How to Protect Yourself from UPI Scams

UPI (United Payments Interface) transactions are here to stay and have revolutionized the payment landscape. This is also one of India’s biggest success stories on the global financial stage.

However, UPI-related scams are also increasing despite the convenience. Did you know that over 95,000 UPI-related fraudulent cases was reported in 2022?

The good news is that there are certain ways in which you can avoid becoming a victim in such cases.

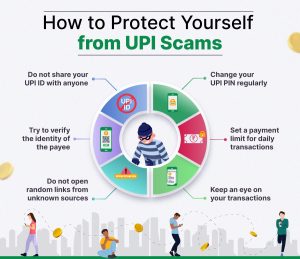

Here’s how you can protect yourself from UPI Scams in the future –

While UPI has made payments incredibly convenient, the number of related scams is on the rise. Unsuspecting customers are lured into making fraudulent transactions which leads to them losing money.

Follow these steps to safe safe –

Firstly, never share your UPI ID with anyone. Try to memorize it or store it in the form of a code that you only you can understand.

If for some reason you had to share your UPI ID, change it immediately after.

Next, ensure that the merchant you are paying to is legitimate. If you are paying online, especially through QR codes, try to verify that the payee is genuine before making the payment.

In recent times, there have been cases of people pretending to be law enforcement officials and sending fraudulent payment links in the name of collecting fines. Another common scam is when people receive links that advertise prizes or gifts which are in reality, malware.

In many UPI-related frauds, scammers scare victims into downloading remote assistance software. Once this is done, cybercriminals can easily access the funds in your bank account through your banking apps or e-wallet.

Therefore, it is of utmost importance that you do not open links from people whose identity you cannot verify.

Another important step that can help you protect yourself is to change your UPI PIN regularly. Additionally, set a daily limit on your transactions. This way, even if you do fall victim to a scam, the amount of money that can be stolen will be limited.

Lastly, keep an eye on your bank statements. If you notice any suspicious transactions, report them to your bank immediately. Doing so can minimize the repercussions of such scams.

In Conclusion

While UPI has definitely made payments much more convenient, the number of people getting scammed due to UPI-related transactions is quite alarming. Taking a few precautionary measures can definitely help you protect yourself from such scams.

The methods listed in this blog are just some of the ways in which you avoid becoming a victim of such fraud. Do you have other ways to protect yourself and your loved ones? Let us know in the comments below.