Retirement is a financial goal that each of us aspires towards. It is also one of those goals that benefits the most from early planning and the magic of compounding as it is a situation where we need a large corpus after our working life. Considering the hectic aspect of today’s working life, early retirement is quite a buzz word. Once you have your calculations with you to know your magic figure for retirement, you can actually start investing by the age of 25 and be ready to retire by 50 and also save on Income Tax on that amount at the same time. Isn’t that wonderful?

All of us have a different capacity to take risks. Depending on the kind of risk that we end up taking, our retirement corpus will also look quite different. So, let us look at four types of plans that can help you retire at 50 and how you could go about it.

The two tax-saving investment options that we looked at here are Public Provident Fund (PPF) with an assumed annual interest rate of 7.6% p.a. and Equity Linked Savings Scheme (ELSS) Mutual Funds with an assumed annual rate of return of 12% p.a. The big difference between these two products is that the interest rate in PPF is guaranteed while that of ELSS often fluctuates depending on the performance of equity markets. However, going by a longer period of time, 12% is a good rule of thumb to assume as an annual rate of return for equities.

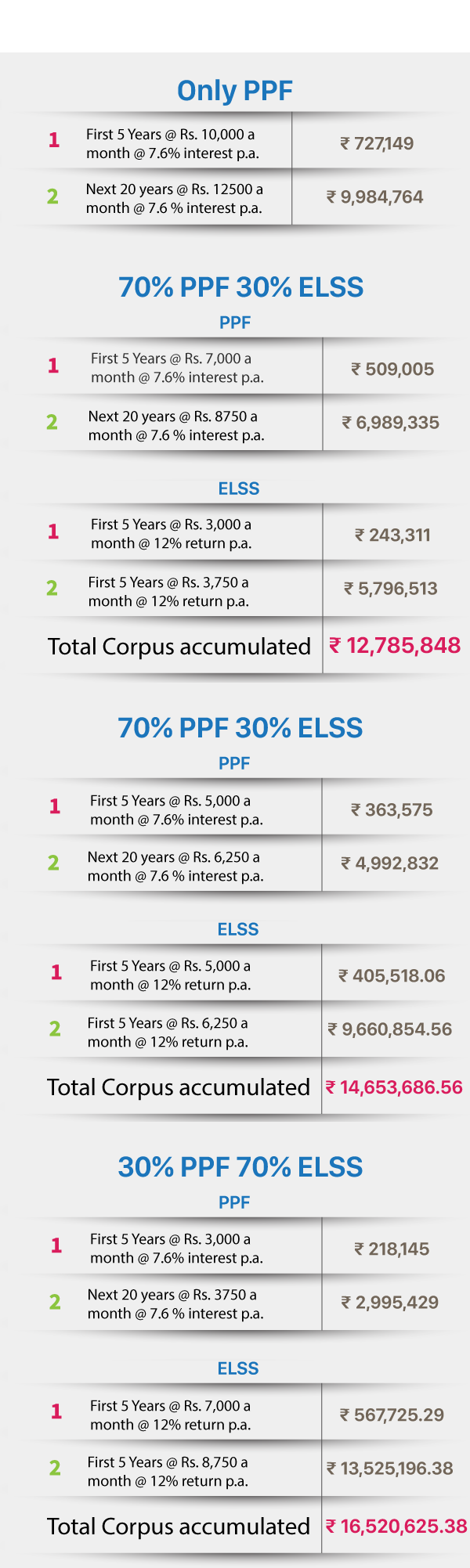

For all the scenarios, it is assumed that you decide to invest Rs. 10,000 every month starting at the age of 25 and raise it to Rs. 12,500 every month from the age of 30 going on till the age of 50.

Scenario 1: No risk portfolio to Retire at 50

If you are someone who likes the ring of “guaranteed returns”, then this portfolio is for you. In this scenario, you would be putting in Rs. 10,000 each month in a PPF account for the first five years and then Rs. 12,500 per month for the next 20 years. While the current interest rate in PPF is 8% per annum, as an average I have taken it to be 7.6%.

In such a scenario, taking into account the quarterly interest accrued in a PPF and the compounded effect, you would have accumulated little over Rs. 1 Crore.

Do note, that as the economy grows, it is a possibility that the interest rate could actually drop. In that case, you would probably need to look at adding equity to your portfolio. Below are a few PPF-ELSS mix portfolios that you could consider.

Scenario 2: Defensive Portfolio to Retire at 50

While PPF gives guaranteed returns, over a long period equity is one of the best asset classes to create wealth. In this portfolio, you can look to diversify just a little by putting 30% in ELSS and the remaining 70% in PPF.

So, starting at 25, for the first 5 years, you would be investing Rs. 7,000 every month into PPF and Rs. 3,000 each month into an ELSS fund. For the next 20 years, you would be splitting your total investment of Rs. 12,500 per month by putting in Rs. 8,750 into PPF and Rs. 3,750 into ELSS. With this strategy, you would have amassed Rs. 1.28 Crores by the age of 50!

Scenario 3: Balanced Portfolio to Retire at 50

When I am not able to make up my mind or decide on something, I generally choose a middle ground. If you too are not able to decide whether to go for the guaranteed returns of PPF or take the risk and the higher returns of ELSS, then this portfolio is for you.

Starting at the age of 25, you start with equally investing Rs. 5000 each into PPF and ELSS each month. For the next 20 years, you hike up your investment to Rs. 6,250 each month in both PPF and ELSS for a total investment of Rs. 12,500. With this strategy, by the time you are ready to retire at the age of 50, you would have a corpus of Rs. 1.46 Crores!

Scenario 4: Aggressive Portfolio to Retire at 50

If you believe in the India growth story, wanting to put in more into equities, then this portfolio is for you. With a minor 30% allocation to the guaranteed returns of a PPF and with a 70% diversion into ELSS, this portfolio makes use of the fact that the volatility risk in equity investment reduces over time.

At the age of 25, you start off by investing Rs. 3,000 a month in PPF and remaining Rs. 7,000 into ELSS. By the age of 30, you increase your contribution to Rs. 3,750 into PPF and Rs. 8,750 into ELSS every month. That would help you stand tall with a retirement corpus of Rs. 1.65 Crores!

As you can see, when planned early, you can easily use your Section 80 C Tax exemption investments to invest and plan for early retirement. For a quick summary look at the below table for the four portfolios discussed above:

| Portfolio Type | PPF | ELSS | Total Corpus |

| No Risk | 100% | 0% | Rs. 1 Cr |

| Defensive | 70% | 30 | Rs. 1.28 Cr |

| Balanced | 50% | 50% | Rs. 1.46 Cr |

| Aggressive | 30% | 70% | Rs. 1.65 Cr |

As they say, early bird gets the worm. In this case, early planning can get you early retirement. Try our investment strategies to help you retire at 50. Starting early is the key, so plan today.

App is good

Thank you

Good knowledge sharing

Thanks Anil