Bad CIBIL Score? Why and How to Improve It?

It is said that first impression is your last impression. For the banks considering lending you some money, this first impression is formed by looking at the credit score. A credit score or CIBIL score as is generally called derives the name from the agency maintaining the database, is nothing but a score based on the credit history of an individual. A credit score reflects the borrowing and repayment habits of the person by providing information about the nature of loans (including credit cards) held by him. Since this report shows the number of loan accounts held with different banks, its repayment history, overdue status, it acts as a perfect barometer for a bank to judge the defaulting tendency of the borrower.

For an individual with a regular credit history of more than 6 months, the CIBIL score ranges from 300 to 900 with the risk being inversely proportional to the score.

This 3-digit numerical expression of our repayment habits clearly impacts our access to loans and credit cards and thus it gets imperative to have a better credit score.

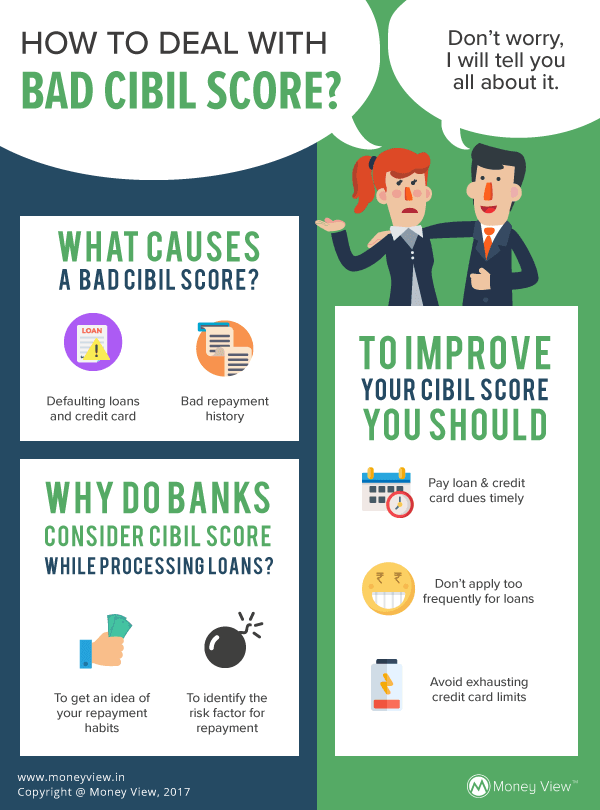

What Causes a Bad CIBIL Score?

CIBIL score is calculated on the basis of various factors of which the factor affecting it the most is your repayment history. Any EMI missed can hamper your credit score.

Further, the credit score is also impacted by the current credit mix of the borrower, which refers to the proportion of the secured loans like home loans, car loans etc. and unsecured loans like credit cards, personal loans etc. Giving an unsecured loan is considered to be riskier for the bank since the bank does not have anything to fall back upon in case the borrower defaults on payment. This is why a higher ratio of unsecured debt adversely impacts your credit score. Banks also consider the income criteria and the borrower’s capacity to pay while processing such loans.

How Does EMI Default Affect the Credit Score?

Even while it is a given fact that missing an EMI impacts the credit score adversely, the extent to which it affects your credit score is dependent upon the amount for which such a default has been made and also the kind of debt on which such default has been made. So, missing a credit card payment affects your credit score much adversely than missing a home loan EMI. Further, it is also dependent upon the length of your credit history. In case, you have just started a loan and defaulted in the first few installments, it can impact your credit score in a bigger way.

Why Do Banks Consider CIBIL Score While Processing the Loans?

As per the RBI guidelines, in case you miss three EMIs, you may be classified as a Non-Performing Asset in the bank’s books. The consequences for banks of such an action are a reversal of interest income and provisioning as per the guidelines. Thus, banks are quite apprehensive of their loan quality and want only good borrowers to stay in their books. Banks get an idea of the repayment habits and tendencies of the borrower from their credit score and credit history. In case your credit history shows that you have been regularly missing your EMIs, banks perceive you as a risky borrower and won’t be keen to give you a loan.

Improving your Credit Score

Here are 3 ways to achieve and maintain a good credit score:

- Paying the Credit Card/Loan Dues timely – One should always strive to pay off the credit card bills and loan EMIs timely without any delay. Being one of the prime factors in the determination of the credit score, a good repayment historywill translate into a high credit score. Credit card companies generally provide an option to pay just minimum dues but that only prevents the customer from the levy of late payment charges. As we have covered in our posts on avoiding credit card debt, make sure you spend only that much amount on your credit card which you can fully repay next month when the amount gets due. And a special tip for payment of credit card dues, the same may be paid online through NEFT. While the normal payment through websites takes 2-3 days to reflect into the credit card account, NEFT payments are generally acknowledged on the same day.

- Not Getting tagged as Credit-hungry Individual– CIBIL records it every time an individual’s credit score is checked by a bank/ financial institution. Credit score displays the number of times credit score has been enquired in total with separate information about the inquiry in the last 30 days, last 12 months, last 24 months. The report also shows the details of inquiries done date-wise. A credit-hungry individual is usually demonstrated by showing numerous inquiries for loans/ credit cards. Repeated inquiries of seeking credit indicate an individual’s excessive reliance on credit and further demonstrates reluctance of the lenders to advance loans if such inquiries have not got converted into loan accounts. It has been seen that a borrower applies for a loan for a particular purpose with multiple banks at the same time and hence, banks access the credit history almost at a similar time, which may give an impression that credit has been denied quite recently. Such methods should ideally be avoided and final application be made only with the bank offering the most competitive rates and services. As a special tip, the individual, while negotiating with several banks, can display their credit history after downloading it from CIBIL website, which will enable the banks to take a better decision and consequently offer you better rates based on the credit rating.

- Keep your balances low– Not only does the timely payment of dues help, the spending pattern of an individual also gets highlighted by the patterns of utilization of the credit limit. If one consistently exhausts their Credit card limits and mostly pay just the minimum amount due, credit score gets adversely affected. Lenders view it negatively as this indicates high reliance of the individual on debts. A special tip, even if one reaches the credit limit during the month due to specific spends, he/she can pay off part dues before the generation of credit card statement to contribute towards a better credit score.

These are some healthy credit habits which can help you improve your credit score and hence grant you access to more credit options.

Borrow smart with a better credit score, but repay smartly to maintain it.

Simardeep Singh is a Chartered Accountant based in Delhi. He loves sharing his knowledge about personal finance and investment.

What if a man bought the loan and something happens and he lost his job and he becomes jobless and his cibil score dips down to 480 but after 1 year he got a job and he started paying his dues on monthly basics and he cleared his loan then what will happen to his cibil score whether it comes up or not

Dear Santosh,

The CIBIl score dips when you default on your EMIs. While it will sustain at those levels if a person continues to honour the dues on monthly basis lately. However, the same can be expected to improve only once the backlog of instalments starts to get cleared. The banking practice is to treat the receipts as First in First out basis and since the person only clears the current instalment, the overdues will still continue to be displayed there.

Sir, I had taken two wheeler loan from bajaj finance 12yrs ago. I spoke to manager and got waived of foreclosure charges and closed loan account. Not sure why but it is reflected as defaulter of 1 emi. How can I correct it? Recently while processing for homeloan, this incident surfaced and it became a major concern for bank. But after thorough verification of my background, the bank sanctioned loan.

Is there a way I can correct it? I don’t have any documents of the two wheeler loan. In fact, in the (old)RC book, i got stamp and authorised signature from rto saying no liability on the bike and sold my old bike.

Thanks

Due to salary late , I am so sorry to say this I want to pay the amount every month 24 . Plus receive my request

Please write back to our support team at loans@moneyview.in or call them at 080 4569 2002. They should be able to help you.

Dear sir,

My emi date every month 5th with autodebit through my account, yesterday then app will open.5th nach failed do to pay emi,showing in app.i will pay online.and autodebit in my account.no one repaly me through mail

Hi Vaishnava, you could write to payments@moneyview.in with all your particulars including your Loan Id. Our team will help you out.

My loan is not getting paid. Some problems are coming up. There are some problems in your loan application.

Hi, If you are facing problems in applying for a loan, please check out FAQs here.