How to Get a Personal Loan Online in India

A personal loan can be your gateway to fulfill aspirations or to take care of any financial emergencies. Since banks and other institutions grant personal loans without any specified end-use, you can use the loan for miscellaneous purposes. You can fund a family vacation, family function, purchase electronic gadgets or take care of a medical emergency among others. With the advent of technology, the turnaround time for such loans have squeezed, and one can avail a personal loan at short notice.

Money View Loans makes it easier and convenient for you to get a paperless personal loan up to Rs. 5 lakhs in 2 hours by applying through the App. It benefits the user in terms of being transparent, quick, personalization of the loan, and staying paperless.

Here is the Process to Get a Personal Loan Online in India with Money View Loans App

1.Initiating the Process – Open Money View Loans App. Click on ‘Get Started’ to begin the process.

2. Enabling Access Permissions for the Mobile App – If you are using Money View Loans App for the first time, the app will ask for several permissions from the user which are required in the application flow. Such permissions include access to location details, SMS data, device information, etc. The app then asks for the e-mail address and mobile number to identify the user and start the loan process.

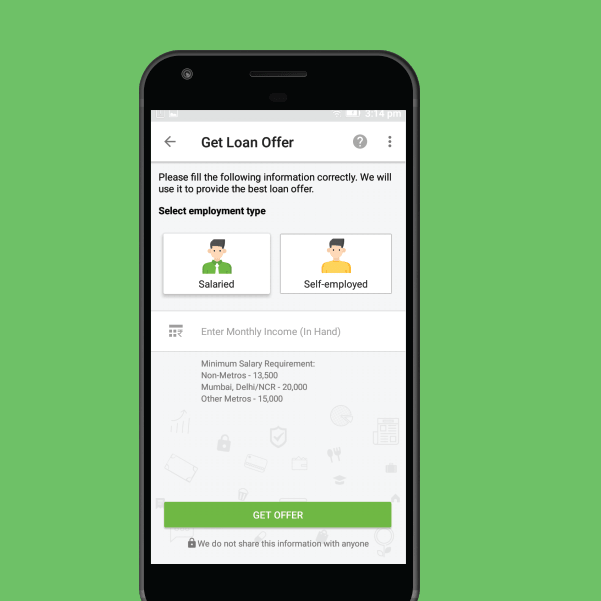

3. Essential Details for Loan Application – The user needs to provide basic details including employment type, i.e. salaried or self-employed. A consistent salary income is considered desirable in unsecured loans such as a personal loan. However, it does not mean that self-employed individuals cannot apply for a personal loan. The employment type is just one of the parameters for determining your eligibility for the loan.

4. Determining the Loan Quantum – The user must enter the monthly income on the same screen. This will impact the quantum of the personal loan being offered, as a higher income will result in the higher and convenient ability for repayment of the personal loan.

5. Confirmation of the Loan Eligibility – Once both the details are entered, the system will calculate the loan amount eligibility and display the same on-screen right away. So, the screen will read something like this: “Congratulations! You’re eligible for a customisable loan of any amount between Rs. ______ to Rs. ________.”

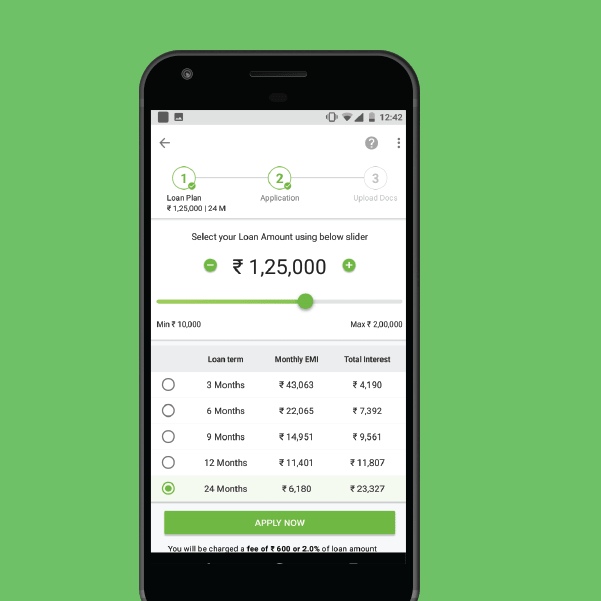

6. Customising the Loan – As per the loan amount eligibility, the user is shown a loan plan selector. This allows the user to select the exact loan amount, loan term, and the EMI amount. EMI is dependent upon the loan amount being applied for and the loan term. Further, the user may be charged some processing fees in respect of the loan, which will be displayed upfront on the mobile screen. The app will also display first EMI date for the loan so that the user can plan the repayments accordingly. The app proceeds with the application flow in a completely transparent manner.

7. Completing the Application – Money View Loans app then asks the user to enter all the relevant information regarding the application. This step aims to capture all the necessary information required to fetch the credit report of the applicant including name, date of birth, address, employment details, loan purpose and Permanent Account Number (PAN), etc. Some additional information may also be required to be entered by the user, including office address, mother’s name, and father’s name.

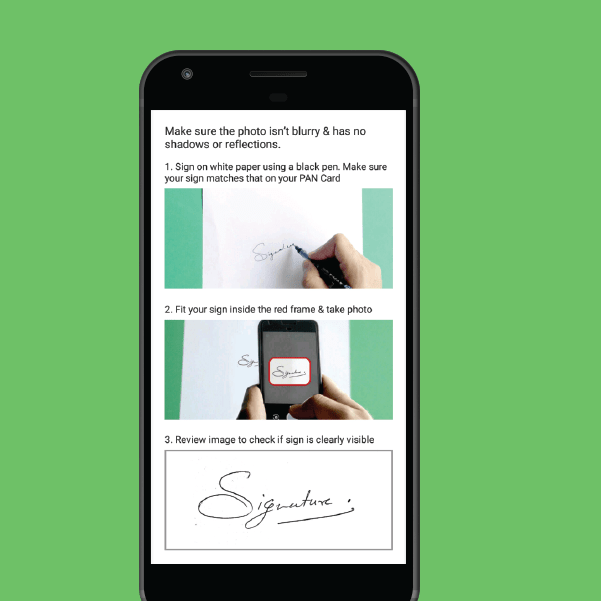

8. KYC Details – After the above details have been entered by the user, the app requires the user to upload ID proof and KYC related documents. The user may upload a copy of the Aadhaar card or PAN card as ID proof, and may also click the picture of the PAN/ Aadhaar card while filling the application, for which the app may ask for permission for accessing the camera. The user must then upload the address proof, for which driving license, passport, gas/ electricity/ telephone/ postpaid mobile bill, voter ID card and Ration card are eligible. The app also asks for the duration for which the user is staying at the current address, for which the address proof is being uploaded. The app then seeks a photograph and video of the applicant, with permission to use the picture on the loan agreement. The video needs to be shot with PAN card in hand.

9. Authentication of the bank details – The user is then required to enter the bank details to enable the app to authenticate the account where the loan amount is needed to be transferred. The app seeks to transfer the loan amount in your salary account if you are a salaried individual. The income will be verified through the bank statement of such salary account, which the user is required to upload during the process. If the bank statement is not readily available, the user can skip this step and email the bank statement at a later stage. However, it must be noted that the loan is not processed until the statement has been received by Money View Loans team.

10. Confirmation of the Details – The application input process is complete now, and the app will display all the details for final confirmation before the same is submitted for loan processing. The user can also enter promo code, if available, to avail any concession on the processing fee.

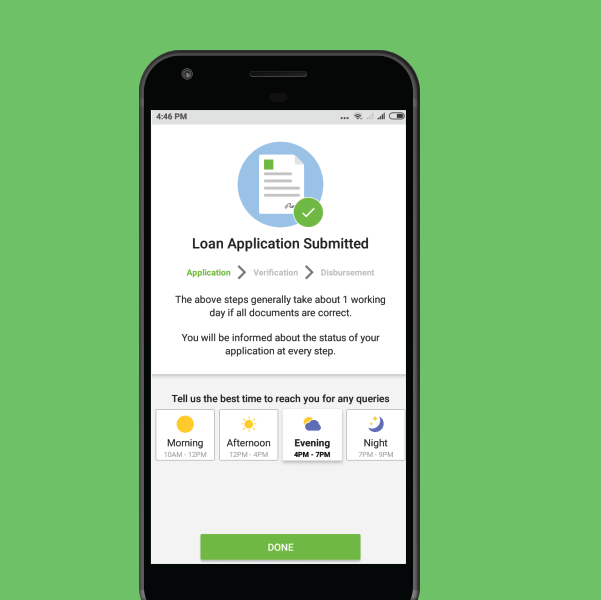

11. Application Submission – Once the user has verified the application details, the app seeks to verify the mobile number as entered by the user by asking for One Time Password (OTP). Upon successful verification, the application gets submitted, and the user is given an option to rate the application process.

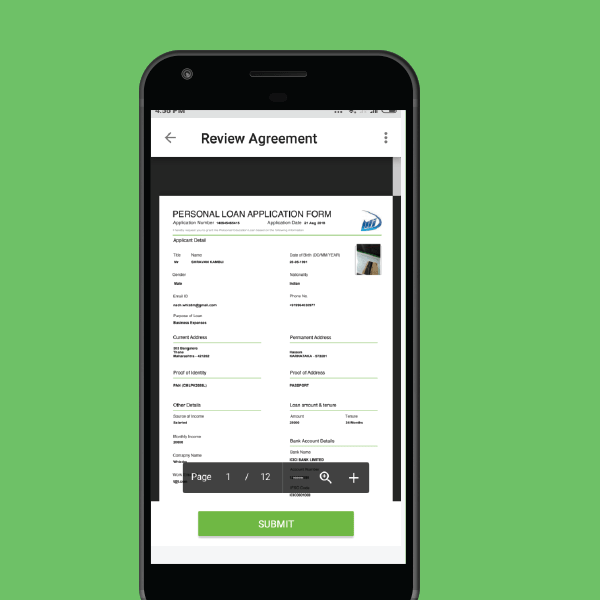

12. Processing the Loan Application – The application verification takes place at the backend by Money View Loans team, which typically takes one working day if all the documents are in order. Once all the documents are confirmed to be in order, the user gets a notification on the app to review the agreement. Once the agreement is reviewed and approved by the user, the loan amount gets credited in the bank account in 2 hours.

The process is simple and straightforward. A number of our current Money View Loans users have lauded the efficiency of it in our User stories that you can read here. Money View Loans offers you a great way to get personal loans online in India. Just make sure that you maintain a decent credit score to stay eligible for a personal loan and follow the steps as listed above.

Nice

Nice work and good job

Nice work

After submitting all documents including ( nach ) and e signed, money not transferred to my account past 6 days. no replies from mail, not able to contact customer care..

We’re sorry you had to go through this. Please try contacting our customer care through any of these avenues.

Thanks

Nice job

I have done all process till Loan Review & Submit agreement till yesterday morning but not received loan pls help to get loan

We’re sorry you had to go through this. Please contact our Customer Care with your Loan ID and they will help you out.

All documents submit as per company required but 24 hour going not any confirmation only show on app wait…

Very poor service..

We’re sorry you had to experience this. Please contact our customer care service and they will be able to help you with this.

My loan is reviewed and submitted yesterday but till now I didn’t get money… And customer care operater is saying that money is ready to disburse then it is taking so much tym

We’re sorry you had this experience with us. Could you let us know if your loan has been disbursed to your account?

I have submitted the agreement but I didn’t get the money credited to me even after one day. Unable to contact the customer care .please help.

We’re sorry you had to go through this. Have you tried sending an email or calling our customer service? Here are the different ways through which our customer service can be contacted.

I have applied in the morning but my documents verification is still pending .whether I have taken loan from moneyview already and paid ontime so why it is being happening. Kindly help and there is nobody to handle your queries.

We’re sorry that you are experiencing this issue. Please contact our customer care services and they will handle this for you.

In the agreement amount is showing amount is different from what loan approved along with the emi.

If approved the agreement which amount is going to be credited.

Is it fraudulent?

Hello, we’re sorry for the confusion. Please contact our customer care who will help you with this issue.

Money not credited after i submitted the application you said 2 hours but is been one day

We’re sorry to hear that. Please do contact our customer care through one of the options given here. We hope the issue gets resolved soon.

Sir

Can you work pan india

Yes, you can apply for our loan from anywhere across India.