Introducing – The Money View Advantage Card

It won’t be an exaggeration to say that our personal loans have revolutionized the market. At Money View, we believe that having access to financial services is a basic right for all and we have taken a step further in order to make this belief a reality.

Presenting – The Money View Advantage Card.

All the benefits of a personal loan and a credit line card in just one pocket-friendly product!

Certain cards are synonymous with a luxury lifestyle. While they come with a number of benefits, the eligibility criteria is quite stringent. But should this mean that these cards should only be in the hands of a few? No!

What if there’s a better option?

The Money View Advantage Card

The Money View Advantage Card is a credit line card which comes with a pre-approved limit that can be used for a multitude of purposes such as shopping, purchasing goods, paying bills, etc. Loaded with benefits such as 0% interest payment period up to 40 days and affordable EMIs, this card can be used for offline purchases, and UPI or QR code scanning too.

Features and Advantages of the Advantage Card

Given below are some of the advantages offered by the Money View Advantage Card –

- Instant Activation

When you apply for a card (credit or debit), you can start using this only after the card gets delivered to you, i.e., the physical card is required for transactions and this usually takes a few days.

But what if we told you that the Advantage card can be used immediately? You no longer need to wait for the card to get delivered to your doorstep to enjoy its benefits.

- Enjoy 0% interest

Purchased something but need a little time to repay it? No problem! With the Money view Advantage card, you can enjoy up to 40 days of interest-free period to make your payment

- Buy Now, Pay Later

You can use your credit limit to shop and indulge without having to pay immediately. Enjoy the convenience of buying now and paying later.

- Affordable EMIs

Are you planning to purchase an item but unsure about repaying it? We have good news for you!

As an Advantage cardholder, you have the option to split your bills into affordable EMIs

- No Joining or Annual Fee

Have you avoided credit cards because of their joining or annual fees?

With the Money View Advantage card you will no longer have to worry about this as this card does not have any joining fee or annual fee – it’s completely FREE!

- Pre-approved Limit up to Rs. 2 Lakh

Based on your credit history and other eligibility criteria, you may be able to avail a pre-approved limit of up to Rs. 2 lakh with no restrictions on the end usage

- Make Shopping Easier

The Money View Advantage card can be used for both online and offline shopping. You wanted convenience and we are delivering it to you!

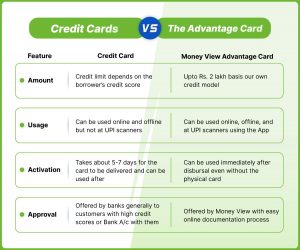

The Money View Advantage card may sound similar to a credit card but there are a few key differences. Let us take a look at them –

Credit Cards vs. The Advantage Card – Comparison at a Glance

In Conclusion

There are a number of financial products in the market today with credit cards being one of the most popular ones. But credit cards are not as accessible to everyone. There are stringent eligibility conditions to meet and disbursal time varies. But the Money View Advantage card aims to go above and beyond.

Accessible, affordable, and loaded with multiple benefits and features.

Excited to be a part of ‘The Advantage’ family? Click here to know more!

In the meantime, let us know what feature you are most excited about in the comments below!

Nice card

Good to see MoneyView scale new heights with every day that passes by.

It is all thanks to support from esteemed customers such as you. Thank you for your kind words.

any E NAch Charge

No, there are generally no charges imposed to activate eNACH mandate.

Will Money View Advantage card limit increases?

Hello, there may be a change in the limit in the future.

When the card will be enabled for transactions?

Hi, our customer service agent will be happy to answer your question. Please contact them through one of the options given here.

Good card

We’re glad you approve.

Dear sir,

Your team are not respond me why

We’re sorry you’re facing this issue. We have multiple options through which you can contact our customer care. Please let us know if you still don’t hear back.

Very good Service Moneyview. I appreciate your support and service. This card very very useful to ordinary commen people.

Thank you Vinoth, for your support!

Super card

How to apply for vintage card

Hello, thank you for your interest. Please click here to apply.

Very good card

Who to apply for the card

Hello, thank you for your interest. Please click here to apply.

i have placedd request for physical card, is it free or chargeable service?

Hello, the Money View Advantage card is completely free to avail. Additionally, there are no joining or annual fee either.

Hi,

When I try to apply it always showing only loan option. There is no option to apply for the card. Pls help me get this card. I don’t need loan right now. Would really appreciate if you could respond to me on my email: vignesh.av24@gmail.com

We’re sorry to hear that. Have you tried calling our customer care centre through one of the numbers given here. We hope the issue gets resolved soon.

Good

The advantage card money is auto debit or manual pay, kindly advice

Hi, you have the option of paying manually.

very very nice card. it is very useful card.

Thank you, we’re glad you are finding our products useful.

We’re glad you are enjoying our newest offering.

मेने पूरा पेमिंट करदेया फिर भी में ये कार्ड यूजी नहीं कर पा रहा हु

We’re sorry to hear that. Please do contact our customer care through one of the options given here. We hope the issue gets resolved soon.

Can get physical card

Yes, once your application is approved, the card will be couriered to you. However, you can start using the online version of the card immediately post approval.

How many days it takes to deliver. Do they deliver credit card by postal services or by courier.

Hi, the card will be dispatched between 7 to 15 days of application approval.

Can we change the credit line into EMI as other cards

Yes, you can convert your payments into EMIs.

Sir if I transfer money in bank account from money view advantage card then 2.95% charge. If I purchase any product on amazon, will any charge deduct?

Or no charge on shopping app till 40 days

If you withdraw money (which gets transferred to your bank account) you will be charged interest for this transaction. However if you are using our card only for shopping and the bill is paid within the interest-free period, there will be no additional interest charged.

after get card option we need to take loan is neccessary

Hello Rahul. No, it is not necessary as the Advantage card comes with a hefty credit limit, similar to a credit card.

I applies for the credit card and get a spent amount of ₹7000 and then used it in a shope to purchase a good which total is ₹7000 but the credit card is not paying its in processing for about 3days now what will i do?

We’re sorry to hear that. Please do contact our customer care through one of the options given here. We hope the issue gets resolved soon.

What is the due date of the advantage credit card.

Hello, the card will be delivered to you within 7-15 working days. However, you can start using the online version of the car through the MV loans app as soon as your application is approved.

Can I get physical credit card?

Yes, you will be getting the physical card but you can start using the card through the Money View loans app as soon as your application is approved.