Inflation and Tax: Are They Diminishing Your Bank Balance?

It looks okay now – your bank balance. As years pass, your salary will increase and so will your savings. Then you will have enough money to do what you really want.

That’s a dream. In reality, here is what will happen: You will worry about money. Circumstances and responsibilities will demand that you work harder as you grow older. You will see the same people while commuting, and at work. Pessimism will fill your life. Eventually, you will surrender to the daily grind. Enjoying life, sending your child to a good college, traveling the world, retiring peacefully… just one word for those dreams – shattered.

Yes, this will happen. Why? Because your money is taking it easy.

To grow in life, you must work hard. Like that, for your money to grow, it must work hard.

Splurging on movies, clothes, shoes, mobile phones, or just leaving it lying in a bank account hurts your money. But how? Banks now offer 6% interest on savings instead of 4%. Hence, your money is growing by two more percent, right? Wrong. With each passing month, you lose money.

Do you make money or lose it?

We enjoy magic tricks. However, you and I know that it’s not magic. The real action goes on elsewhere, hidden from the naked eye. Just like that, for your savings, you miss something invisible to the naked eye – inflation and taxes.

At the current growth rate, inflation in India averages around 7%. If your bank offers 6% interest on savings, your real rate of return is -1%. If the interest on your savings is above ₹10,000, it attracts further taxes. So have you made money or lost it?

A 7.5% – 8% interest in a Fixed Deposit means that you narrowly edge inflation out. How does that help you?

Expecting life to get better while your money lies in a bank is like competing with Dhoni’s speed in wicketkeeping. You will never win.

People tell you about a trade off. You either don’t have enough money, or must work your butt off. If you do the latter, you cannot enjoy life. They tell you that people who live the elusive good life were either always rich, or got lucky.

But it is not so. Your money can work for you, while you work in the corporate. And you can retire twenty years from today… all this while leading a good middle class life. Don’t believe me again? Allow me to blow your mind.

Make your money work for you

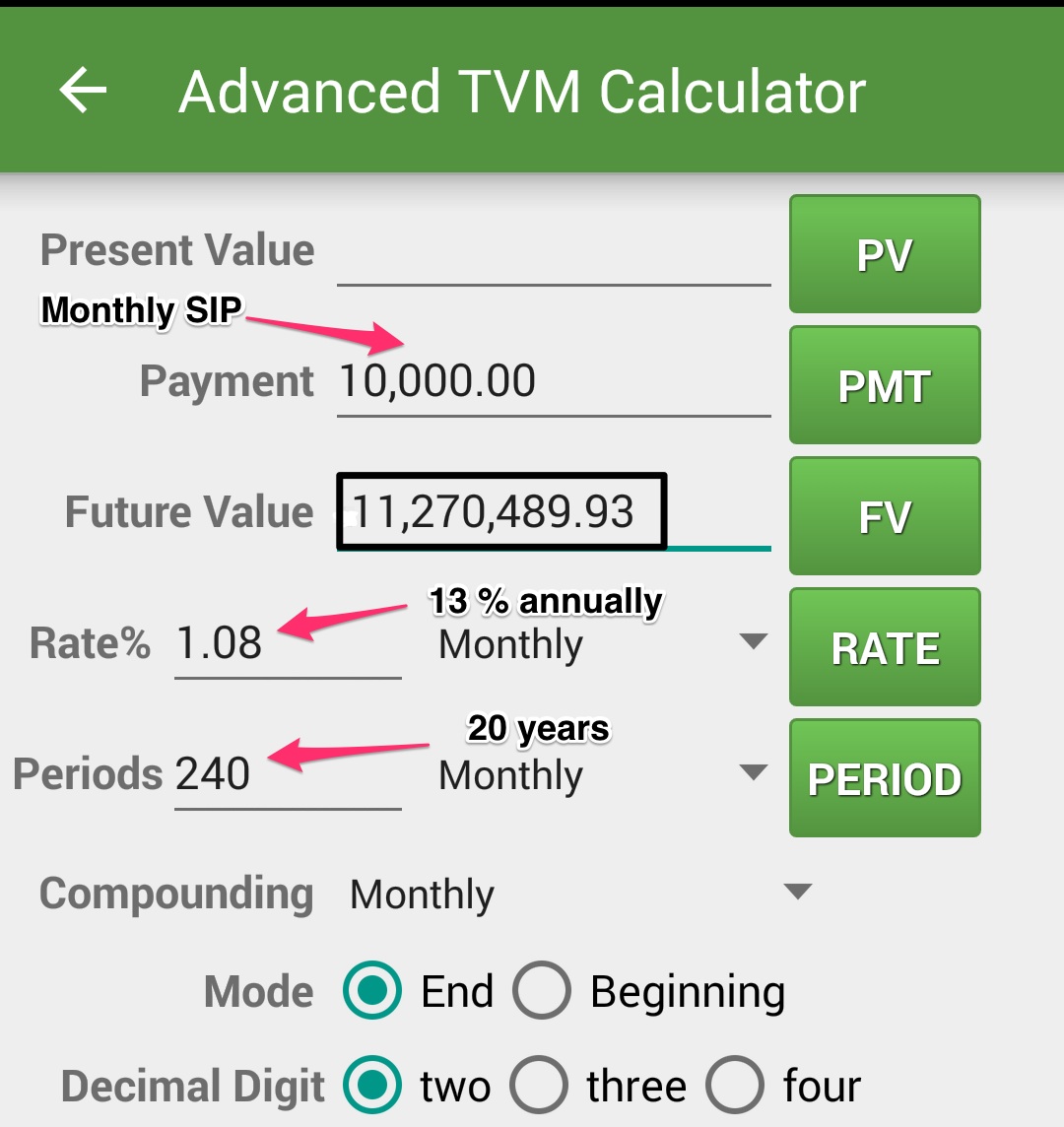

Here is what you will earn if you invest ₹10,000 per month in a fund which offers just 13 percent returns annually for the next 20 years.

No, you didn’t read it wrong. The amount you get after investing just ₹24 lacs over 20 years is ₹1.12 crore! Your money has increased almost 6-fold. Even after accounting for inflation and taxes, a hefty amount remains. Add your personal savings to that, and you are looking at life free of money worries.

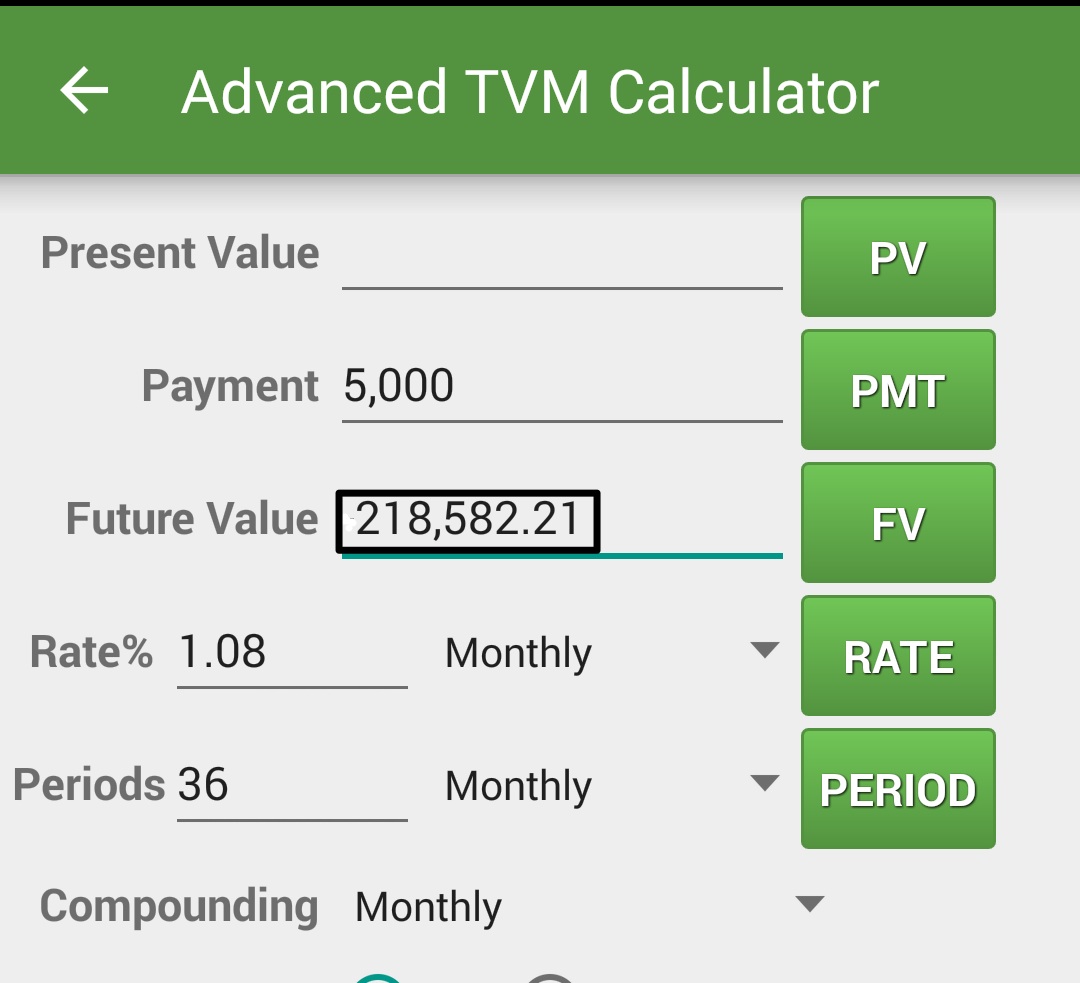

Unfortunately, we commit the blunder of staying invested for ridiculously short periods. Look at the calculation below.

At the end of 3 years, you have invested ₹1.8 lacs and received just ₹2.1 lacs (including your invested principal). It’s around 17 percent. Doesn’t look glamorous, does it?

This is when you must hang in there. Choose a fund which offers good returns and saves taxes too.

MDBSC

Coined by Ashal Jauhari, MDBSC stands for My Dull and Boring SIP Continues. Regardless of market conditions, regardless of how boring your investment portfolio is, keep investing. Never mind that your earnings don’t grow astronomically. Never mind others telling you to invest in Ponzi schemes promising to make you three times richer in one month. So long as your fund gives a Compounded Annual Growth Rate of 13-15 percent, keep investing.

You will face the occasional cash crunch, or spend in something unexpected. But remember MDBSC. Give investing a break when it’s unavoidable, but don’t stop. Compensate for a sabbatical by extending your investment period towards the end.

Investing monthly in a SIP requires discipline. It’s tempting to ‘use your money better’ – watch new movies, party with friends, upgrade phones every year and cars every 3 years. If you don’t ‘have fun’, peers will call you ‘boring’ and ‘kanjus’. “You don’t know how to live for the day”, they will say. But in twenty years, they will call you ‘lucky’. Because you will pursue what you want and live on your terms. They, on the other hand, will continue slogging in the corporate and endure their bosses’ tantrums. What was that quote on short term pains?

Vishal is the founder of Aryatra, a venture to help individuals improve their productivity and live more fulfilled lives. He also is a digital marketing consultant helping businesses generate revenue from their online presence.