Tracking Your Spends – How to Navigate Between Essentials and Non-Essentials

By now, you might have read various articles regarding financial planning and categorizing your expenses into essential and non-essential spends. But what exactly are these two categories? How do you classify your expenses into them? It is time to go back to the basics!

But before that, you need to track your spending. And we mean all of your spending!

Step 1 – Categorize Spends

Once you’ve tracked your expenses, they will largely fall into the categories given below –

- Groceries and other household items

- Utility Bills (Water, Electricity, etc.)

- Credit Card Bills/Loan EMIs

- Food & Drinks (takeaways, parcels from restaurants, eating out post COVID, etc.)

- Vehicle related expenses (petrol, servicing)

- Education expenses (if relevant)

- Cable/Internet/Mobile Bills

- Clothes

- Household expenses (cleaning, repairs, renovation, maintenance fee if you live in an apartment)

- Entertainment (movies, streaming services, books)

- Miscellaneous (expenses that do not fit into other categories)

We would recommend tracking your expenses every week or every other week.

If you are feeling overwhelmed, there is no need to worry because you can use an app to track your expenses. One of the best apps to keep track of expenses is the Money View Money Manager App which does both the tracking and categorizing for you.

Note: Please note that everyone’s way of living and expenses differ. Feel free to add in or remove categories as relevant and necessary for you.

Step 2 – Essential vs. Non-Essential

Once you have figured out all your expenses, it is time to categorize the same further.

- Essential expenses refers to those expenses that are needed for living, and for you to continue maintaining your standard of living comfortably. This can be further divided into Fixed and Variable expenses.

- Fixed expenses are those that remain the same each month such as rent, fixed loan EMIs, taxes, etc.

- Variable expenses are those that vary each month such as electricity bills, groceries, credit card bills, etc.

- Non-essential expenses are those that you would want to spend on but do not necessarily need such as movies, magazines, make-up, video games etc.

Now here’s where the line demarcating these two types of spends gets a little blurred. While food and clothing is necessary, buying over and above what is strictly needed is considered to be a non-essential spend.

Similarly when it comes to books, travel, etc., if it is related to your source of income or your education and you strictly cannot do without it, you may categorize the same as an essential spend.

What about Savings and Investments?

Savings and Investments definitely enhance the quality of your life and lead to greater income down the line while fostering financial discipline.

Our take? Consider it to be an essential expense and continue to invest and save wisely.

Should I Completely Stop Non-Essential Expenses?

No, not at all, maintaining a healthy balance is more important. Which leads us to our next step –

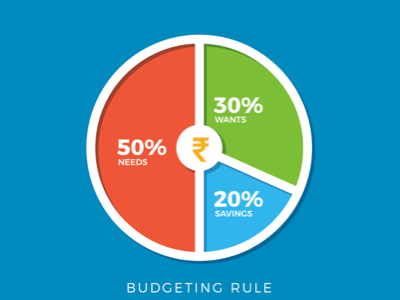

Step 3 – 50-20-30 Rule

The next step is to become a strict budgeter. While this is not the most exciting thing to do, your finances will thank you for following this rule.

Ideally, 50% of your income must be spent on living expenses, including rent, utility bills, loan/credit card bills, groceries, etc.

20% of your income must be spent on savings and investments.

The rest 30% of your income can be spent on non-essential expenses such as vacations, fancy gadgets, etc.

Tailor this guideline to suit your needs but ensure that discipline is maintained at all times.

In Conclusion

Starting to track your spending and categorizing them into essential and non-essential spends will help you reach your financial goals much sooner. Follow the steps mentioned above but adjust them to suit your requirements. If you can find a way to cut down on your expenses effectively (for example, sharing the Netflix bill with your friends) then go ahead.

We understand that sometimes you may need extra income to cover your expenses. Availing a personal loan from Money View can be beneficial in this regard. Visit our website or download our app to apply.

Does the app provide categorisation as essential or not?

You have the option to either choose from the categories provided (such as groceries, shopping, healthcare, etc.) or you can create your own categories. As for whether a category is essential or not, it is completely dependent on your requirements. We hope this helps. Please do try the app, we would love to know your feedback

Good Blog which is useful in maintaining the monthly budget

We’re happy this blog helped you!