntary act but at times may attract penalties of Rs.5,000 if not done on time. In some cases it is mandatory, especially at times when applying for a home loan or a credit card. Thus, it is advisable to file your income tax returns well within the due date.

The following are the prerequisites to be able to file your Income Tax Returns -

If your gross total income is above Rs.2.5 Lakh, it is mandatory to file your income tax returns. In other scenarios, it is not mandatory, but is a good habit as it helps when you apply for a home loan or a credit card.

Yes, it is mandatory to link your PAN and Aadhaar to file your Income Tax Returns.

Tax, Filing & Linking Guide

Banking & Investment Tips

Finance and Banking Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?